Pharma derails exports growth; but April dip seen as temporary blip

Most economists expect Singapore's exports expansion to continue for rest of year, albeit at a more moderate pace after April's 0.7% slide

Singapore

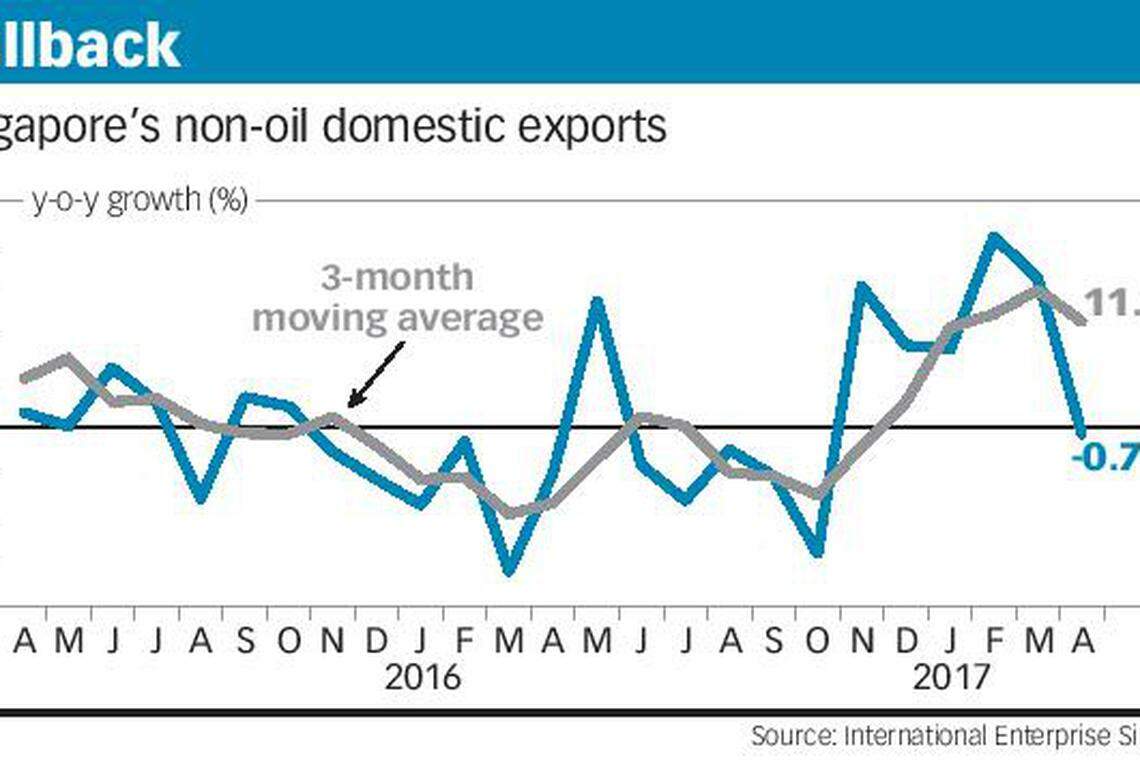

ONCE again, the volatile pharmaceuticals sector proved to be the spoiler for Singapore's exports. It plunged 40 per cent in April 2017, causing non-oil domestic exports (NODX) to shrink 0.7 per cent year on year, snapping a five-month growth streak.

But electronics exports remained healthy, growing 4.8 per cent year on year in April - its sixth consecutive month of growth - this was a slight moderation from 5.2 per cent in the previous month. Growth was due to exports of personal computer parts which grew 32.9 per cent, disk media products (17.9 per cent) and integrated circuits (9.2 per cent).

But the robust showing was outpaced by a decline in non-electronics NODX, which dipped 2.9 per cent, a reversal from 20.8 per cent growth in the previous month.

The biggest culprit was pharmaceuticals, which posted a decline of 39.9 per cent from a year ago.

Other non-electronics exports such as non-electric engines & motors and non-monetary gold dropped by 69.2 per cent and 23 per cent respectively.

