Higher Q1 profits meet analysts' forecasts, but valuations still lofty

Earnings relegate two-year spell of downward estimate revisions safely to the past

Singapore

FIRST-quarter corporate earnings met analysts' expectations with the banks turning in a surprisingly strong performance, analysts said.

But an uncertain outlook and relatively rich valuations raise doubt about whether the mildly positive start can lift market prices.

"We've had two years of earnings decline, and this time around there are no major downgrades - banks have delivered," UOB Kay Hian head of research Andrew Chow said. "But together with that, the Straits Times Index (STI) is already up 12 to 13 per cent year-to-date."

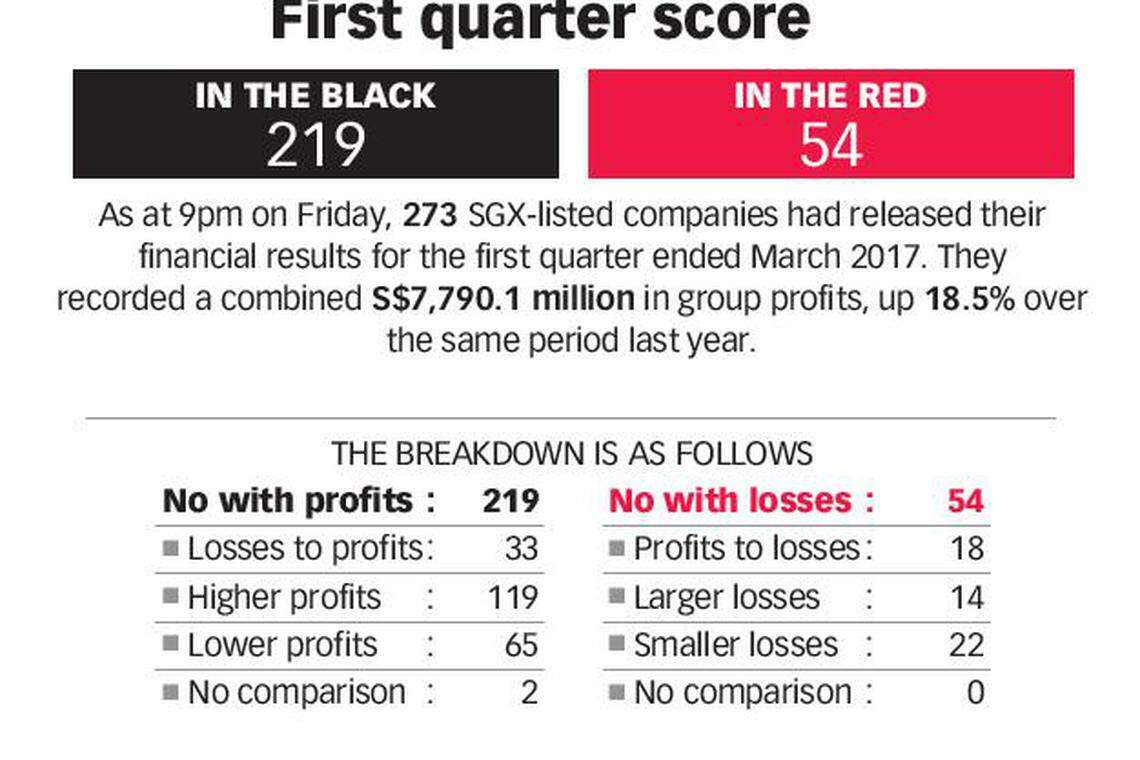

As at 9pm on May 12, 273 Singapore-listed companies whose fiscal years end on Dec 31 had reported a combined S$7.8 billion in first-quarter net profits, up 18.5 per cent year-on-year. Profitable companies outnumbered lossmakers 219 to 54, or about four to one.

Of the companies that had reported, 175 posted better results, while 97 reported worse numbers, or about nine improvements for every five that declined.

Mr Chow said that about half of the results within his firm's coverage matched expectations, and the remainder were roughly evenly split between beats and misses.

"In a nutshell, there was a slight pick-up in beats, but broadly speaking still in line," he said.

The banks were a positive surprise in the first quarter, with wealth management income giving a boost to the lenders. DBS Group Holdings' net profit increased by 1 per cent to S$1.21 billion, excluding one-off items such as a S$350 million gain from the divestment of the PWC Building in Singapore.

United Overseas Bank's Q1 net profit grew 5.4 per cent to S$807 million, while OCBC Bank's net profit rose 14 per cent to S$973 million.

"Banks saw stronger non-interest income, mainly coming from better wealth contribution," OCBC Investment Research's Carmen Lee said.

Mr Chow said that asset quality also improved slightly during the quarter for the banks.

"In terms of the provisioning for the oil and gas sector, the worst seems to be over," Mr Chow said. "That has given us a lot of comfort. We're also seeing loans growth, with relatively solid net interest margin expansion in DBS and UOB. We have been 'overweight' and pushing the banks, and Q1 gave us more confidence to be positive."

The oil and gas and offshore and marine sectors remained underwhelming, although stabilised oil prices provided respite from the previous quarters' declines. Keppel Corp's net profit rose 24 per cent to S$260.4 million, propped up by its investment and property businesses despite struggles in its oil and gas segment. Sembcorp Marine's sale of a 30 per cent stake in Cosco Shipyard kept it profitable.

"Oil and gas results were either in line or slightly below expectations," Ms Lee said.

Positive surprises were scattered across the board. Electronics manufacturer Venture Corp's first-quarter net profit jumped 35.6 per cent to S$48.6 million, while among the commodity players Wilmar International beat estimates with its 51 per cent net profit increase, to US$361.6 million.

Overall, the results announced so far were mostly in line with what analysts were expecting. That was also the case three months ago, which bolstered confidence that the market will now be able to put a two-year streak of downward estimate revisions safely in the past.

But while the worst may be over, analysts still expect the rest of the year to be bumpy.

"We expect earnings to remain fairly muted for the rest of the year despite global optimism of better 2017 earnings, largely from the improving global outlook," Ms Lee said. "We believe that Singapore companies will still face a challenging operating environment for this year from several fronts - oil and gas, a soft rental market, muted economic growth, slower consumer sales etc - and expect a better earnings outlook in 2018."

Prices also already seem to be fully pricing in those soft expectations.

"Valuation for the Straits Times Index (STI) is currently not as cheap as two quarters ago, especially with the 13 per cent year-to-date gain for the STI," Ms Lee said, noting that current prices are about 14.9 times earnings, which is slightly above the five- and 10-year averages.

Prices are also 1.2 times book value, which is just below the five-year average.

"At the current level, most stocks have already seen good gains so far this year and we expect some light profit-taking to take place in the later part of May and into June as this is traditionally a quieter trading period due to the school holiday and summer breaks," Ms Lee added.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Hong Kong regulator to probe PwC auditing role over Evergrande

US: S&P, Dow open flat as Middle East jitters ease, Netflix weighs on Nasdaq

DBS puts 46 HDB shops, private strata retail units on market for S$210 million

China to facilitate Hong Kong IPOs and expand Stock Connect

Global equity funds see surge in outflows as rate cut hopes fade

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece