Softening of medical tourism nudges health groups overseas

As regional hospitals improve and charge less for care, local private hospitals try to hang on to medical tourists

Singapore

SINGAPORE'S medical tourism has not been in the pink of health of late, with well-heeled medical tourists now looking elsewhere for health care, where standards have risen and treatment comes at more competitive prices.

So instead of trying to attract foreigners to Singapore for dental work, heart bypasses and a nip-and-tuck, some of Singapore's biggest private hospital groups are changing tack.

With their brand names still firmly in hand, they are investing in medical facilities outside Singapore, where they have set up shop to provide their foreign patients with the high-quality care they are reputed for.

Raffles Medical Group, for example, has three medical centres in Hong Kong and one in Shanghai; IHH Healthcare Berhad, which owns and operates four private hospitals in Singapore, has about 50 hospitals in Asia, central and eastern Europe, and is opening two more in China.

Kelvin Loh, chief executive officer of Singapore operations at Parkway Pantai, which is part of IHH, told TheBusiness Times that growth in medical tourism at the group's Singapore operations last year was muted compared to the year before, "due mostly to broader economic headwinds".

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Parkway Pantai has diversified its foreign patient base with patients from less-traditional markets such as Myanmar, Cambodia, Vietnam, Bangladesh, India and China, he said.

"Even with stable in-patient volumes, we have continued to improve revenue intensity, or average revenue per in-patient admission, for medical travellers as they come to us for the complex procedures."

He added that, in the longer term, the group remains confident of its ability to attract medical travellers to Singapore - even as Parkway Pantai continues to expand its footprint across Asia.

Director of PanAsia Surgery Group Melvin Look agreed that winging abroad is one strategy.

To stay ahead, he said, private groups here "must continue to reinvent themselves and reinvest, and start looking into exporting Singapore medicine overseas, rather than wait for the patients to come".

His group noticed a decline in the number of foreign patients in the last few years, both in absolute numbers and as a percentage of total patient load. Foreign patients, who used to comprise up to half of the group's patient load, now make up about a fifth.

"Many foreign patients are seeking treatment at their local hospitals, or going to Thailand and Malaysia, where standards have improved and the cost is much lower.

"Even what hospitals further afield have done has affected us. Russian patients are going to South Korea, and Bangladeshi patients are going to India," he said.

Hospitals in Thailand and Malaysia have been testing Singapore's hold on the medical-tourism market by offering high-quality care at much lower cost. They may not have the state-of-the-art technology Singapore's private hospitals have, but can carry out standard surgery at a fraction of the cost.

A report by BMI Research has noted that hospitals in Thailand and Malaysia have been rolling out aggressive measures to woo patients away from Singapore's expensive hospitals, where the cost will be "a financial deterrent for foreign patients".

A heart bypass in Singapore costs 41 per cent more than in Thailand and 106 per cent more than in Malaysia, BMI Research found.

A relatively low-cost total hip replacement surgery at a private hospital in Singapore could set one back around S$14,000; the same procedure at Mahkota Medical Centre in Malacca - which treats more than 80,000 foreign patients a year - costs the equivalent of only S$8,800.

Treatment costs aside, room costs are higher in Singapore as well. A basic single room in Farrer Park Hospital costs S$562 a day. An equivalent room in one of hospital services company Columbia Asia Group's hospitals in Indonesia costs S$77.

The strength of the Singapore dollar against key regional currencies such as the Indonesian rupiah and the Malaysian ringgit has been no help in keeping Singapore's healthcare hub dreams robust.

