Singapore banks start 2018 with O&M woes fading into distance

Strong business momentum feeding into projections of high single-digit loan growth this year

Singapore

THE three Singapore banks will usher in the Lunar New Year amid a likely shift in sentiment - not just as risk from the offshore-and-marine (O&M) segment is fading, but also amid an improved outlook for the region.

This comes as OCBC and UOB in the fourth quarter joined DBS in deploying excess funds to offset fresh allowances for O&M customers.

The switch to a new accounting standard, which took effect on Jan 1, has allowed banks to draw down funds from their general provision reserves.

The banks have used this to cover large allowances for specific bad loans, particularly from the beleaguered O&M segment, in the second half of 2017. OCBC and UOB took the drawdown in Q4, and DBS, in Q3.

With this, the three banks have had most of their concerns in the oil-and-gas segment sufficiently cushioned against further stress. UOB's chief Wee Ee Cheong noted that most of the issues in the oil-and-gas segment "are behind us". OCBC's chief executive Samuel Tsien described the risks in the bank's O&M portfolio as being "very comfortably contained" now. DBS chief Piyush Gupta reported that the bank has also cleaned up the bad-loan portfolio. Ng Wee Siang, senior director at Fitch Ratings Singapore, said the positive overall trends for 2018 were characterised by rising net interest margins (NIM) and strong fees. Excluding the oil-and-gas exposure, loans in the book are resilient, he added.

"The outlook appears positive, barring any external shocks."

Krishna Guha, an analyst from Jefferies Singapore, said the strong business momentum feeds into the strong 2018 guidance from the banks, which are all projecting high single-digit loan growth this year. Credit costs are also set to fall.

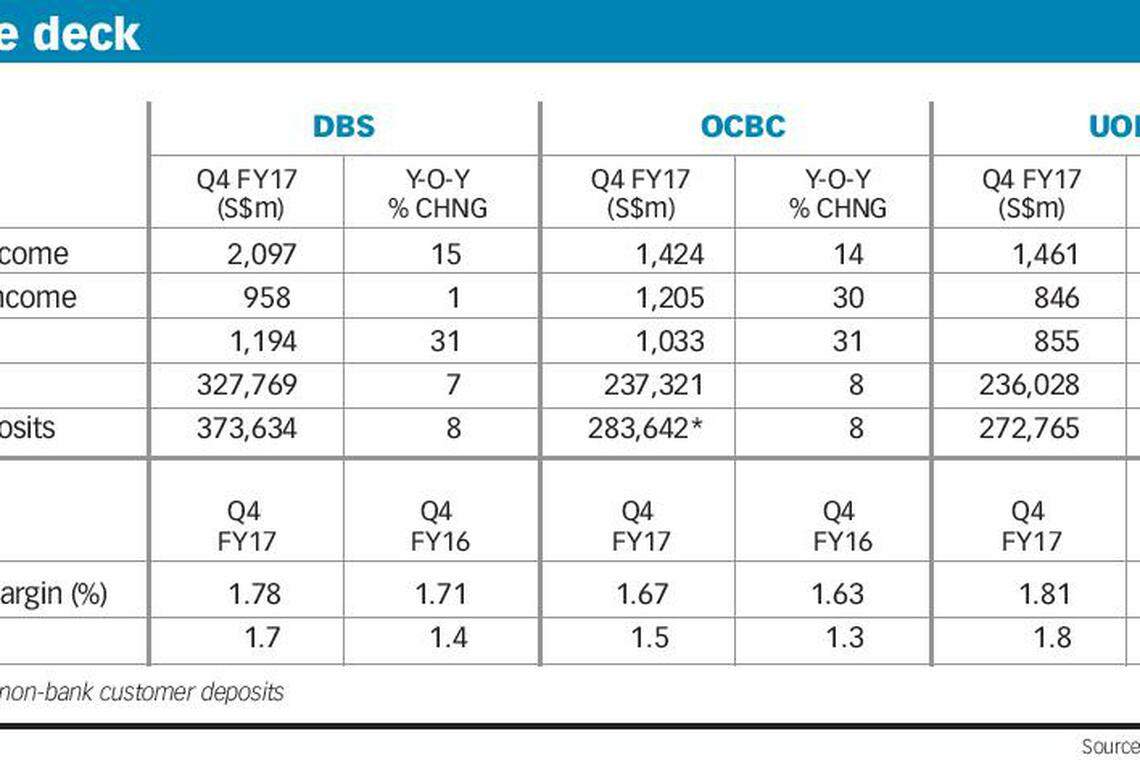

OCBC on Wednesday posted fourth-quarter results that beat forecasts. Its quarterly net profit rose 31 per cent to S$1.03 billion, from S$789 million the year before. Analysts polled by Bloomberg had tipped an average forecast of S$956 million.

Mr Tsien said: "Business confidence has increased. The momentum that we saw in 2017, quarter by quarter, seems to be sustainable."

UOB reported a 16 per cent rise in its fourth-quarter net profit to S$855 million, which missed estimates. Analysts polled by Bloomberg were expecting a net profit of S$891 million.

Still, stronger growth is expected this year. Mr Wee said in a statement: "With the improving outlook across the region, our customers are stepping up on their regional expansion plans and expect further growth in their personal wealth."

DBS' Mr Gupta said in the bank's results briefing that the global macroeconomic environment is robust, with the improving interest rate environment expected to provide NIM uplift.

DBS' net profit reached a record high of S$1.19 billion for the fourth quarter, up 31 per cent from the previous year. The result was on par with the S$1.2 billion average estimate of analysts polled by Thomson Reuters.

This result season has been dominated by special dividends. DBS proposed a final dividend of 60 Singapore cents a share for 2017 - double that of last year- and also a special dividend of 50 Singapore cents a share as a one-time return of capital buffers that had been built up, and for the bank's 50th anniversary.

UOB, meanwhile, is offering a final dividend of 45 Singapore cents a share and a special dividend of 20 Singapore cents a share.

OCBC disappointed relatively, with a final dividend of 19 Singapore cents a share, up from 18 last year.

Its chief said the bank will maintain a 40-50 per cent dividend payout, noting that the bank believes it has growth opportunities to grab by deploying capital.

"We view that there are enough organic opportunities in the market... we see this as a growth business. We want to retain the capital so that we can grow our franchise and give an even higher return on a consistent basis to our shareholders."

Shares of OCBC closed down 31 cents or 2.5 per cent, to S$12.26; UOB ended 60 cents or 2.2 per cent lower, at S$26.24. DBS closed higher at S$28.03, up 40 cents or 1.4 per cent.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Honda to invest US$808 million in Brazil by 2030

US: Nasdaq, S&P tumble as Netflix, chip stocks drag

Europe: L’Oreal gains cap third week of declines

Telegram messaging service to allow Tether stablecoin payments

Hong Kong regulator to probe PwC auditing role over Evergrande

US: S&P, Dow open flat as Middle East jitters ease, Netflix weighs on Nasdaq