Braddell View another victim of moribund en bloc market

Property players continue to avoid big housing sites; commercial sector has better fate

Singapore

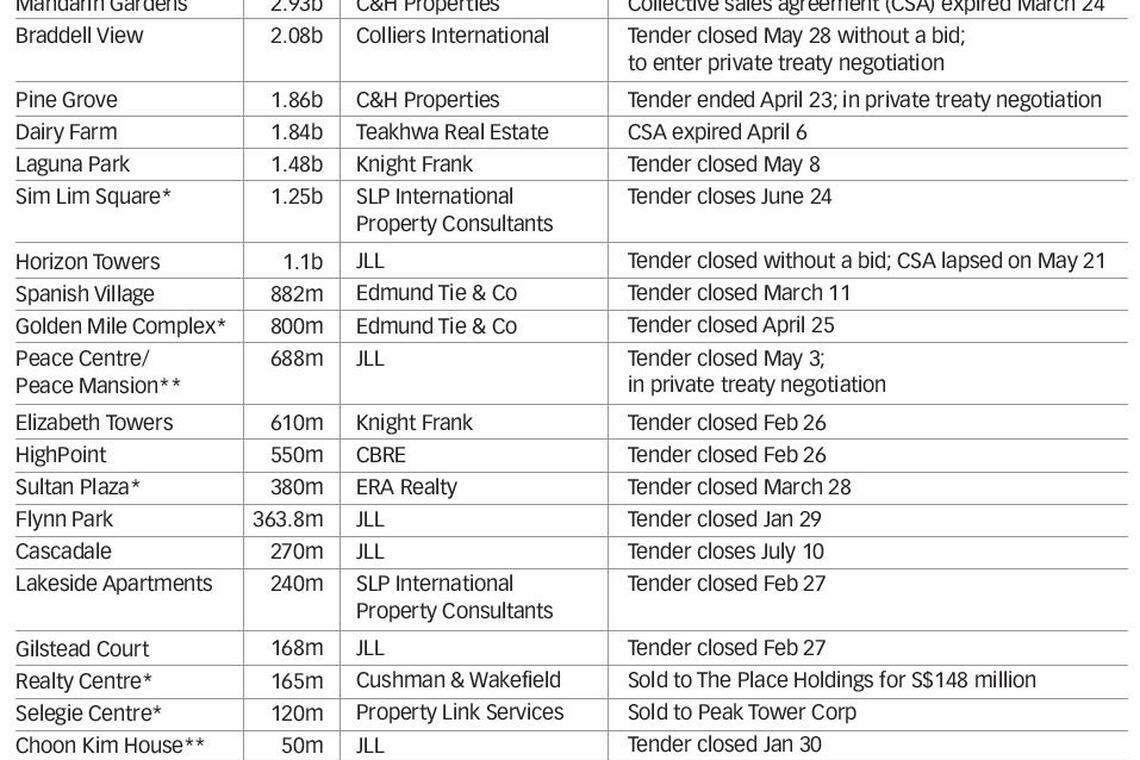

THE collective-sale cycle appears to be running out of steam, with no residential projects having achieved a successful outcome so far this year; the mega Braddell View estate has become the latest to reach its tender close with zero bids.

Market watchers were unsurprised by the lack of takers for Singapore's largest private residential site, the owners of which were angling for over S$2 billion. The size of the estate and the cooling measures implemented last July were cited as factors.

In response to queries, Tang Wei Leng, managing director of marketing agent Colliers International, said: "The Braddell View collective sale committee has instructed Colliers to enter into a private treaty negotiation for the collective sale of the development, with a view to relaunching the tender if necessary."

Knight Frank's head of research Lee Nai Jia said the en bloc market is facing challenges because most developers already have enough of a landbank, which makes them more discerning about acquisitions.

"Developers are more wary about such a large site. It's a huge quantum, and they may want to use the funds for other opportunities in the market," he said, adding that sites under the Government Land Sales (GLS) Programme, such as the one on Tan Quee Lan Street next to Bugis MRT station, could lure developers.

Two GLS sites were awarded in early April, one at Middle Road for nearly S$492 million to Wing Tai Holdings and the other in Sims Drive for S$383.5 million to Hong Leong Holdings and City Developments Ltd.

And even as sales are ongoing in the residential market, there is a fair bit of supply in the market as well.

A report by Edmund Tie & Company observed that the residential en bloc market has been muted since July's cooling measures; no sales were recorded in the first quarter.

"The only residential/residential mixed-use sites sold in Q1 2019 were listed under the GLS Programme - Kampong Java Road and an integrated mixed-use site in Pasir Ris Central," the report said.

The 918-unit Braddell View was put up for collective sale on March 27 with a reserve price of S$2.08 billion, or a land rate of S$1,199 psf ppr, inclusive of the differential premium (estimated at S$795.1 million) to intensify land use and to top up the lease by a fresh 99 years.

Once a Housing and Urban Development Company (HUDC) estate, the 1.14 million sq ft site has a gross plot ratio of 2.1, and a leasehold tenure of 102 years from Feb 1, 1978.

Other billion-dollar hopefuls such as Mandarin Gardens and Dairy Farm failed to hit the mandatory 80 per cent threshold for owners' consent. The collective sales agreement for Horizon Towers, shooting for S$1.1 billion, lapsed on May 21 with no bids.

En bloc sales in the commercial sector, however, have fared a bit better this year. Realty Centre went for S$148 million to The Place Holdings in April; Selegie Centre sold for S$120 million in March to Peak Tower Corp.

Christine Li, head of research (Singapore and South-east Asia) at Cushman & Wakefield, said commercial en bloc sales have picked up in recent quarters owing to the uptrend in commercial property rents. "Investors and landlords are bullish on the outlook, and that incentivises en bloc hopefuls to band together to capture the window of opportunity for a successful en bloc."

The recently announced CBD Incentive Scheme and the Strategic Development Initiative (SDI) could also expedite the rejuvenation of older commercial properties, she said. "This could enhance the value of properties and help owners of ageing properties to unlock values at a favourable price." (The CBD scheme aims to rejuvenate eligible office buildings in the CBD by encouraging their owners to convert them into mixed-used developments; the SDI, applicable island-wide, encourages private developers and building owners to redevelop their older buildings.)

But some residential sites are holding out for a collective sale, even with this year's lacklustre record. Tan Hong Boon, JLL executive director (Capital Markets), said: "Developers are more cautious, but some may be looking. The key is to price it reasonably. If the site isn't too big, the risk of not being able to sell within five years is lower; the chance of finding a buyer is also better."

Big sites are riskier because developers must develop and sell all units within five years to qualify for upfront remission of the 25 per cent additional buyer's stamp duty (ABSD) on the land purchase price.

This week, JLL launched two sites for sale: The 16-unit freehold Newton Lodge, which sits on a 21,409 sq ft site, is making a second bid at a collective sale for at least S$44 million; the freehold, 134-unit Cascadale in Upper Changi, spanning 167,528 sq ft, has a S$270 million reserve price.

Mr Tan is optimistic about these two projects, noting that their size and price tags are reasonable.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

US existing home sales drop in March; median price increases

German home building permits tumble 18% in February, extending rout

China national who had Singaporeans front plan to buy East Coast houses pleads guilty

Freddie Mac seeks regulatory approval to back home-equity loans

China national fined S$45,000 for having Singaporeans front plan to buy East Coast houses

Condo rents inch up after 7-month decline; volumes recover: SRX, 99.co