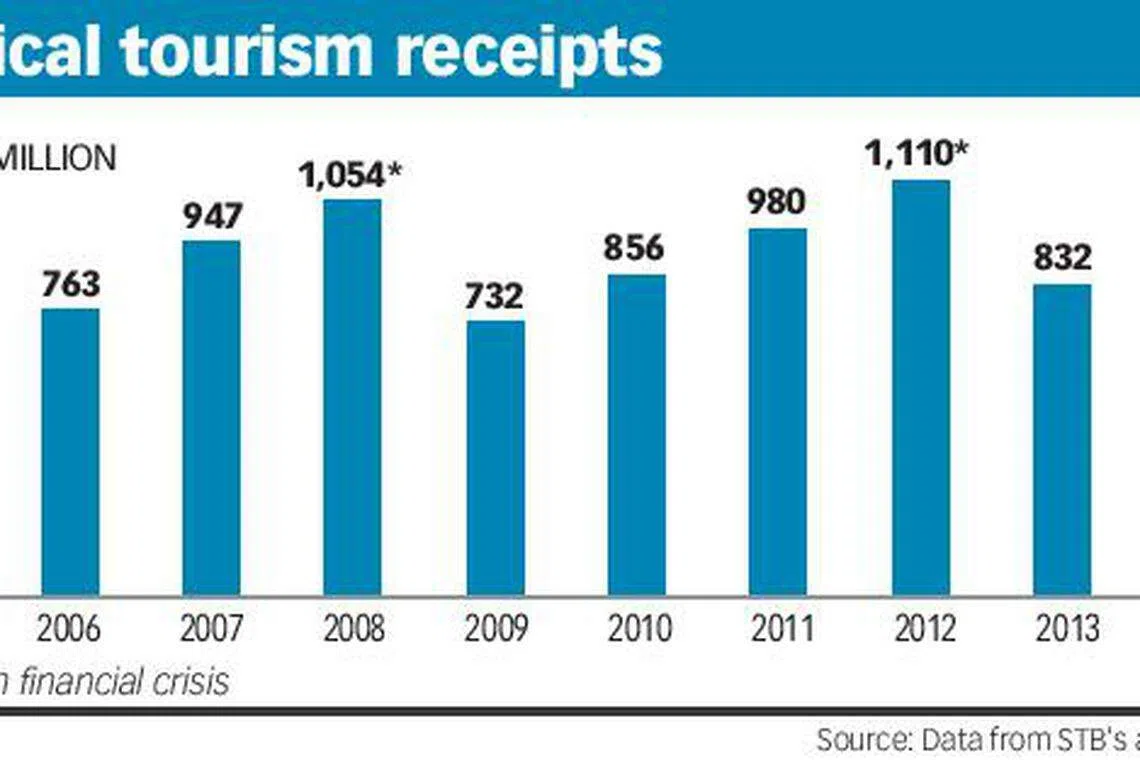

Singapore Tourism Board (STB) figures say that medical tourism receipts stood at S$1.05 billion in 2008, but fell to S$732 million the year after, following the 2008 financial crisis. Then it climbed to S$856 million in 2010, and peaked at S$1.1 billion in 2012.

A similar pattern of rises and falls played out between 2012 and 2014. From that S$1.1 billion peak in 2012, receipts fell to S$832 million the following year, after another global economic crisis, then edged up in 2014 to S$994 million.

A source close to STB told BT that because of the financial crisis of 2008, STB had redirected all available resources to leisure and business travel, and dropped formal support for education and healthcare.

STB's director of trade engagement and market access Soo Siew Keong said: "Over the years, the STB has worked closely with private healthcare providers to expand their reach in key target markets. With the experience and networks built over time, these private healthcare providers are now in a position to take the lead and directly drive the growth of the industry."

Mr Loh said Parkway Pantai's strength lies in its "differentiated capabilities".

"As our peers move up the healthcare value chain, we stand out on our proven track record of delivering superior clinical outcomes. We stay ahead of the curve by continuing to enhance our service offerings, such as investing in state-of-the-art facilities, disruptive medical technologies and a strong team of doctors and healthcare professionals."

He added that fundamentally, medical tourism to Singapore will be supported by regional growth trends; demand for quality private healthcare will rise in tandem with an ageing population, an increase in incomes and private insurance coverage.

But it is not as if all players are feeling the heat. The year-old Farrer Park Hospital, still has "a good mix" of Malaysians, Chinese, Indonesians and Bangladeshis making up about half its total patient load, which has grown five-fold in the first nine months of the hospital's operation.

Its spokesman said The Farrer Park Company, which comprises Farrer Park Hospital and Farrer Park Medical Centre, do not believe health tourism is a zero-sum game.

"Asia is on the rise with a growing high-income group and an even larger middle-income class. Travel within the region has never been better or easier with the advent of low-cost carriers and the wide selection of accommodation on platforms like Airbnb," she said.

READ MORE:

Copyright SPH Media. All rights reserved.