Businesses still optimistic, but profits a concern for large, foreign firms

BT-SUSS survey predicts GDP could expand faster in the third quarter of 2017

Singapore

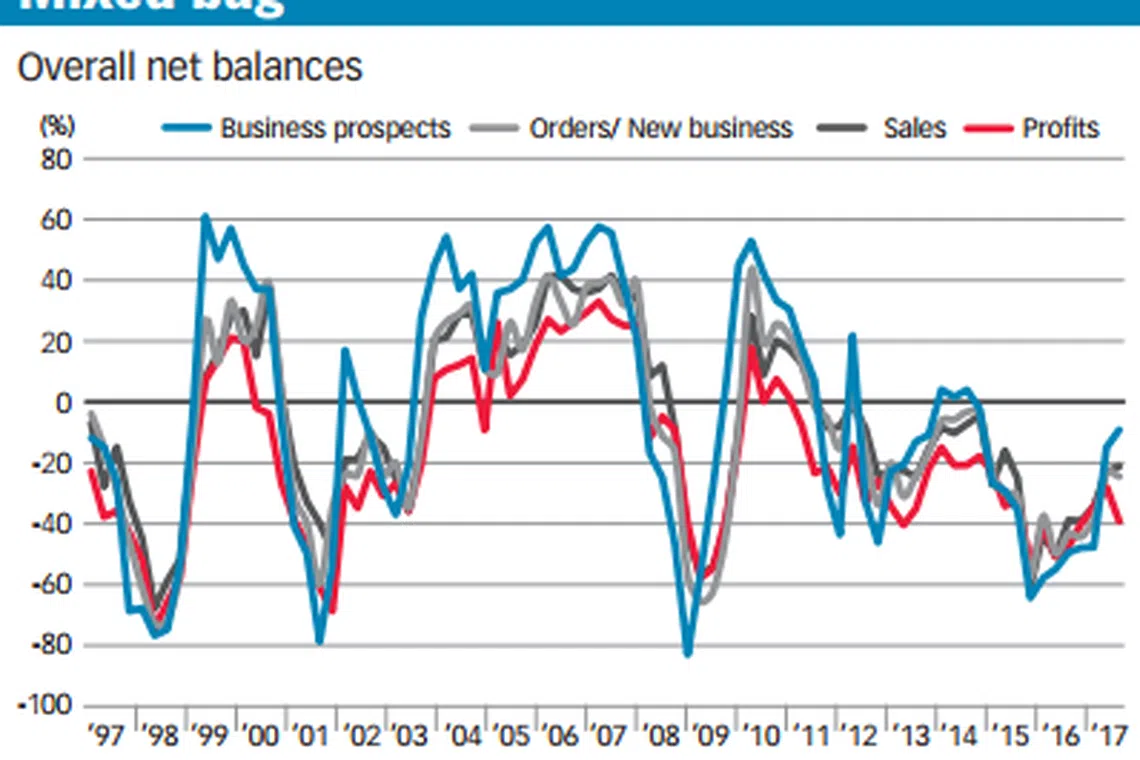

BUSINESS conditions in Singapore continued to improve in the second quarter of 2017, but the improvements were not as good as the previous quarter. Even though sales were marginally better, profits have weakened among large and foreign firms, while orders or new business remained largely unchanged.

Pessimism over business prospects in the next six months continued to diminish, albeit at a slower rate, based on the latest Business Times-Singapore University of Social Sciences (BT-SUSS) Business Climate Survey.

The survey portrays an environment consistent with official surveys and predicts that gross domestic product (GDP) could expand faster in the third quarter of 2017.

Of the 174 firms polled in June and July this year, firms foreseeing much better prospects over the next six months have emerged, although at a small proportion of 2 per cent.

About 24 per cent of firms expect business prospects to be better, unchanged from the previous quarter's survey. The proportion of firms expecting business conditions to worsen fell 3 per cent to 33 per cent.

The business prospects net balance - a weighted diffusion index that takes the difference between the proportion of positive and negative firms - improved by 6 points to -9 per cent.

Local and large firms are less pessimistic over business prospects than in the preceding quarter. All net balances show business prospects to be less gloomy than a year ago.

Comparatively, latest official business expectations surveys showed a net weighted balance of 4 per cent of manufacturers and 5 per cent of firms in the services sector anticipate a favourable business situation for the period July to December 2017.

The BT-SUSS survey showed sales net balance was better by 2 points to -21 per cent in Q2, with 3 per cent more firms reporting up to 25 per cent rise in sales compared to Q1.

Local and large firms attained better sales while small and foreign firms suffered worse sales. About 23 per cent of companies reported more than 25 per cent lower sales, 1 per cent more than in Q1. All sales net balances showed improvements compared to a year ago.

Profits net balance fell by 11 points to -39 per cent in Q2, at a similar level as three quarters ago. Large and foreign firms were hit by lower profits, while small and local firms saw slightly better profits.

About 4 per cent more firms than previously were hit by over 10 per cent lower profits. All profit net balances, except that of foreign firms, were better than that a year ago.

Lower profits for large and foreign firms could be due to foreign exchange losses, said ANZ economist Ng Weiwen. He said: "The Singdollar was stronger against most of these currencies such as yen, US dollars and South Korean won in Q2, so it might have some implications on their perception, especially on how they book their profits."

Maybank Kim Eng economist Chua Hak Bin said weaker profits could be coming from troubled sectors, such as offshore marine, construction, general manufacturing or some brick and mortar retail players.

He said: "Restructuring and strict foreign worker policies could also be raising wage costs and reducing profitability for some labour-intensive companies. Overly strict foreign manpower measures could be restraining some companies from capitalising on the demand upswing."

The net balance for orders or new business activity at -25 per cent in Q2 was little changed from Q1 (24 per cent), as only local firms obtained better orders or new business.

About 20 per cent of firms indicated better orders or new business, up 2 per cent from Q1. This offsets the 2 per cent more firms who experienced lower orders or new business. All net balances, except that of foreign firms, improved from a year ago.

Domestic activities have generally improved in Q2 from Q1 while overseas activities have weakened. But overseas business has continued to perform better than that in Singapore, as in Q1, the survey noted.

Other findings showed 53 per cent of firms expect sales to decline in 2017 over 2016, outstripping 29 per cent of firms predicting sales growth.

"This implies that 2017 would be another year of relatively weak economic performance but with signs of improvement," said the survey report, whose consultants are Chow Kit Boey and Chan Cheong Chiam.

All sectors are expecting lower sales in 2017, except for manufacturing which shows sales growth, with a net balance of 12 per cent. The rest of the sectors have smaller negative net balances, where transport and communications firms are the least pessimistic while commerce firms are the most pessimistic.

The manufacturing sector remains the star performer for the fifth consecutive quarter, having attained best results in sales, profits, orders or new business and is the most optimistic about business prospects in the next six months.

A regression analysis of the indicators predicts Q3 growth of 2.7-3.1 per cent year-on-year, based on an official advance estimate for Q2 GDP of 2.5 per cent. A conservative prediction using expected sales change shows GDP growth of 2.3 per cent.

Economists said the findings are in line with the observation that economic growth could have peaked and that momentum would soften going forward, due to the high base seen in Q4 2016.

OCBC Bank economist Selena Ling noted that the electronics industry should still be supported by the new smartphone cycle.

Copyright SPH Media. All rights reserved.