The Good, the Bad, and the Ugly of Integrated Shield Plans

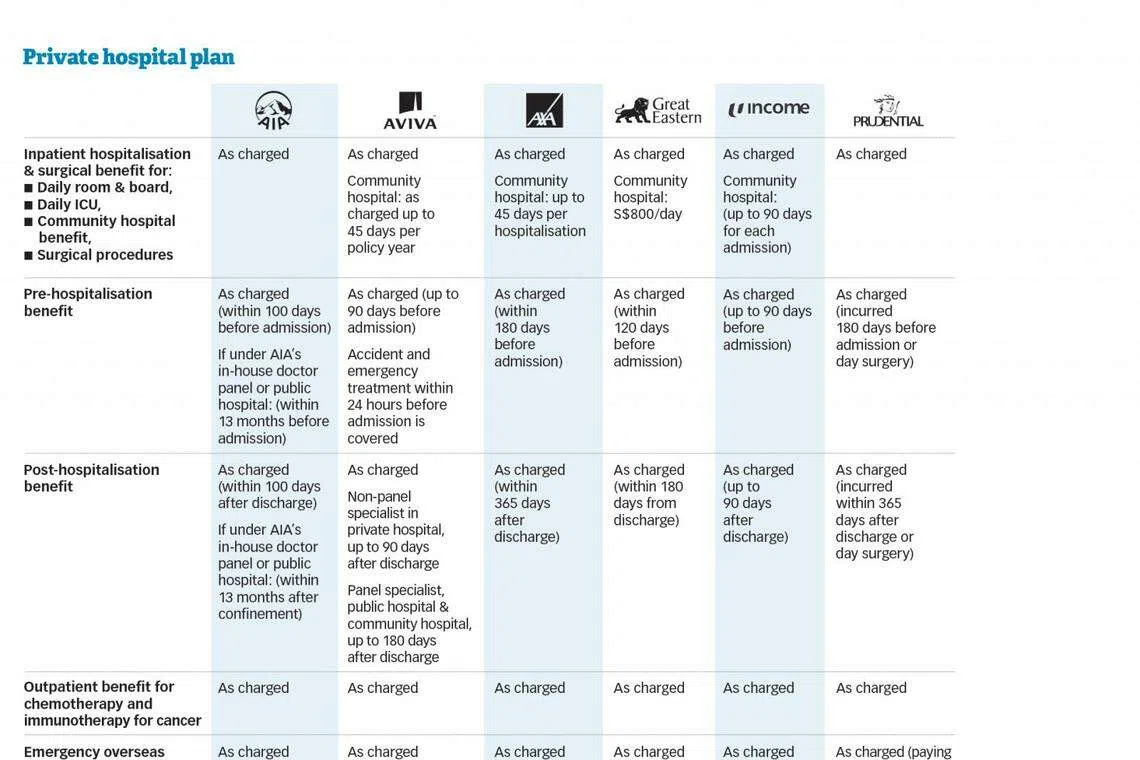

All you need to know about IPs, how the different plans stack up, and why your premiums are on the rise.

IN the beginning, all was good. The intention of having Medisave-approved private medical insurance schemes was noble, Singaporeans benefited from the improved coverage, and the business was profitable for insurers. But somewhere along the way, the sheen of the Integrated Shield Plan (IP) schemes faded and things went sideways.

In theory, they seemed a clever - and inexpensive - solution to that jaw-dropping hospital bill. Government-sanctioned medical insurance provided by private insurers, with premiums paid at least partly out of Singaporeans' Central Provident Fund savings.

As healthcare bills go up, Singaporeans now need private medical insurance more than ever, but IP premiums are on the rise and show no sign of abating - the latest round of increases being in late 2016 and early 2017.

Insurers are struggling to contain ballooning medical claims that have made their businesses increasingly unsustainable, causing some to swing into the red for years.

According to the Life Insurance Association Singapore (LIA Singapore), the industry claims ratio jumped from 57 per cent in 2011 to 82 per cent in 2015. The ratio measures claims payable as a percentage of premium income. In the same period, underwriting profit margin shrank from 14 per cent to a 5 per cent loss.

The LIA study pointed to several trends that aggravated the situation:

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Higher usage of IPs and IP riders (optional benefits offered on top of the plan for a higher premium); Escalating claims for private hospitals and bigger hospital bills; and Higher doctors' fees.

In the 10 years from 2005 to 2015, the Consumer Price Index (CPI) for healthcare climbed a steep 30.6 per cent, outpacing Singapore's core inflation. Prices of consumer goods and services rose by 21.7 per cent in the same period.

Two in three Singapore residents have an IP, the LIA found. And the proportion of Singapore residents who also have riders on top of their IPs has risen sharply from 19 per cent in 2011 to 32 per cent in 2015. Today, one in three has an IP and an IP rider.

The trouble with riders, particularly those covering deductibles and co-payment for private hospital treatments, is that while they widen essential coverage for the policyholder, they also inflate claims payable by the insurer.

The LIA found that average bills for private hospitals was double that of public hospitals for inpatient treatments, 21/2 to three times more for outpatient treatments, and four times more for day surgeries.

Enter the Health Insurance Task Force (HITF), an industry-led initiative chaired by Mimi Ho of Regulatory Professionals Pte Ltd, with representation from LIA, the Consumer Association of Singapore, Singapore Medical Association, Ministry of Health and the Monetary Authority of Singapore.

In October 2016, the HITF released its suggestions to do away with "as charged" IP riders, set medical fee benchmarks to reduce overcharging by doctors, and have insurers form panels of preferred healthcare providers.

Nine months later, a gridlock remains between the parties involved in the discussions. No concrete plans have been hammered out.

So insurers have taken it upon themselves to try to somewhat contain the situation.

For instance, AIA in January rolled out an in-house network of more than 160 specialists who are selected based on criteria such as depth of experience and reasonableness of fees.

Unlike third party administrators (TPAs) that AIA also works with, the specialists under the in-house panel do not pay to join the scheme.

To encourage policyholders to go to doctors on its network, chief marketing officer Ho Lee Yen says AIA is offering perks like discounts in outpatient consultation fees, and longer pre- and post-hospitalisation benefits for private hospital IPs. That said, policyholders can still get treated by doctors outside of this panel without penalties.

Prudential's head of medical Mack Eng says the insurer is also considering this route. Earlier this year, it introduced a new claims-based pricing approach for the rider of its private hospital IP, something Mr Eng believes can help promote "positive behavioural changes in healthcare consumption".

Andrew Yeo, NTUC Income's general manager of life and health business, says the insurer is "currently exploring various options, including the use of TPA" besides studying the recommendations of the HITF.

Others like Aviva and AXA are tapping the expertise of TPAs in managing panel doctors to control their claims without setting up their own panel, which is a laborious process.

In March, Great Eastern launched a call-in service for its IP policyholders to provide pre-authorisation of medical expenses - something a TPA helps with for the insurer to keep tabs on claims.

On a wider scale, insurers have initiated campaigns to urge policyholders to stay healthy. And that is by far the best policy.

Copyright SPH Media. All rights reserved.