China Belt & Road: S'pore expected to benefit from regional uplift

Observers say economic competitiveness makes S'pore less attractive B&R investment destination, but Asean's resulting growth can help S'pore

Singapore

SINGAPORE and China pledged on Monday to cooperate on China's infrastructural "project of the century", but observers say the city state is likely to catch only a few droplets from the flood of monies.

However, Singapore should still try to position itself to catch the rising tide of opportunities that China's "Belt and Road" (B&R) initiative can bring to Asean, they added. This will lift Singapore's boat, as the city state tries to navigate global uncertainties that may drag on its growth.

"China's economy has graduated from primary school and is now going to secondary school, so there's competition with Singapore on the high-end side, so the B&R investments are not likely to flow here," said Tan Kong Yam, professor of economics at Nanyang Technological University. He was previously a chief economist for Singapore's Ministry of Trade and Industry, and he also worked at the World Bank.

"But the B&R is upgrading Asean's infrastructure. And that can benefit Singapore's companies looking for opportunities in the region," he added.

On Monday, Chinese Foreign Minister Wang Yi and his Singaporean counterpart Vivian Balakrishnan said in a press conference in Beijing that they had agreed to work more closely on the B&R initiative.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"Both of us are of the view that, against the background of a backlash against globalisation, China and Singapore, as the champions of regional integration, need to work together to address challenges and uphold common interests," Mr Wang said.

The B&R initiative is arguably a loose string of projects aimed at facilitating trade and investment flows between China and other countries, by investing in infrastructure.

The initiative offers China a chance to export its excess industrial capacity overseas, while extending the global reach of its currency.

China's endeavours culminated in a B&R forum one month ago, where President Xi Jinping said he looked forward to sharing ideas with leaders from more than 100 countries so that this "project of the century can benefit peoples from around the world".

The B&R initiative comes at a time when Asean is expressing an intense hunger for infrastructure financing. The Asian Development Bank estimated that the region needs US$5.5 trillion from 2015 to 2030.

There are initial signs showing that the initiative is quenching Asean's thirst. Maybank Kim Eng economist Lee Ju Ye noted that since the B&R initiative was first introduced in 2013, China's outward direct investments (ODI) into Asean grew by 7.5 per cent in 2014, and then surged by 87 per cent in 2015.

Singapore has received most of these Chinese ODI funds. A Maybank Kim Eng report showed that these flows into Singapore totalled about US$11 billion in 2015 - almost thrice the combined total of what the other Asean economies received in that year. For that year, the funds flowed into services sectors, particularly leasing and commercial services.

But don't expect Singapore to benefit much from those funds, say observers.

"The city-state's small size and developed status mean that the opportunities will not be in inward infrastructure investment," said BMI Research infrastructure analyst Christian Zhang.

"Historically, it has been difficult for international companies to participate in China-backed infrastructure projects in Asia and Africa, and this will continue to be a challenge for both Singaporean and other non-Chinese companies around the world," he added.

