Singtel hits 12-year low amid heavy trading

The last time it closed below S$2.16 was in October 2008; counter has slumped nearly 36% year to date

Singapore

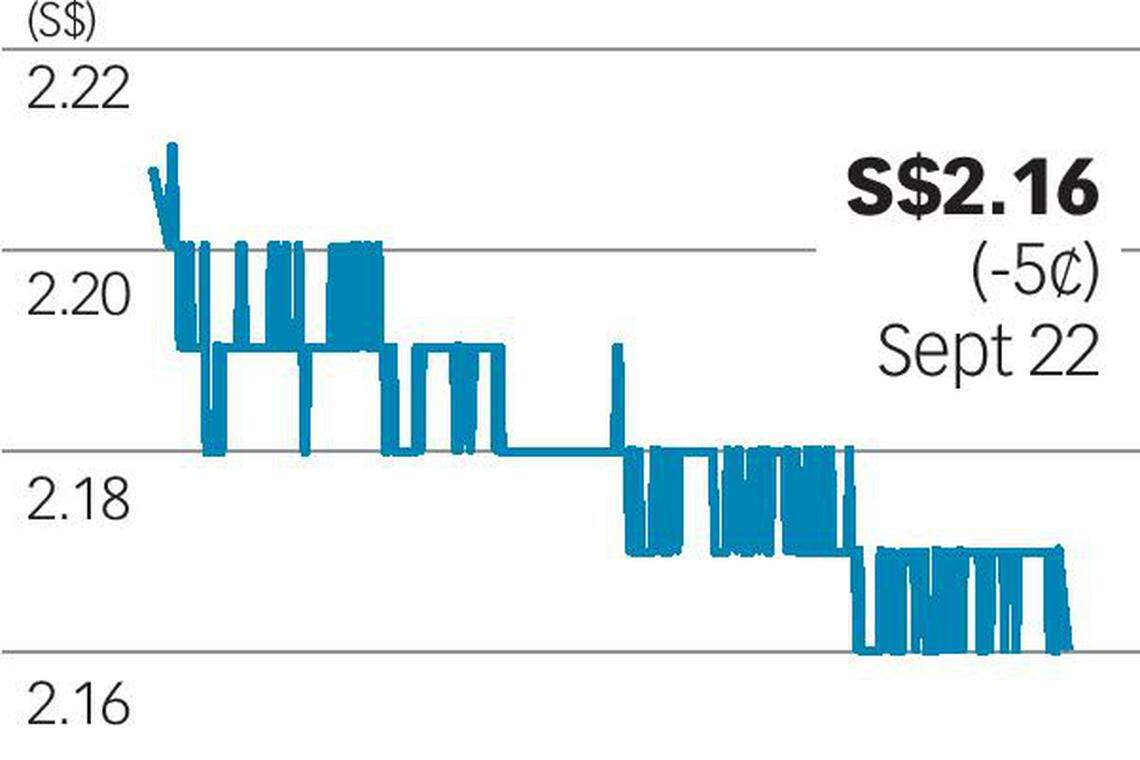

SINGAPORE Telecommunications' (Singtel) share price on Tuesday fell to its lowest in 12 years as heavy volumes changed hands.

It lost S$0.05 or 2.3 per cent to end the day at S$2.16, after 40.5 million shares were traded.

The last time it closed below this level was in October 2008. Year to date, the counter has slumped nearly 36 per cent.

The counter was the second most active by value and the fourth most traded stock by volume on the Singapore bourse for the day.

There were about a hundred large trades - each with a value of more than S$150,000 - throughout the day, according to Shareinvestor data.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

One married deal was recorded on Shareinvestor at around 9.04 am, done at S$2.205 with 59,300 shares; another was done at 5.06 pm at S$2.179 with 121,200 shares changing hands.

But even as its share price has skidded since the start of this year, Singtel remains the most widely owned stock in Singapore with some 16.32 billion shares outstanding as at Tuesday, according to the Singapore Exchange's website. Singtel's website also says there are more than one million Singaporeans among its retail shareholders.

