CDL's Q3 profit sinks 8.3% to S$156m on sales slide

Kwek Leng Beng again urges qualifying certificate policy to be reviewed to help developers in land banking

Singapore

SMALLER one-off gains and the absence of "lumpy" contributions from property sales compared to a year ago weighed down its third-quarter results for City Developments (CDL).

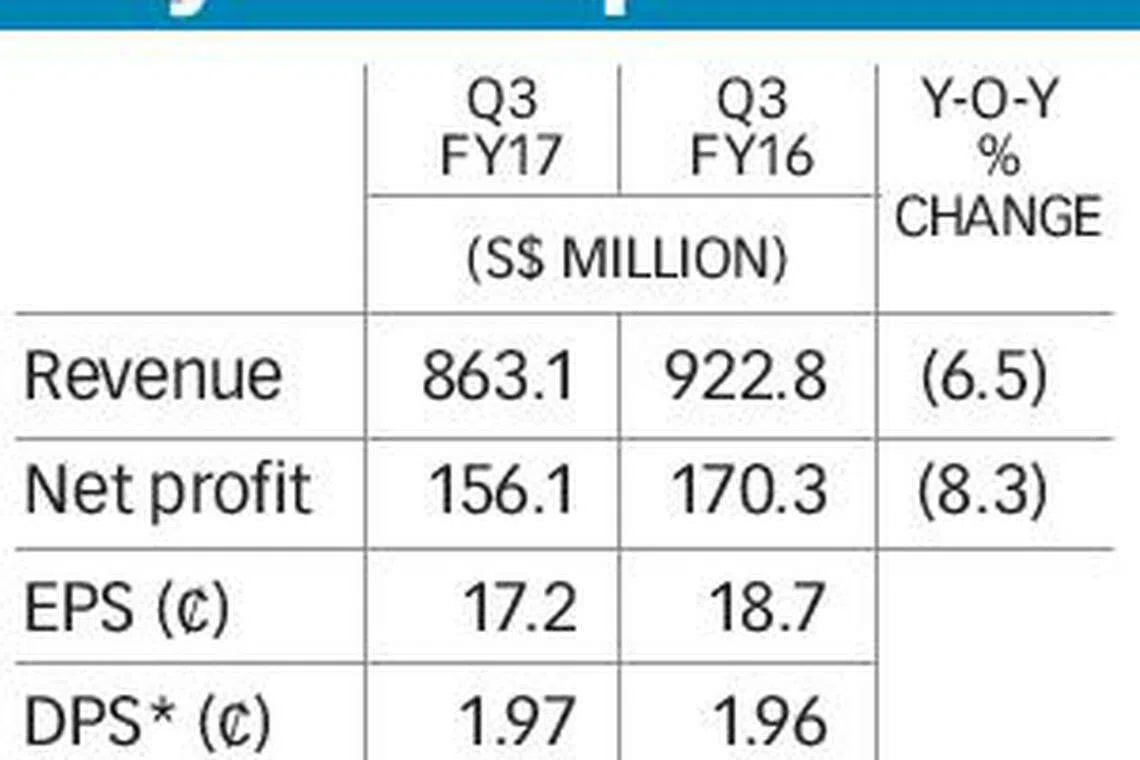

Net profit sank 8.3 per cent to S$156.1 million from the preceding year. For the three months ended Sept 30, revenue fell 6.5 per cent to S$863.1 million.

The revenue drop was primarily due to the absence of revenue recognition from Jewel@Buangkok which completed in Q3 2016, Hanover House in Reading, United Kingdom, as well as lower contribution from its D'Nest and Coco Palms projects.

On the booking of lumpy revenues and profits, CDL said "executive condominium (EC) and overseas projects are largely recognised in their entirety upon completion; for Singapore private residential sales, the timing of recognition is dependent on the stage of construction and sales progress".

For the nine-month period, earnings fell 14.2 per cent to S$351.5 million, on the back of S$2.5 billion in revenue, an 8.7 per cent drop from a year ago.

The developer said its Q3 and year-to-date results were boosted by a gain following the divestment of a non-core office building in Osaka.

Results for the corresponding year-ago period also included a gain from the divestment of the group's interest in City e-Solutions and the full recognition of revenue and profit of Lush Acres, a fully sold EC.

"Excluding these one-off items, the group's year-to-date Sept 2017 profit after tax and minority interests actually increased by 3.5 per cent."

In his statement, CDL executive chairman Kwek Leng Beng flagged that with the Singapore property cooling measures still firmly in place, the property market is still far from its previous peak almost a decade ago, and that recent improvements in market performance are coming from a low base the year before.

"We are confident that the government will continue to be nimble and make necessary tweaks to these measures, when the situation warrants."

He again called for the government to "sooner rather than later" review the qualifying certificate (QC) policy which prevents land banking for listed property companies. This is so as to balance supply and demand, and moderate escalating land prices.

"Policies like the QC are an impediment which have resulted in the rush to bid up land prices as land must be acquired and then developed within a limited period, rather than being held on a balance sheet over the longer term, which would moderate escalating prices," he said.

So far this year, the group and its joint venture associates have sold 1,056 units including ECs, more than double the units sold during the same period last year.

The total sales value amounted to about S$1.8 billion, almost triple the S$622 million in sales value a year ago.

For the third quarter, earnings per share dipped to 17.2 Singapore cents from 18.7 Singapore cents in the previous year.

Net asset value per share edged up to 10.38 Singapore cents as at Sept 30, from 10.22 Singapore cents three months ago.

Dividend per preference share rose to 1.97 Singapore cent, up from 1.96 Singapore cent in the previous year. It will be paid on Jan 2, 2018. Dividends for ordinary shares are given out in the half-year and full-year periods only.

The counter lost 22 cents to finish the day at S$12.14 on Thursday.

Copyright SPH Media. All rights reserved.