Internet economy in South-east Asia to top US$240b by 2025: study

Singapore

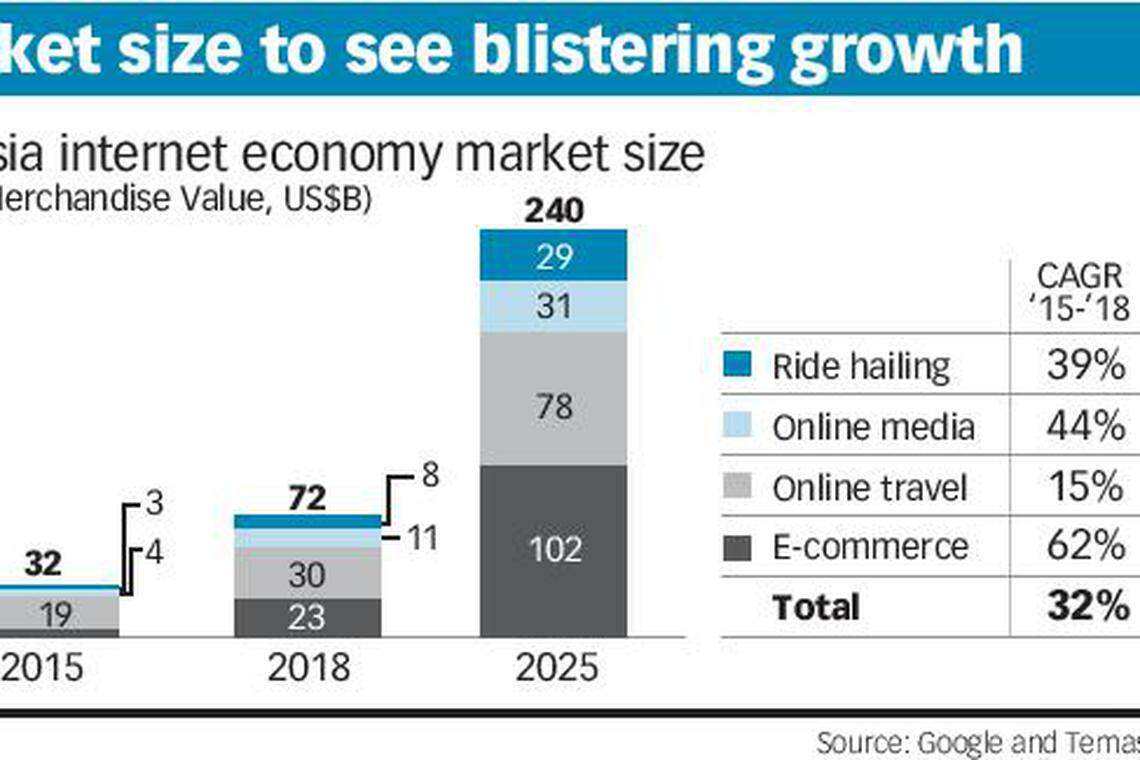

SOUTH-EAST Asia's Internet economy is expected to exceed US$240 billion by 2025, beating the previous estimate of US$200 billion put up just a year ago, as lower costs enable more consumers to go online using their mobile phones.

This year, the region's Internet economy is expected to hit US$72 billion in gross merchandise value (GMV) - which measures the total value of merchandise sold - representing growth of 37 per cent over a year ago according to a new study released by Google and Temasek on Monday.

This is an acceleration beyond the 32 per cent compounded annual growth rate (CAGR) recorded between 2015 and 2018.

In Singapore, the Internet economy formed 3.2 per cent of GDP, second only to Vietnam in South-east Asia.

The study, first published in 2016, encompasses e-commerce, online travel, online media, and ride-hailing. Within these areas, new sectors, mainly online vacation rentals, online food delivery, subscription music, and video on demand were added.

The impressive growth rate is in large part due to the increasing affordability of mobile Internet. The cost of one gigabyte of data has been more than halved relative to people's income over the last four years, according to Rajan Anandan, vice-president for India and South-east Asia at Google.

Of the six countries, Indonesia is the fastest-growing. Supported by the largest Internet user base (150 million users in 2018), it has the largest (US$27 billion) and fastest-growing Internet economy in the region at 49 per cent CAGR from 2015 to 2018.

It is poised to grow to US$100 billion by 2025, accounting for US$4 of every US$10 spent in the region.

Of the sectors, e-commerce continues to be the most dynamic, and is expected to exceed US$23 billion this year. This represents growth of more than four times the US$5.5 billion in GMV clocked in 2015. It is expected to exceed US$100 billion by 2025.

The three largest players in the region - Lazada, Shopee and Tokopedia - are estimated to have grown more than seven times collectively since 2015 and are estimated to account for 70 per cent of the market.

Separately, 2018 is turning out to be a record year for fundraising, with US$9.1 billion raised in the first half of the year, nearly as much as all of 2017. Taken on a half-year basis, the US$9.1 billion raised is more than 2.5 times the US$3.6 billion raised in the first half of 2017.

This puts total funds received by Internet economy companies in South-east Asia at US$24 billion in less than four years.

While two thirds of the funding went to the region's nine unicorns, it is worth noting that the non-unicorns raised about US$2.6 billion in the first half of 2018, about four times what was raised in the first half of 2017.

Also worth noting is that companies valued between US$10 million and US$100 million raised a record US$1.4 billion in the first half of 2018. Fundraising for this sector of the ecosystem was stagnant over the past two years, in 2016 it pulled in US$0.8 billion and in 2017 US$1.0 billion.

"This is very interesting and it has happened because there are a number of new players that are being attracted to the region," said Rohit Sipahimalani, joint head, investment group, at Temasek, citing VCs like Seqoia and B Capital.

"In general, I feel that it's a recent trend in terms of seeing that acceleration (in funds raised) but one we think should continue because of that presence - people are setting up here to look for opportunities."

Meanwhile, the ride-hailing sector - including, for the first time, online food delivery - is estimated to reach US$7.7 billion GMV in 2018. The report projects that this sector will reach almost US$30 billion by 2025, of which more than US$20 billion will come from transport and over US$8 billion from online food delivery.

Separately, online media, which includes online advertising, gaming, subscription music and video on demand, is projected to exceed US$11 billion this year. It is projected to reach almost US$32 billion by 2025.

READ MORE: Region's VC, PE to double to US$70b by 2024: Bain report

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Pro-China local leader ousted in Solomon Islands election

Japan‘s March inflation slows to 2.6%, eyes on BOJ move

S&P downgrades Israel rating on heightened geopolitical risk

‘We have our jury’: panel selected for Trump criminal trial

UK wage growth and services inflation too high for rate cut, BOE’s Greene says

US to reduce licensing by 80% for UK, Australia to boost Aukus