More growth expected in tourism this year after a bumper 2017

Singapore

AFTER yet another milestone year in 2017, the Singapore Tourism Board (STB) is betting on further growth, its optimism underpinned by an improving global economy and rising travel demand in the Asia-Pacific.

Tourism receipts are slated to grow by between 1 and 3 per cent to hit S$27.1 billion to S$27.6 billion this year. The number of visitor arrivals may edge up by 1 to 4 per cent to clock in at between 17.6 million and 18.1 million, the Singapore Tourism Board (STB) has projected.

The tourism sector, which contributes some 4 per cent to Singapore's gross domestic product, registered record highs in tourism spend and visitor arrivals last year, for the second year running.

Preliminary estimates show that Singapore attracted 17.4 million visitors, or 6.2 per cent more year on year, surpassing the 17-million mark for the first time, with broad-based growth recorded across key markets.

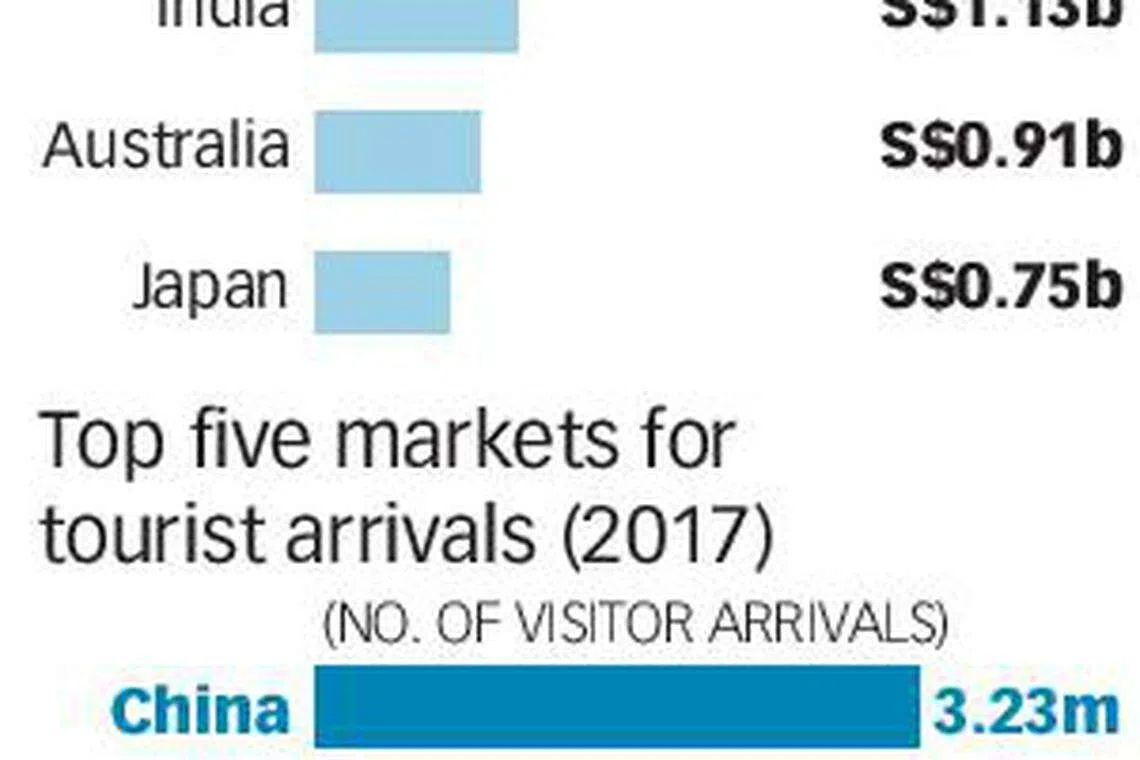

China, which bypassed Indonesia to become the top source market for the first time, made a 13 per cent jump in arrivals to 3.23 million.

India racked up the highest growth rate at 16 per cent, overtaking Malaysia to steal third place, and Vietnam slipped into the top 10 for the first time.

In particular, there was growth coming out of Tier 2 and 3 cities in China, Indonesia and India, thanks partly to marketing efforts by the tourism body. For instance, the number of visitors from Tier 1 cities in China rose 11 per cent to 1.27 million last year, and up 22 per cent to 979,000 for Tier 2 cities.

Arrivals from the United States grew 9 per cent to a record 565,000, as a result of the launch of direct flights from the American west coast by Singapore Airlines and United Airlines.

However, tourist flows eased from markets such as Thailand (-3 per cent) and Hong Kong (-13 per cent). In the case of Hong Kong, the STB said, new air links and cheap fares on budget carriers might have lured travellers away to North Asia instead.

All in all, visitors spent S$26.8 billion here last year, an increase of 3.9 per cent, as visitors from all of Singapore's top 10 markets dug deeper into their pockets.

Speaking at a briefing on Monday, STB chief Lionel Yeo said: "We were aided by a benign macro-economic environment and a stronger-than-expected global economic recovery, (while) outbound travel sentiment in most of our source markets was positive. This, coupled with the efforts of STB and the industry, led to the record breaking performance."

But the STB noted the challenges on the horizon, such as geo-political tensions and intensifying competition from regional markets.

In terms of spend by markets in the first three quarters of 2017, the Chinese emerged the biggest spenders for the third year in a row, spending S$3.08 billion.

Travellers from the United Kingdom and the US racked up the biggest growth in tourist spend, at 24 per cent and 22 per cent respectively. Overall, travellers to Singapore mostly spent more on areas such as shopping, sightseeing, entertainment and gaming, as well as in the "others" category, which includes airfare, transport and medical expenses.

For the business travel (BT) and the meetings, incentives, conferences and exhibitions (MICE) industry, arrivals slid five per cent year on year to 1.75 million in the first nine months of 2017, likely due to the scaling back of corporate budgets. However, these travellers also racked up bigger bills, spending four per cent more at S$3.15 billion. STB has yet to release full-year figures for BTMICE segment.

Meanwhile, the cruise industry sailed ahead. Passenger volumes surged 17 per cent to a record 1.38 million, on the back of more ship calls and a steady stream of cruise travellers from markets such as India. The number of ship calls rose by 3 per cent to 421, of which 16 were maiden calls.

RHB analyst Vijay Natarajan, commenting on the outlook for the tourism industry, said: "There are quite a few positive factors on the demand side. There's a clear pick up in corporate demand for hotels, especially from segments such as IT and fintech. Global economic growth, coupled with the fact that Singapore is the 2018 Asean chair, should translate to more intra-regional travel."

Other boosts include a busier MICE calendar as biennial events return, as well as Changi Airport's new Terminal 4, which frees up capacity at the other terminals and should bolster travel growth.

He added: "Things are looking positive. If the growth momentum can be sustained, it should be a good year."

Last year, gazetted hotels took home nearly 4 per cent more revenue at S$3.7 billion. But a five per cent increase in room supply caused the average room rate to fall 3.3 per cent to S$216 amid competition, even as the average occupancy rate rose 1.5 percentage points to 84.7 per cent. Revenue per available room (RevPAR) thus dipped 1.5 per cent to S$183.

As at end 2017, there were more than 67,080 hotel rooms across 420 hotels, although the pace of incoming supply will slow this year to under two per cent. With supply tapering off, RHB's Mr Natajan estimates a potential 3 to 7 per cent gain in RevPAR this year.

At Monday's briefing, the tourism body's management said that it would push ahead with ongoing efforts to market Singapore to growth countries such as China and Indonesia, reaching out, in particular, to the Tier 2 cities.

Copyright SPH Media. All rights reserved.