In for a scary taxi ride

ComfortDelGro's core cab business could suffer if Grab and Uber are here to stay

EVERY time I feel like buying a car, I stop and ask myself: Would I rather blow S$100,000 on a Honda, or plonk that money in ComfortDelGro stock?

For the longest time, the thought experiment pointed me very clearly in the direction of the stock.

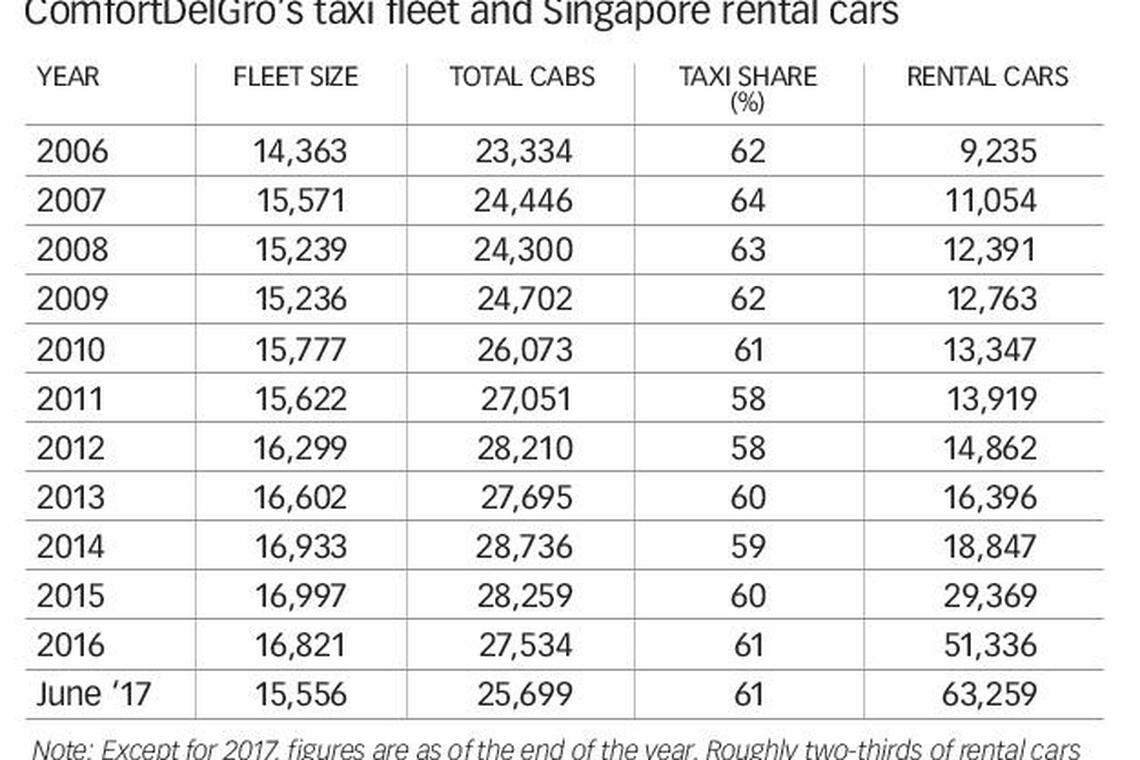

I have taken SBS Transit buses almost every day for more than 20 years, so I know a thing or two about sticky demand. If I flagged a cab, it was likely to be Comfort or CityCab, given their combined 60 per cent market share of the taxi market.

ComfortDelGro generates solid free cash flow from which dividends are paid, is in a solid net cash position, and enjoys double-digit operating margins for most of its businesses.

But as Bob Dylan would sing, "the times, they are, a-changin". This year, taxi operating statistics are finally deteriorating fast. Given that taxis accounted for 36 per cent of group operating profit in 2015 and 2016, or more than S$160 million a year, a decline in taxis spells bad news for ComfortDelGro shareholders.

Last month's news of the firm's potential tie-up with ride-hailing giant Uber only confirms my suspicions that ComfortDelGro's sterling profit record is in serious trouble, which the market has not awoken to fully.

How bad will things get?

The most scary statistic is the firm's declining fleet size. Based on Land Transport Authority (LTA) statistics, ComfortDelGro's Singapore taxi fleet has hovered at almost 17,000 vehicles for the last few years despite the onslaught of Grab and Uber. The vast majority were rented out.

