Top interns rake in up to S$10,000 a month at major foreign banks

High compensation for undergrads aimed at employer branding and drawing outstanding ones to join firms upon graduation, says HR consultant

Singapore

ALEX (not his real name) raked in close to S$9,000 a month last summer as an undergraduate intern in Singapore. His secret? Working in the sales and trading division at a foreign investment bank.

And his is apparently a fairly typical case, at least among those who land internships in investment banking or sales and trading at foreign banks such as Goldman Sachs, JP Morgan, Citi, and Deutsche Bank. These trainees are paid between S$8,000 and S$10,000 a month, The Business Times understands.

When contacted, the banks either did not respond or declined to comment.

According to human resource (HR) consulting firm Adecco, most interns here typically get a monthly stipend of between S$600 and S$1,000 for their vacation work stints. Among full-time employees, the average gross monthly income last year was S$3,500, excluding employer CPF.

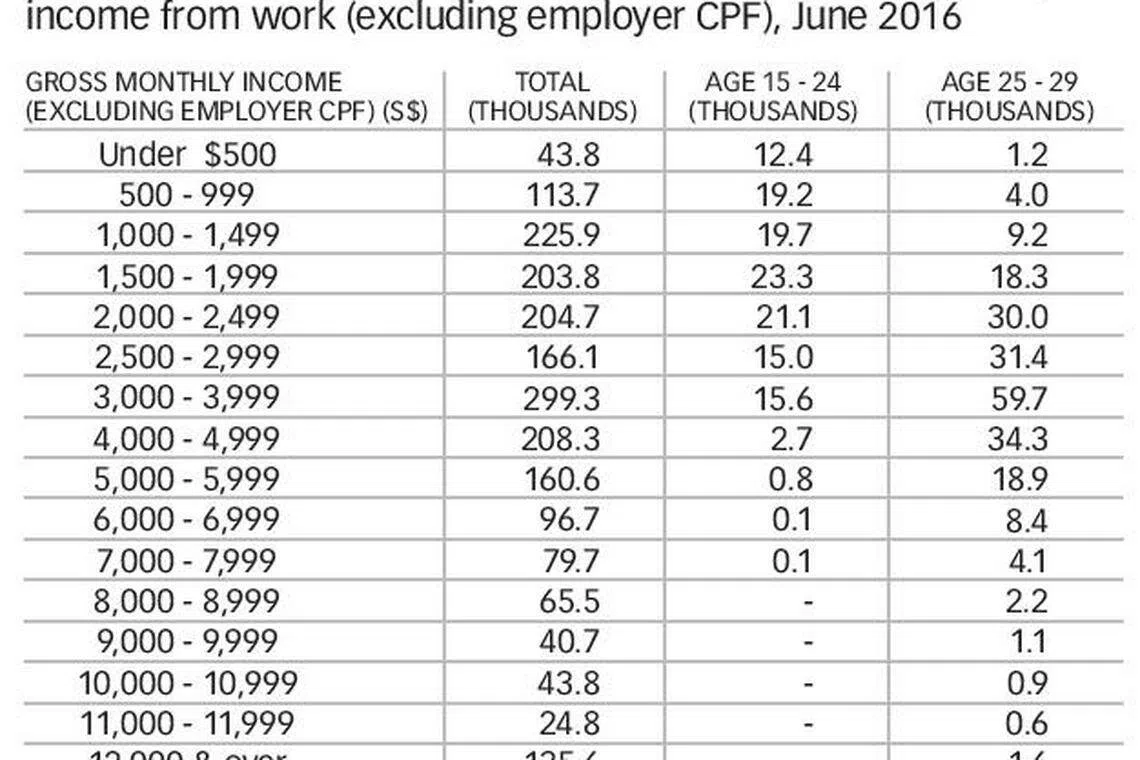

In addition, only 106,200 out of 2.1 million full-time employees - just over 5 per cent - were in the S$8,000- S$9,999 pay bracket (excluding employer CPF), figures from the Ministry of Manpower show. As for full-timers between the ages of 15 and 24 - the typical age of most interns - only 100 out of 130,200 earned between S$7,000 and S$7,999. The number drawing at least S$8,000 a month is too insignificant to be recorded.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

But, as would be expected, these top-paying internships don't come easy - in terms of both securing one as well as the demands of the job.

"I would be in the office at 6.30am and leave at 9pm," said Alex, explaining that he had willingly stayed back to read up on market news and prepare reports for the team for the next day.

He revealed that on the day of the "Brexit" vote results last June, most interns were in at 4am. "Expectations are pretty high; you work really hard if you want the full-time job. This can range from doing the most menial tasks like buying coffee three times a day, to automating spreadsheets for the team to make things go faster."

Linda Teo, country manager of HR firm ManpowerGroup, said the banks see high compensation as part of employer branding and talent-attraction strategies.

"They are willing to offer top dollar to attract the creme de la creme of interns with the hope that especially outstanding interns will take up full-time roles with these companies after they graduate," added Ms Teo.

A past intern that BT spoke to managed to achieve conversion to a full-time role during his internship in a sales role at a foreign investment bank.

"I was given a big research project which had a direct impact on the actual business my team was involved in," he said. "At the end of five weeks, I needed to present to the whole team on my thought process and how this project could translate into actual P&L (profit and loss)."

After his first five weeks, the market analyst, now in a global role, was moved to a different team during a rotational stint - to an area where he had zero experience in.

"Essentially, I was thrown into the deep end of the pool. The tempo was just as fast and my new manager had high expectations for me nonetheless, despite me being new to the asset class. To impress my second boss, I had to do a lot of self-reading and work longer hours to make up for deficiency in experience."

Erman Tan, president of the Singapore Human Resources Institute (SHRI), said that interns who are offered a high salary despite not having had full-time experience are typically smarter, are excellent orators and leaders, and who can simplify complex problems. It is no wonder that even the application process for these internships can be as arduous as they come.

Applicants are first filtered by their resumes and essays, as well as psychometric and personality tests.

Some candidates are required to go through a phone interview with a mid-level executive, before meeting face-to-face with senior management.

Those who manage to battle through to the next round often undergo a full or half day's worth of back-to-back interviews and assessments, which can be in a group or individual setting. For some, a zero-sum game trading exercise might even be thrown into the mix.

A past intern at a major US bank said that summer interns form the dominant pipeline of full-time hires.

"Interns are empowered to take on tasks of full-time analysts. This can range from executing client mandates to financial analyses and modelling," added the ex-intern, who worked in the investment banking division.

According to global recruitment firm Hays, full-time investment banking analysts here drew annual salaries of S$70,000 to S$90,000 in 2016, while associates earned S$90,000 to S$130,000.

Meanwhile, junior global market traders took home S$55,000 to S$70,000 in 2016, while traders earned S$80,000 to S$180,000. The numbers do not include bonuses.

These top-paying finance internships aside, employers here are increasingly willing to invest in interns with multidisciplinary skills, or who show potential to perform.

"In addition to the usual stable of high-paying employers such as investment banks and tech behemoths like Google, Facebook and Microsoft, we are seeing an increasing number of employers who place a premium on cross-discipline skill sets," said Looi Qin En, chief operating officer of local talent recruitment startup Glints. He cites software firm Silverlake Axis which is offering S$1,000 a month to polytechnic and university interns with the relevant skill sets for fintech development. The firm has also offered an all-expenses-paid overseas learning trip to woo these interns.

Meanwhile, DBS Bank and OCBC Bank have come out with specialised internship programmes that focus on using multidisciplinary skills to address specific business problems.

Now in its second year, the DBS UNI.CORN programme saw a five-fold increase in applications to over 1,000 this year. UNI.CORN interns, who hail from diverse disciplines, are paid more than the typical undergraduate interns, who get between S$1,100 and S$1,500.

OCBC launched its FRANKpreneurship programme in March, featuring one and a half years' of effort and partnerships with Adobe and Google. Interns are attached to different departments and tasked to find creative solutions to a problem that may not be confined to any existing banking issue.

Copyright SPH Media. All rights reserved.