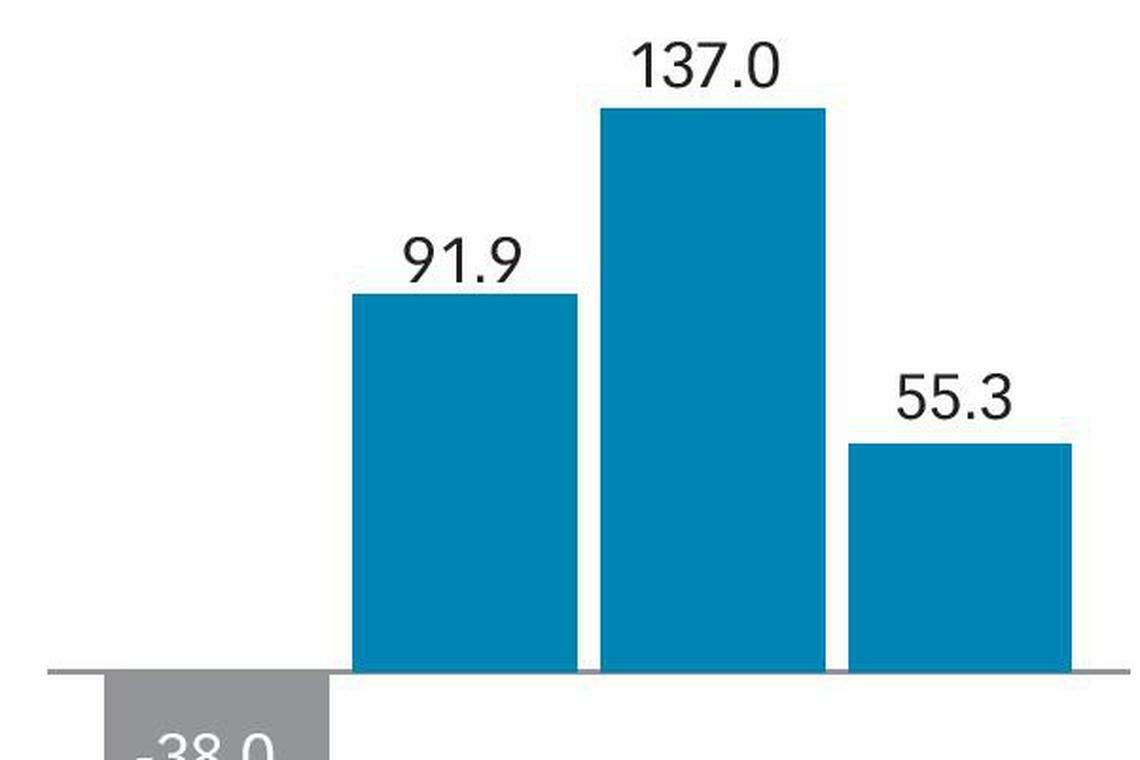

An investor who has been holding the blue chip since its initial public offering (IPO) in 1993 would have got a total return of around 55.3 per cent, assuming the dividends were reinvested into the securities, according to Bloomberg data.

The IPO represented 11 per cent of Singtel shares, with the rest held by Temasek Holdings. The public offer was done via three tranches of Group A, B and C shares, with Singapore citizens able to buy Group A shares at a discount.

In any case, Singtel's latest valuation as measured by yield is still nowhere near its record low. For the current quarter, it has traded at an average dividend yield of 5.6 per cent. That's below the peak of 6.9 per cent for the quarter ended March 31, 2020, but above the trough of 2.6 per cent for the quarter ended Sept 30, 2000.

And the stock has outperformed over the last decade notwithstanding Singtel's worrying financial metrics.

From end-2009 to end-2019, before the Covid-19 crisis, its shares delivered a total return of 81.3 per cent. The Straits Times Index returned 25.4 per cent on the same basis.

That being said, a significant portion of that return came from Singtel's generous dividends, which are now threatened by the Covid-19 pandemic and the company's deteriorating financial position.

Analysts in recent weeks had continued to favour the stock, with mostly "buy" recommendations.

CGS-CIMB kept its "add" call and S$3.10 target price (TP) on Sept 11, DBS maintained a "buy" rating while cutting its TP to S$2.69 on Sept 4, while RHB stayed "buy" with a S$3.20 TP on Aug 18. OCBC also has a "buy" call on Singtel as at Aug 18, with a lowered fair value of S$3.08.

In a recent report, Standard & Poor's (S&P) Global Ratings forecast Singtel's reported earnings before interest, taxes, depreciation and amortisation (Ebitda) to decline by 11-13 per cent to between S$3.9 billion and S$4.1 billion in fiscal 2021.

Meanwhile, adjusted Ebitda - which includes dividends from associates - is estimated to drop 6-8 per cent to between S$5.1 billion and S$5.2 billion, the credit ratings agency said. It estimates cash dividends will be reduced to S$1.8 billion to S$2 billion in fiscal 2021, from S$2.86 billion in fiscal 2020.

READ MORE: Tech stocks reverse rally to lead markets rout in Asia, US, Europe

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

S&P slashes Boeing credit outlook as rating hovers above junk status

Honda to spend US$11 billion on EV strategy in Canada

GlaxoSmithKline sues Pfizer and BioNTech over Covid-19 vaccine technology

Mapletree Industrial Trust Q4 DPU rises 0.9% to S$0.0336

Nasdaq’s profit falls as shaky economy keeps IPO revival elusive

iFast Q1 net profit surges on ePension unit performance