Everything changed this year. The firm's fleet began dropping precipitously at the rate of one to 2 per cent a month. By June, the fleet was down to just over 15,500 vehicles.

If the decline continues at one per cent a month, the fleet will number less than 15,000 at the end of the year. Clearly, large numbers of drivers are giving up.

Falling revenue

Assuming ComfortDelGro's average taxi daily rental rates were S$140 a day in 2016, every cab gone from the fleet is a loss of over S$50,000 in revenue. Even if average rates were S$110, that still works out to S$40,000 of lost revenue per cab.

The math is straightforward. If 2,000 S$140-a-day vehicles are gone from ComfortDelGro's fleet this year, revenue will drop by S$100 million.

Assuming variable costs are proportionate and margins stay the same, more than S$10 million in operating profit will already be lost from that decline in fleet size.

It gets worse. Revenue has already been lost from call bookings, given how Grab and Uber have superior booking systems.

Another major hit comes from downward rental revisions. To retain drivers, the firm has already started slashing rates in various new rental schemes. After the cuts, it is uncertain whether the firm can keep revenues steady through other revenue-sharing initiatives.

For a fleet of 15,000 cars, every S$10 in daily rental cuts might result in more than S$50 million lost in annual revenue, and the assumed S$5 million in operating profit lost.

If Grab and Uber are here to stay, ComfortDelGro's taxi operating profit will drop by anywhere from S$15 million a year and up, until drivers stop leaving ComfortDelGro and the market stabilises.

Meanwhile, there are fixed administrative costs that cannot be cut, so the profit impact assumption might be an underestimate.

How low will group operating profits fall? Other than the public transport business, the firm's own outlook for its other businesses isn't cheery.

We can take reference from ComfortDelGro's latest financial statements, where total operating profit is already down by S$10 million in a quarter. Revenue from the taxi business is down year-on-year by S$36 million for the second quarter.

A decline in the taxi business will have knock-on effects on the firm's auto servicing business, although a tie-up with Uber could mitigate that.

Given the trend, group operating profit already looks set to be down by S$40 million this year, or about 2 cents a share. Without taxes and on a multiple of 15 times, that's already a 30-cent impact on share prices.

Market structure woes

The bleeding looks unlikely to end this year. And so the multiples investors are willing to pay for the firm might fall further.

If I learnt anything from investing, it is that businesses can decline for a longer than expected time.

The fundamental story for transport remains strong.

But what has happened with Grab and Uber is that the taxi-booking business might be separated from the taxi-operations business. While the taxi-booking business might end up a duopoly, the taxi-operations business is veering dangerously from oligopoly to perfect competition.

After all, the products that operators offer are identical: Private, air-conditioned transport from Point A to Point B. It isn't too difficult to get a private-hire licence or a rental car. Consumers are unlikely to have brand loyalty. They simply go for the cheapest price, once they are assured of safety. You can usually get smooth rides on a Toyota as well as an Audi.

It is not perfect competition yet. Not everybody has perfect information about prices or access to Uber and Grab apps. And there's an oversupply of rental cars.

As the private-hire market consolidates, the uncomfortable truth is that ComfortDelGro has lost its cushy position in Singapore taxis.

In the medium term, is the firm ready to operate a driverless taxi fleet? Or will it be disrupted by Google and the auto giants?

This is not to say I won't buy ComfortDelGro if I think the price is right. I still think its bus and rail businesses are rock-solid with growth potential.

How much they are worth is a matter for debate. By a simplistic 20-times multiple of estimated net profit, the public transport segment might be worth S$1.20 a share. The rest of the businesses, excluding taxis, might be worth S$0.50.

In a worst case scenario of a sustained taxi glut, ComfortDelGro investors can still sit tight on a "regulator-approved" cut of public transport oligopoly profits.

There is cause for more caution. The world is in a low interest rate, low oil price, and high earnings multiple environment. That could change.

And as this year shows, Grab and Uber cannot be ignored. I'm still not getting that Honda.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Volkswagen workers vote decisively to unionise in Tennessee

Sony deal for Paramount would draw added regulatory scrutiny

Bitcoin 'halving' has taken place: CoinGecko

Lululemon to shutter Washington distribution center, lay off 128 employees

Wall Street bonus rules return to regulatory agenda in third try

Honda to invest US$808 million in Brazil by 2030