As oil gets beaten down, analysts find reason to look up

Singapore

WHILE ravaged oil markets indicate the persistence of weak demand, market watchers are expecting recovery by the end of the year, though not at pre-crisis levels.

Sharp production cuts and post-crisis demand recovery will lead the pick-up in oil prices, said Tan Min Lan, Asia-Pacific head of UBS' chief investment office, at a media teleconference on Tuesday.

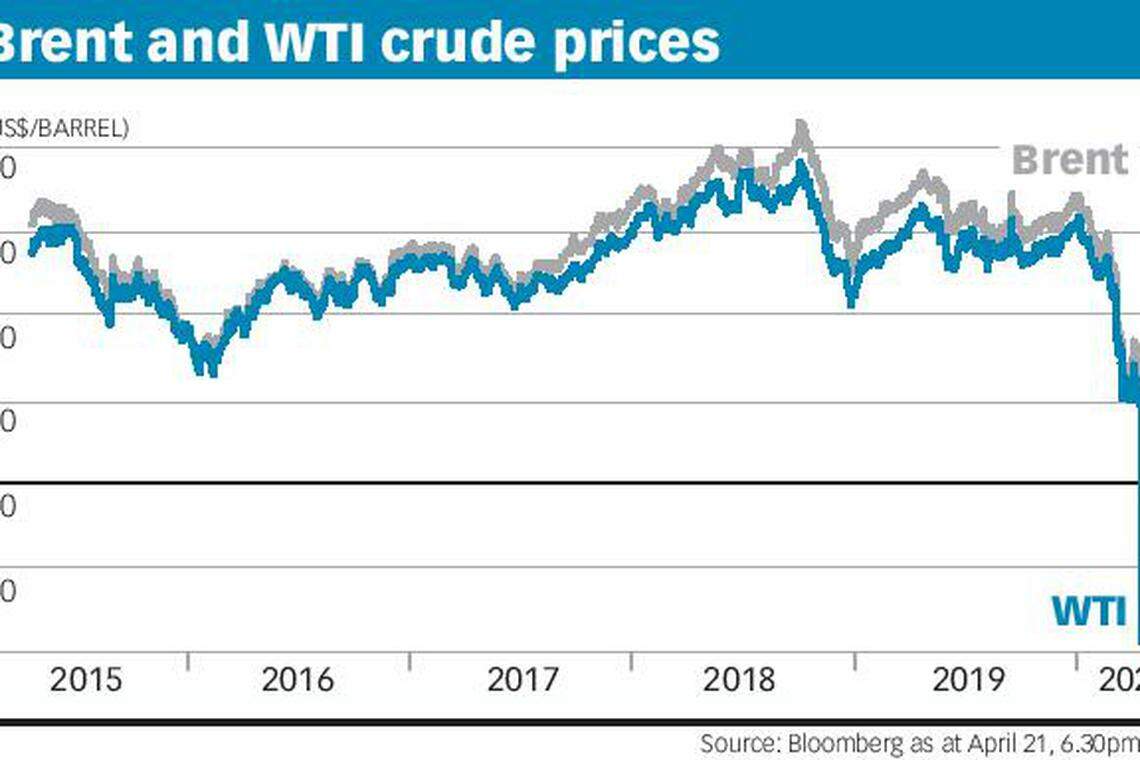

As at Tuesday morning, the bank projected both US benchmark West Texas Intermediate (WTI) and international benchmark Brent crude at US$20 per barrel at the end of June. But it expects a recovery in the second half of the year, with year-end targets of US$40 per barrel and US$43 per barrel respectively.

At the end of Asian trading hours at 6.30pm Singapore time, WTI was trading at -US$8.45 per barrel after reaching unprecedented lows and ending in negative territory for the first time on Monday at -US$37.63 per barrel. Brent crude was trading down 16.4 per cent at US$21.37 per barrel.

The bank's 12-month view that oil prices will recover takes into account the sharp production cuts by the Organization of the Petroleum Exporting Countries (Opec) and companies that are not able to survive current oil prices, as well as the prospect that economies will reopen in the second half of the year.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

While demand will not pick up to where it was pre-crisis, it will "pick up quite a bit relative to where we are today", Ms Tan told the media.

Still, market watchers pointed out the scarcity of storage spaces will pose a challenge in the coming months as the supply glut continues.

The dwindling room to store oil will push prices lower, forcing the closures of oil fields especially for less efficient producers in North America and South America, said Ms Tan.

Separately, a commentary on Tuesday by head of commodities strategy Warren Patterson and senior commodities strategist Yao Wenyu at ING also pointed out that the "extreme demand destruction" is causing storage to fill up quickly.

"It is likely that storage this time next month will be even more of an issue, given the surplus environment, and so in the absence of a meaningful demand recovery, negative prices could return for June," they noted.

While it was the first time that WTI has traded in negative territory and at less than half the price of Brent, James Trafford, analyst and portfolio manager at Fidelity International said negative oil prices are unlikely to become a new normal.

He pointed out that the spot WTI price is now better reflected by the June contract. Furthermore, Brent crude, which is less tied to US consumption "did not see the same price action".

Still, the oil price movement confirms that near term demand is very weak and associated equities in the sector are expected to remain broadly weak on the back of global demand shocks, said Mr Trafford.

In addition, market watchers have long pointed out that the Opec+ deal to slash production by 9.7 million barrels a day starting in May is not sufficient to absorb the huge surplus as demand continues to be battered by lockdowns and other measures to contain the spread of Covid-19.

"Over the medium term, I see oil price gains capped, as accumulated storage must be unwound, spare capacity must come back online, and the oil-intensity of the economy probably settles below pre-crisis levels," said Mr Trafford.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Energy & Commodities

Oil jumps, equities fall as Iran blasts fan Middle East tensions

Gold set for fifth weekly gain as geopolitical risks buoy demand

Oil holds near 3-week low as US sanctions interrupt easing tensions

Seatrium unit ordered to pay US$108 million in arbitration over equipment supply contracts

BP reshapes its leadership team as some executives leave

BHP to decide on future of nickel business by August, trims met coal estimates