CapitaLand shareholders to hold shares in new investment and lodging entity

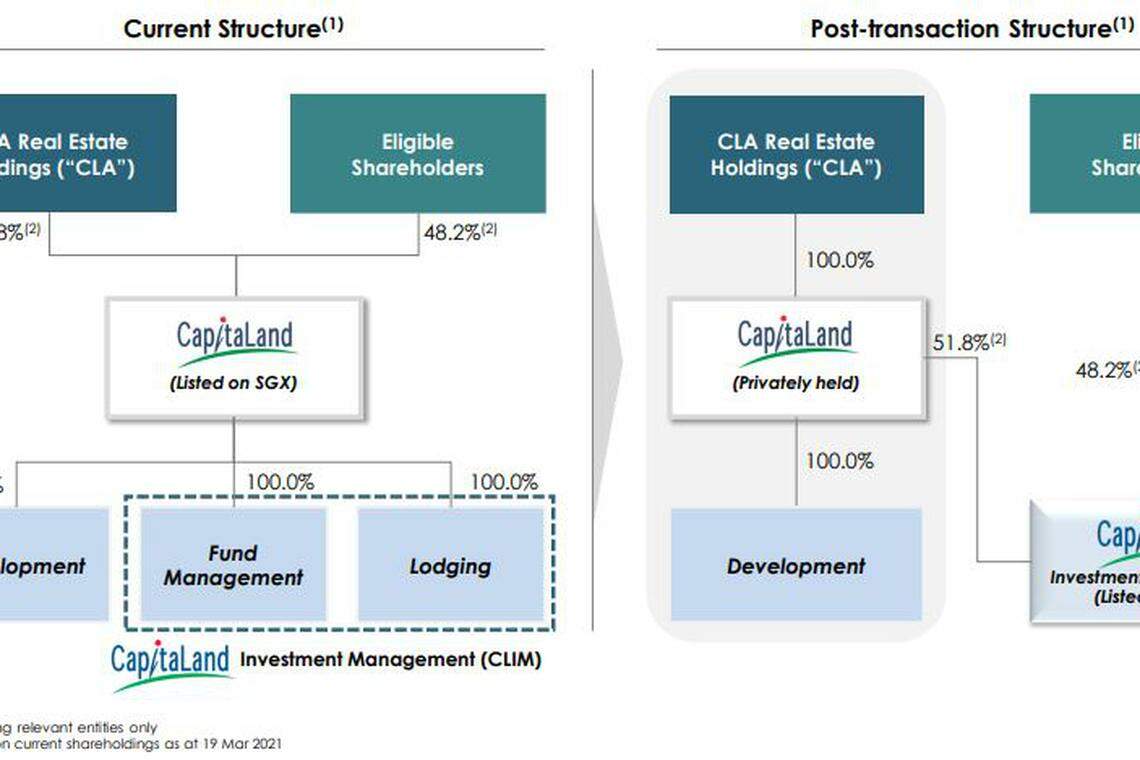

CAPITALAND'S shareholders are set to hold shares in CapitaLand Investment Management (CLIM), which is to be listed on the Singapore Exchange by way of introduction, while the group's real estate development business will be privatised.

CLIM will own the investment management platforms and lodging business of CapitaLand. With assets under management of about S$115 billion, CLIM is expected to be the largest real estate investment manager (REIM) in Asia, and the third-largest listed REIM company globally.

On Monday morning, CapitaLand, announced, together with CLA Real Estate Holdings (CLA), an indirect wholly-owned subsidiary of Temasek, a scheme of arrangement to effect the proposed corporate restructuring. CLA is the largest shareholder of CapitaLand, holding a 52 per cent stake.

As part of the proposed scheme, CapitaLand will distribute approximately 48 per cent of shares in CLIM to all its shareholders, excluding CLA. CapitaLand will hold 52 per cent of CLIM. CapitaLand will also distribute in specie 6 per cent of units in CapitaLand Integrated Commercial Trust to shareholders, excluding CLA, thereby bringing its current 28.9 per cent stake in CICT to 22.9 per cent.

For every one share held in CapitaLand, shareholders will receive one CLIM share, between 0.155 and 0.143 unit of CICT and cash of S$0.951. The implied value per share for CapitaLand's shareholders is S$4.102, based on current share capital or S$3.969 assuming fully diluted share capital. At its inception, CLIM will be a fully integrated REIM with funds and property management capabilities across multiple asset classes and a spectrum of private and listed funds. CapitaLand's lodging management business, which encompasses the global serviced residence management platform under The Ascott Limited, will also become a part of CLIM. Upon completion of the scheme, the remaining real estate development-related business and assets under CapitaLand, with a pro forma net asset value of about S$6.1 billion, will be held privately by CLA.

Ng Kee Choe, chairman of CapitaLand Limited, said the proposed restructuring "will provide the impetus for us to further expand and scale up our asset and investment management, and lodging businesses while benefiting from the pipeline of projects from CapitaLand as part of the ecosystem".

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

CapitaLand called for a trading halt on Monday before market open, and lifted the halt after the closing bell. Its shares closed flat at S$3.31 on Friday.

READ MORE:

- CapitaLand chases faster growth with restructuring, planned listing of CLIM

- Beyond a new CEO, a reset for CapitaLand?

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

General Motors beats quarterly results targets, raises forecast

Soilbuild bags contracts worth S$81 million

Spotify’s monthly user numbers miss estimates on lower promotions

China bubble-tea chain Chabaidao plunges on Hong Kong debut

Singapore stocks extend gains on Tuesday led by banks; STI up 1.5%

Adobe to bring full AI image generation to Photoshop this year