Dip in biomedical production hampers January's factory output

Biomedical manufacturing cluster contracts by 13.5% year-on-year, as the pharmaceuticals segment declines 18.3%

Singapore

OUTPUT by Singapore factories slowed more than expected in January 2017, mainly due to the seasonal effect of Chinese New Year and a decline in biomedical manufacturing.

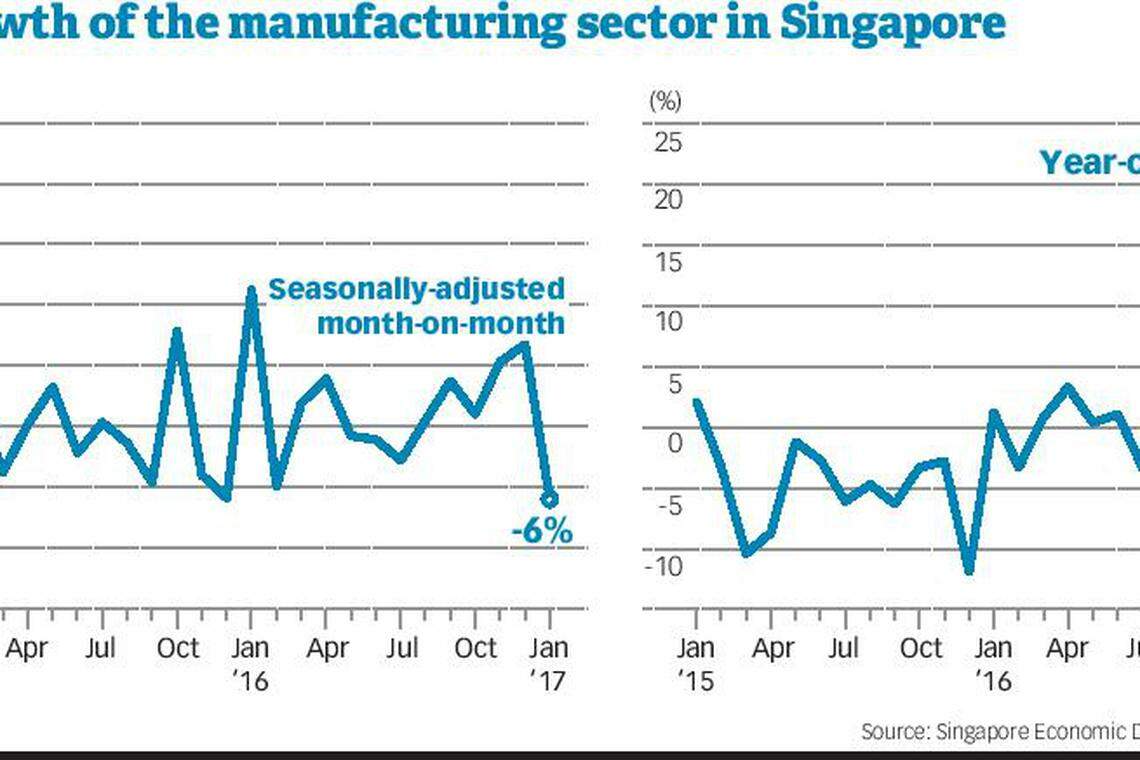

Industrial production grew a modest 2.2 per cent in January 2017 compared to a year ago, data released by Singapore Economic Development Board on Friday showed.

With the volatile biomedical manufacturing stripped out, output grew a stronger 7 per cent year-on-year.

Relative to December 2016, factory output dipped a seasonally-adjusted 6 per cent in January 2017. Output was down 1.5 per cent when biomedical manufacturing was excluded.

Bloomberg's poll of private sector economists had expected factory output in January 2017 to shrink to a median estimate of 9.5 per cent year-on-year, from December 2016's surge of 22.1 per cent. A Reuters poll of 12 analysts had a median forecast of 8.4 per cent growth.

The volatile biomedical manufacturing cluster contracted by 13.5 per cent year-on-year, as the pharmaceuticals segment declined 18.3 per cent due to a different mix of active pharmaceutical ingredients produced and lower output of biological products.

But the drop was offset by the robust growth of precision engineering (24 per cent) and electronics (14.8 per cent), led by the machinery and systems segment which expanded 40.3 per cent, driven by stronger export demand for semiconductor-related equipment.

Semiconductors grew 25.8 per cent and and computer peripherals 3.7 per cent, while the rest of the electronic segments registered output declines.

The general manufacturing industries sector also contracted by 13.8 per cent. As the Chinese New Year season led to fewer production days in January, the food, beverages and tobacco segment shrank by 10.8 per cent.

The miscellaneous industries segment fell 14.3 per cent, largely led by lower production of construction-related materials such as metal doors, windows, grilles and gratings. Weak demand in commercial printing also led to a 22.7 per cent decline in printing output.

The transport engineering sector, which declined by 3.8 per cent, saw its aerospace segment grow 27.5 per cent with higher repair and servicing jobs from commercial airlines. But this was offset by the drag in land transport (-3.9 per cent) and marine and offshore engineering (-18.9 per cent), due to a lower level of rig-building activity and weak demand for oilfield and gasfield equipment amid the low oil price environment.

ANZ economist Ng Weiwen thinks there are positive undercurrents for an emerging market in Asian manufacturing, "with a recovery in global CapEx mitigating any fading impulse from the latest smartphone cycle".

"But it will take some time for the official data to confirm whether that is happening," he said, as he puts more emphasis on Purchasing Managers' Indexes, which are usually less affected by Chinese New Year distortions.

UOB economist Francis Tan is optimistic, saying February's industrial production (IP) could surprise on the upside due to the same seasonality effect.

"Taking the average of January and February to compare manufacturing's performance is recommended. We are forecasting a 7.2 per cent year-on-year growth rate in next month's IP. This implies a January-February growth of 4.5 per cent year-on-year."

Similarly, Nomura economists Euben Paracuelles and Brian Tan said electronics output growth could rebound in February as the base effect fades, but this will likely remain narrowly fuelled by semiconductors. They also believe the broader economy is still on weak footing and vulnerable to the threat of protectionist policies in the US.

Nevertheless, Citibank economist Kit Wei Zheng said the lift to manufacturing and trade-related industries growth from the recent tech re-stocking trend and external demand may have legs into 1Q17.

"That said, headwinds to growth remain as we continue to see the development of a two-speed economy, with domestically-oriented and interest rate-sensitive sectors likely to underperform," he added.

Mr Kit continues to see a Monetary Authority of Singapore (MAS) easing in April as unlikely. "But in the absence of demand-pull inflationary pressures, we think it is too early to expect MAS tightening at this stage," he said.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

NTUC aims to do more to support PMEs, who now account for nearly half its membership

Daily Debrief: What Happened Today (Apr 25)

Singapore’s inflation eases more than expected in March, with headline inflation at 2.5-year low

8 in 10 firms in S-E Asia, Greater China positive about business environment: UOB survey

Flexi-work request guidelines not meant to prescribe blanket outcomes for employers or influence hiring of workforce: SNEF

Daily Debrief: What Happened Today (Apr 23)