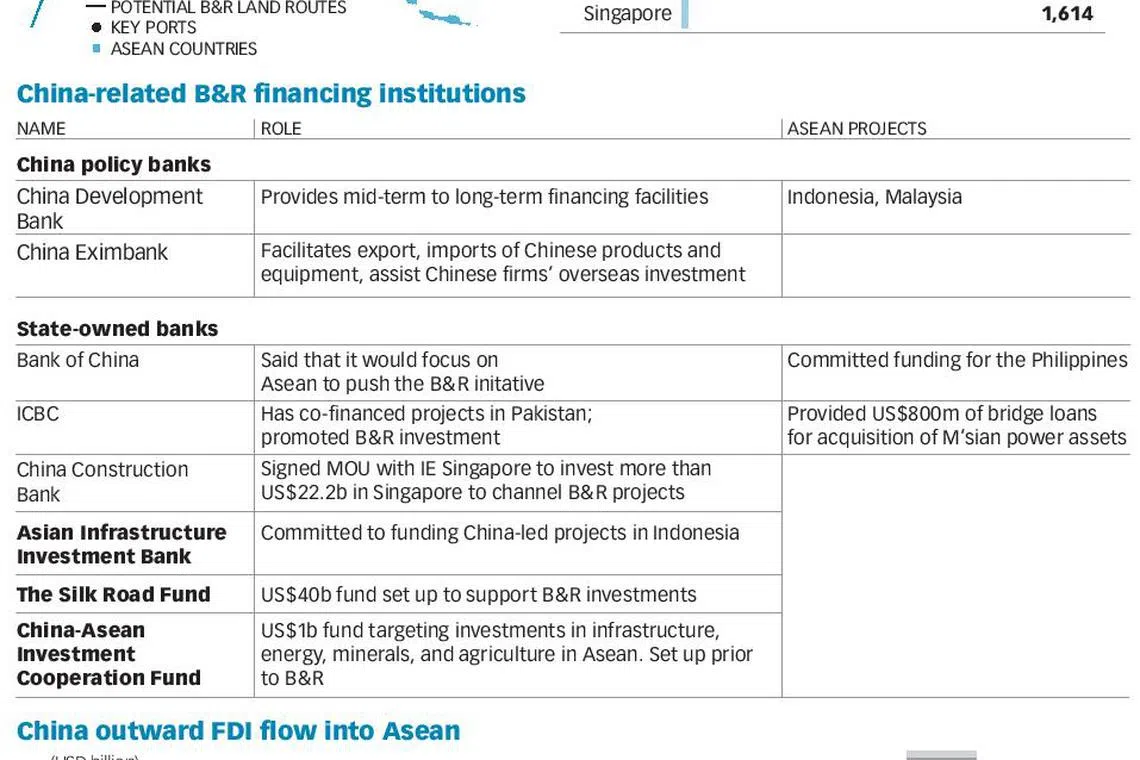

Observers say most of the funds are using Singapore as a regional financial hub to support other projects in the region.

For example, a tranche of Bank of China's US$3.6 billion B&R-related bond sale in 2015 was denominated in Singapore dollars and sold via Singaporean banks, noted HSBC economist Joseph Incalcaterra.

Said Tony Cripps, chief executive officer of HSBC Singapore: "The scale and size of the required investment will inevitably require private investment, and Singapore's established capital market makes it the natural infrastructure finance hub for the region."

But there is more at stake for Singapore than trying to capture that flow of B&R monies into Asean.

Crucially, the initiative has the potential to brighten Asean's macroeconomic outlook. This can boost Singapore's economy and companies that are based here, said observers.

Singapore's Foreign Minister Dr Balakrishnan has highlighted as much. He said in a China Daily interview published on Monday that Asean "needs enhanced public infrastructure and connectivity". "The 'Belt and Road' initiative complements the Master Plan for Asean Connectivity."

The B&R initiative comes as Singapore's government highlighted US policy flip-flops, and the United Kingdom's divorce from the European Union as potential threats to its growth.

Already, doors are opening for some Singapore-based firms. Trafigura, one of the world's largest oil traders, is supporting an Asian financial partner, believed to be a Chinese entity, in a US$1.35 billion shipping order in a move initiated by the latter's B&R ambitions.

Analyses by NTU's Prof Tan found that economic growth in Singapore's neighbours can boost its growth. For example, a one percentage point growth in Indonesia between 2000 and 2010 yielded a 0.26 multiplier effect for growth in Singapore's economy. For Malaysia, this was at 0.3.

This means that Singapore companies can find more opportunities in the regional economies as China's Belt and Road winds through South-east Asia.

"Because we are servicing the Asean region, and now that we're expecting more railway projects in Indonesia, more airport and seaport projects in the region, we can then be more involved in project financing, in designing, in management," said Prof Tan.

READ MORE:

Copyright SPH Media. All rights reserved.