Even millionaires have cost worries if they live to a 100

Singapore

CLOSE to half of Singapore's millionaires expect to live to 100, and this is driving significant changes to their spending, investing and legacy behaviour, a study by UBS has found.

UBS Investor Watch Research has found that 46 per cent of those polled in Singapore expect to live to 100, compared to 53 per cent globally.

The expectation of a long life is creating anxiety, however, as 42 per cent worry that their wealth will not support them till age 100. Of these, 66 per cent worry about the rising costs of healthcare, and 63 per cent worry about whether they can afford their current lifestyle in retirement.

In Asia, 45 per cent worry about their wealth lasting till 100, compared to 21 per cent in Europe.

Investment behaviour is expected to shift as 45 per cent plan to adjust their long term financial plans and 46 per cent their spending patterns.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The research surveyed 5,000 millionaires in 10 markets, with at least US$1 million in investable assets (excluding property). The markets included Germany, Hong Kong, the US and UAE. In Singapore, 400 individuals were polled between December 2017 and April 2018.

Singapore's average life expectancy, based on World Health Organisation data last year, was 83.1 years, compared to 83.4 in Switzerland and 83.7 years in Japan.

Hartmut Issel, UBS head of Asia Pacific equities and credit (chief investment office), said: "It it heartening to note that many Singaporeans already have a financial plan in place, and are adjusting their investment portfolios in preparation for a longer life span.''

The silver lining is that almost 80 per cent have a financial plan in place. "If 80 per cent see the need to plan for the long term, it tells us that 20 per cent don't hold that view strongly. We need to reach that 20 per cent as well to have a discussion on life expectancy. You need to think about how you invest and put a plan in place.''

Singaporean millionaires believe being healthy is the top priority: 83 per cent worry that their health will deteriorate over the next 10 years and 92 per cent say investing in their health is more important than growing their wealth.

The average wealthy Singaporean would sacrifice around a third of their wealth today if that could guarantee another 10 years of healthy life.

The majority (85 per cent) believe that activity and work have positive effects on health. In fact 68 per cent expect to work longer than the traditional retirement age to maintain their lifestyle.

On legacy planning, 51 per cent plan to give more away while they are still alive. Over half plan to give more to their grandchildren than their children, believing that it will be more useful at their stage of life.

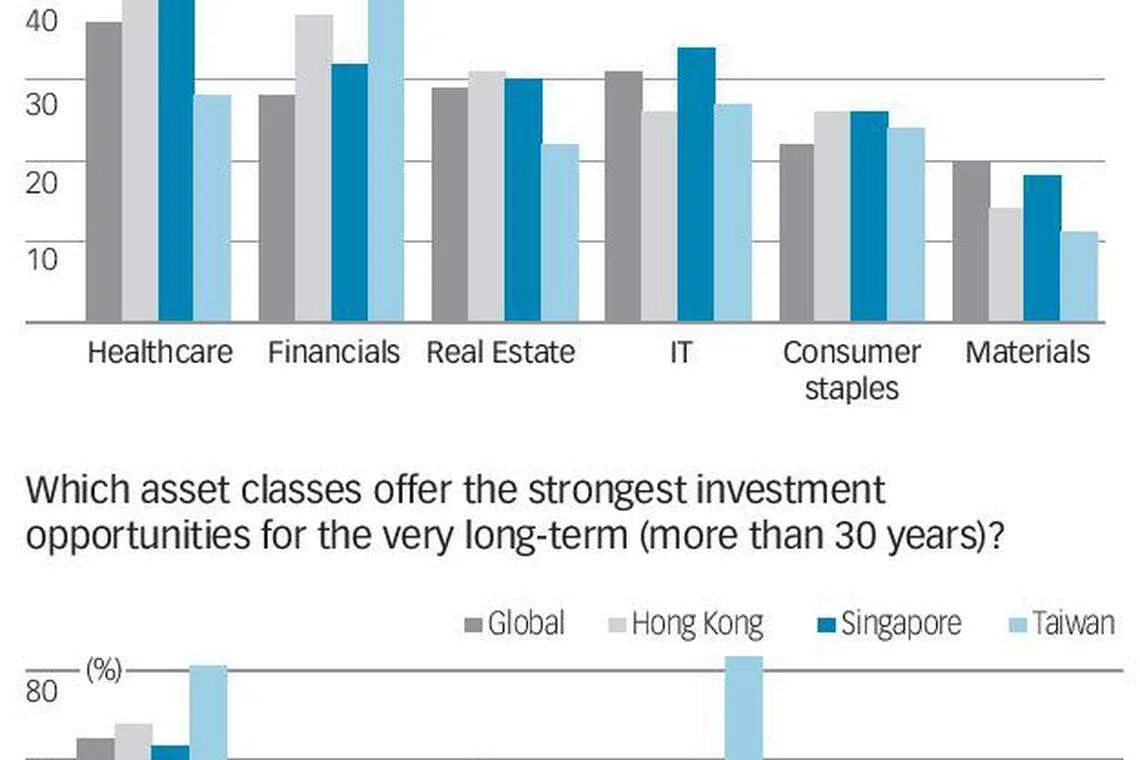

On investments, Singapore's high net worth individuals picked healthcare as their top choice for long term investment opportunities. Equities and real estate were also favoured, but so was cash, which was picked by 40 per cent of respondents. In Asia cash was favoured by 52 per cent.

Copyright SPH Media. All rights reserved.