Month on month, NODX declined by a seasonally-adjusted 9 per cent in April, deepening the 1.1 per cent drop in the previous month, as the decline in non-electronics exports offset the rise in electronics exports.

Shipments to some of the top 10 markets - the EU 28, Hong Kong, the US and Japan - dropped, outweighing the rise in shipments to Taiwan, South Korea, China, Malaysia, Indonesia and Thailand.

Non-oil re-exports (NORX), a proxy for wholesale trade services, also declined 0.1 per cent year on year in April, compared to the 9.1 per cent growth in March 2017, as lower shipments of non-electronics NORX offset the rise in electronics NORX. Total trade rose 5.7 per cent in April 2017 compared with a year ago, continuing the growth trend in previous months.

While some economists are optimistic that exports will continue to recover, the majority feel that growth will moderate for the rest of the year.

Brushing off the weak April NODX as a temporary blip in Singapore's trade recovery, Maybank Kim Eng economist Chua Hak Bin said the electronics exports are still expanding at a healthy pace and are more representative of global demand.

UOB economist Francis Tan too thinks it is only a temporary, technical pullback from an exceptionally strong month in March, when NODX grew 16.5 per cent year on year.

He said: "NODX growth rates are notoriously volatile and a single month of technical pullback should not veer us off course in our longer term view of the recovery in global trade for 2017."

OCBC economist Selena Ling said NODX is "still very healthy" as it expanded 10.9 per cent year on year for the first four months of 2017, as compared to -8.4 per cent year on year for the same period in 2016.

Mr Chua attributed the drop in pharmaceutical exports to a high base as the April 2016 level was a record high since April 2015. Pharmaceuticals production too has been contracting for the entire Q1 2017 by an average of -13.5 per cent, he said.

Mr Chua feels Singapore's exports and manufacturing will continue to be well supported for the rest of this year, albeit at a more moderate pace.

However, the moderation in electronics exports points to "tentative signs of a maturing tech cycle", said ANZ economist Ng Weiwen.

He said: "Against this backdrop and with China reverting back to its old but unsustainable investment-led growth model, we think that it would be challenging for the recent strength in exports to be sustained in the second half of 2017."

Credit Suisse economist Michael Wan said Singapore's exports to China were one of the main contributors to the exports growth slowdown in April, moderating to 11 per cent year on year in April from 46 per cent year on year in March. He said strong Chinese domestic demand seen in Q1 should fade moving forward, with the infrastructure boost peaking and smartphone demand softening.

While Mr Tan is positive NODX will expand at 0.7 per cent in 2017 on the back of continued growth in electronics exports, he said the strong double-digit NODX growth since November 2016 cannot be sustained into the second half of 2017, since recent trade numbers reported by Asian economies also point to a slower growth rate.

He said: "We are expecting Singapore's 2017 NODX to finally expand, after recording four previous years of contraction. As for now, we are still carefully watching the negative impact from the anti-globalisation rhetoric that has been fuelling developed markets' sentiments."

DBS Bank economist Irvin Seah said exports demand may be peaking, based on April's overall manufacturing purchasing managers' index (PMI), which had eased by 0.1 point to 51.1 while the electronics PMI dipped a tad to 51.6, from 51.8 previously.This is reinforced by recent dips in the PMIs of some key markets as well, he said.

The manufacturing rally over the past six months could be nearing its end too, as the strong performance thus far has been largely driven by consumer demand, noted Mr Seah.

He said: "To sustain the current pace of expansion, much will really depend on companies increasing their capex going forward. That is, capital investment growth in key markets such as the US, China and to a lesser extent, eurozone, would have to increase in order to provide further impetus to manufacturing activities.

"Otherwise, expect growth momentum to slow in the subsequent quarters."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Global wave of consultancy layoffs has not hit Singapore

Daily Debrief: What Happened Today (Apr 19)

An economy transformed: Lee Hsien Loong’s 20 years as Singapore’s Prime Minister

Daily Debrief: What Happened Today (Apr 18)

Singapore’s first RoboCluster launched for facilities management, to turn R&D into market solutions

Daily Debrief: What Happened Today (Apr 17)