Nice touchdown for SIA Q2, but carrier warns of bumpy ride ahead

Singapore

SINGAPORE Airlines (SIA) turned in a better second quarter despite a tough environment, buoyed by robust operating results.

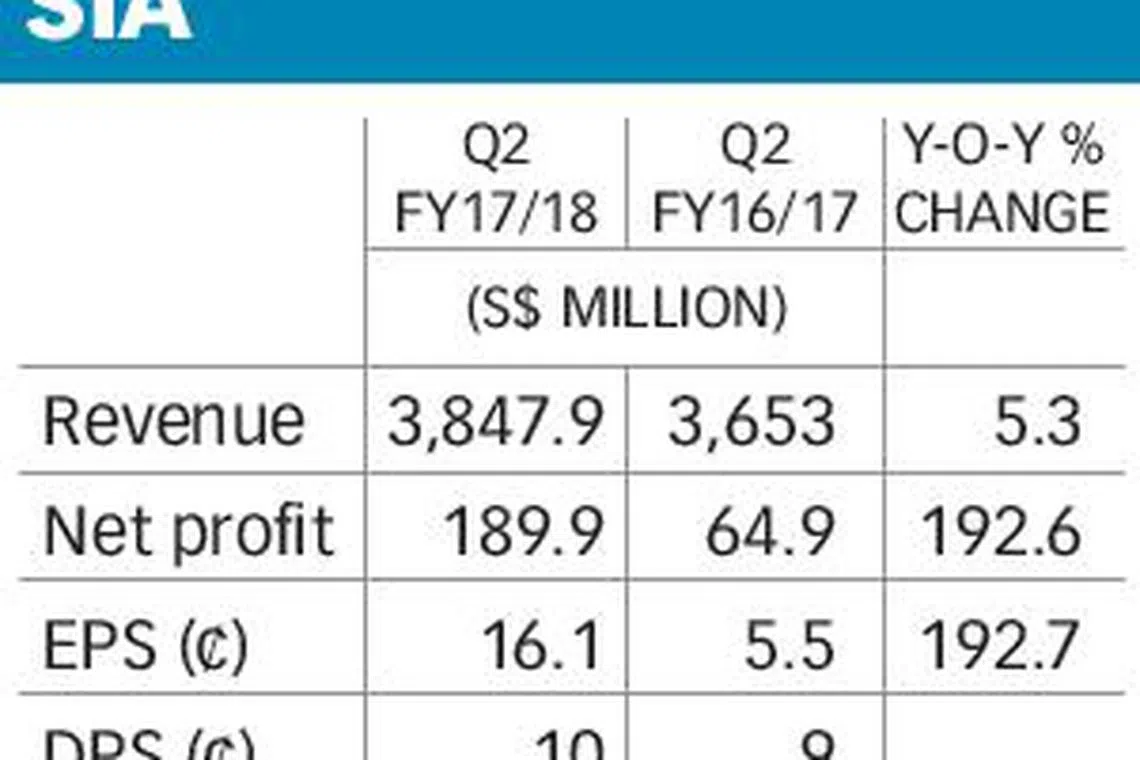

The bottom line nearly tripled to S$189.9 million, up from S$64.9 million a year ago, as both passenger and cargo traffic increased.

However, the airline group, which is fighting off competition from both full-service carriers and budget airlines, warned that yields continue to remain under pressure, despite some stabilisation in recent months.

It said: "Headwinds remain as competitors mount significant capacity in key markets."

For the quarter, the parent airline's yield declined 2 per cent year on year to 10 cents per passenger-km.

Revenue rose 5.3 per cent year on year to S$3.85 billion; earnings per share clocked in at 16.1 Singapore cents, rising from 5.5 cents a year ago.

For the quarter under review, operating profit more than doubled from S$109.1 million to S$232.6 million; this was underpinned by revenue growth, which outstripped the increase in expenditure.

Expenditure climbed two per cent to S$3.62 billion, partly due to higher staff costs and handling charges, offset by a 1.7 per cent dip in fuel costs.

Across the group, the results were mixed: the parent airline and SIA Cargo posted stronger profits, while Scoot and SilkAir's profits fell as they continued to invest in spreading their wings.

The decline in yield at the parent airline was offset by higher passenger revenue from a 2.3 per cent increase in passenger traffic; this enabled the parent airline to post an operating profit of S$170 million, up from S$79 million previously. Passenger loads were higher by 1.4 percentage points at 81.8 per cent.

SIA Cargo, in particular, swung into the black with an operating profit of S$26 million, vis-a-vis an operating loss of S$11 million the year before. The cargo unit's revenue expanded S$65 million, lifted by a 5.4 per cent growth in freight carriage and a 9.1 per cent improvement in cargo yield as trade conditions improved.

Meanwhile, SIA Engineering's operating profit shrank from S$25 million to S$20 million.

The airline's results outperformed UOB Kay Hian's projection, which had estimated a Q2 net profit of S$142 million owing to higher load factor.

For the six months ended Sept 30, the group's net profit surged about 32 per cent year on year to S$425 million on the back of higher operating profit and lower share of losses from associated companies. Revenue edged up 5.5 per cent to S$7.71 billion, with improvements across all business segments.

The airline group has declared an interim dividend of 10 cents per share, up from nine cents a share a year ago, to be paid on Dec 5.

SIA, which unveiled its newest cabin products for the A380 last week, will be returning the second of its five leased A380s back to the lessor, leaving it with 17 A380s in its fleet. It has ordered five brand new A380s, the first of which will arrive mid-December and will be deployed on the Singapore-Sydney route from Dec 18.

The airline group said fuel prices will remain volatile as the outlook for oil demand brightens against the backdrop of ongoing supply constraints.

For the second half of the financial year, the group has hedged 29.5 per cent of its fuel needs in MOPS and 11.7 per cent in Brent at US$65 and US$53 per barrel respectively. It has in place longer-dated Brent hedges with maturities extending to FY22-23; these account for up to 47 per cent of the group's projected annual fuel consumption at US$53-59 per barrel.

Amid pressure from carriers such as the Gulf trio and the Chinese airlines, SIA embarked on a three-year transformation programme this year, which it says is on track.

"The group is identifying new opportunities for revenue generation, re-structuring of its cost base and enhancement of organisational effectiveness under the programme," it said.

Elsewhere in the region, Hong Kong flag carrier Cathay Pacific is on a cost-cutting drive, entailing the slashing of at least 600 jobs, as it seeks to turn itself around.

In the coming quarters, competition from budget carrier Norwegian Air and Qantas - which is re-routing its Sydney-London service via Singapore come March 2018 - could hit passenger yields, UOB Kay Hian analyst K. Ajith said in a recent report.

"Cargo earnings, meanwhile, are expected to reverse into the black, following improved loads, and are likely to be sustained into 2018."

Cash and cash equivalents totalled S$3.28 billion as at Sept 30, more or less flat from S$3.27 billion a year ago.

Shares in SIA closed seven cents lower on Tuesday at S$10.32.

Copyright SPH Media. All rights reserved.