Singapore consumer prices stay flat in January

OVERALL consumer prices in Singapore remained flat in the first month of 2018, even though the cost of key items such as healthcare and education went up.

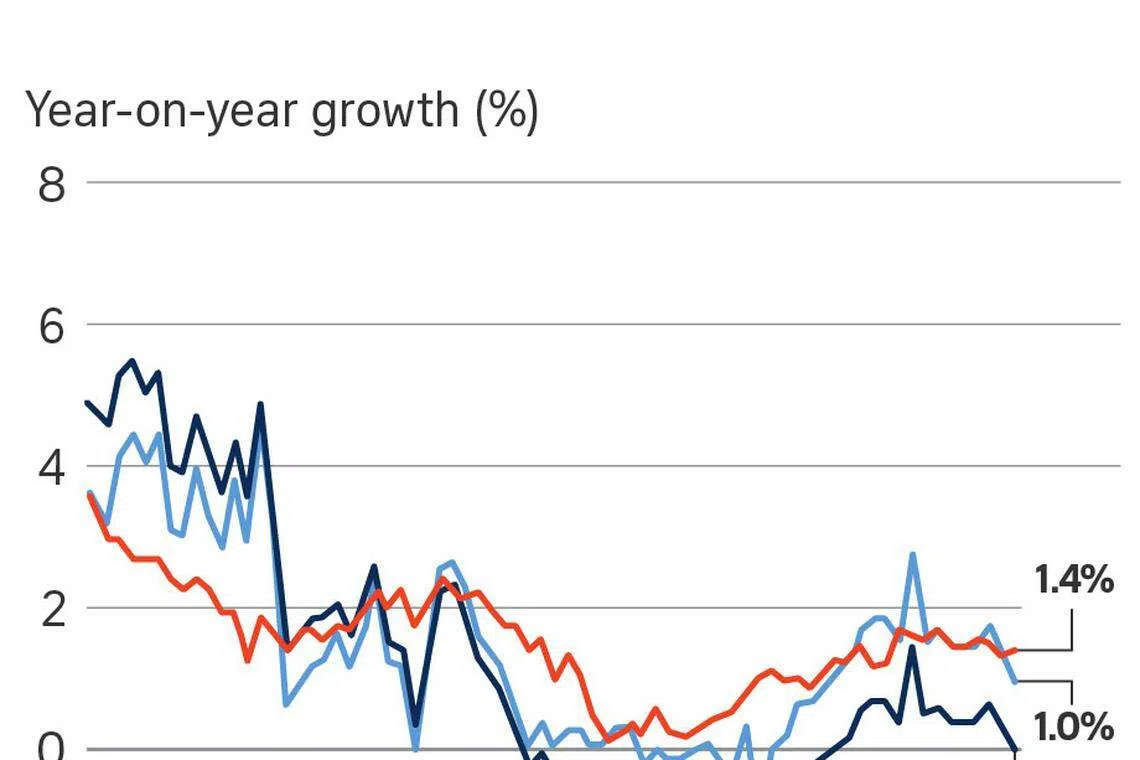

There was no change in the consumer price index - the main measure of inflation - for the month of January compared to a year ago, according to the Department of Statistics data released on Friday.

This was a dip from the preceding month's inflation rate of 0.4 per cent, as well as below economist estimates of a 0.4 per cent increase.

This was mostly due to lower accommodation and private road transport inflation.

Core inflation, which strips out the cost of accommodation and private road transport costs to better gauge everyday expenses, edged up to 1.4 per cent in January, up slightly from 1.3 per cent in December.

The cost of accommodation fell by 5.3 per cent in January, compared to the 3.8 per cent decline registered in the preceding month, as Service & Conservancy Charges (S&CC) rebates were disbursed to HDB households in January 2018, but not in the same month last year.

Private road transport inflation moderated to 1.6 per cent in January, from 2.6 per cent in the previous month, due to lower car prices and a decline in Certificate of Entitlement (COE) premiums.

Food inflation eased to 1.1 per cent in January from 1.4 per cent in December, mainly due to price increases for non-cooked food items. The cost of prepared meals also rose at a slightly slower pace compared to the previous month.

Services inflation was 1.3 per cent in January, unchanged from the previous month. A smaller decline in the cost of public road transport, together with larger increases in education and recreational & cultural services fees, offset a fall in telecommunications services fees and a steeper drop in air fares.

The Monetary Authority of Singapore and the Ministry of Trade and Industry said that imported inflation is likely to rise mildly, as global demand improves amid ample supply in key commodity markets. Global oil prices are also expected to increase only slightly in 2018 as compared to 2017.

"Overall, cost pressures in the economy should remain relatively restrained. Although labour market conditions have improved recently, the gradual absorption of previously accumulated slack will temper wage pressures in the near term. Meanwhile, other non-labour costs such as commercial and retail rentals continue to be subdued," they said in a joint statement.

Core inflation is expected to stay in the 1 to 2 per cent range in 2018, while headline inflation is projected to be zero to 1 per cent this year.

Copyright SPH Media. All rights reserved.