Singapore manufacturing expands again in February but at a slower clip

Singapore

SINGAPORE'S manufacturing sector continued expanding in February for the sixth consecutive month, albeit at a marginally slower rate.

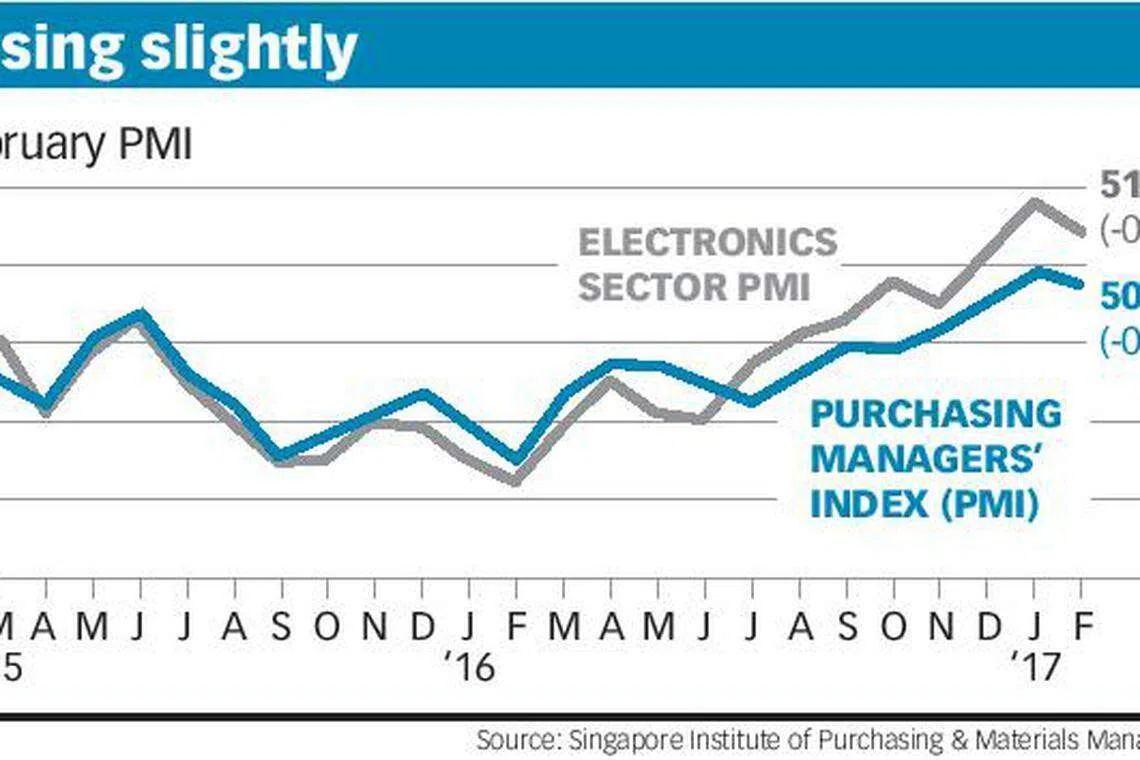

The Purchasing Managers' Index (PMI) stood at 50.9 - down 0.1 point from January - as a result of a slower expansion rate in factory output, new orders, new exports and lower imports.

Economists said the drag in expansion could possibly have come from the seasonality effect and the softening of bullish sentiments.

The PMI is a leading economic indicator. A reading above 50 indicates expansion in the manufacturing economy, and a reading below that, a contraction.

Nevertheless, all the indicators for February showed expansion, based on data released by the Singapore Institute of Purchasing & Materials Management (SIPMM) on Thursday.

SIPMM said: "Inventory and stocks of finished goods expanded at a slightly faster rate, indicating stock accumulation in spite of higher input prices."

Manufacturing employment remained on a growth trajectory for the second month, after having posted contractions since November 2014.

The electronics sector PMI dipped by 0.4 point from the previous month, when it was 51.4.

This was the result of a 0.6 point decline in factory output and a lagging expansion in new orders, new exports, imports and employment.

SIPMM said: "Both the inventory and stock of finished goods recorded a slightly faster rate of expansion.

"The electronics order backlog index maintained an expansion reading for the second month, and supplier deliveries reverted from contraction to a moderation."

As the electronics sector records its seventh consecutive month of expansion, the latest readings indicate a strengthening growth in the months ahead, SIPMM said.

OCBC economist Selena Ling said the input price gauge for both the manufacturing and electronics PMI climbed again in February, suggesting sustained pricing pressures.

Still, the softer February data has to be seen in the context of the January readings, which were the highest since November 2014 for overall manufacturing PMI and since October 2014 for electronics PMI, she said.

Regionally, the manufacturing PMI cues were also somewhat mixed.

Ms Ling said China's official and Caixin manufacturing PMIs were fairly upbeat at 51.6 and 51.7, but those for Taiwan and Malaysia underwent some pullback from January levels; that for South Korea stayed below the 50 handle for the seventh straight month.

Singapore's industrial production data in January 2017 had showed that factory output grew a modest 2.2 per cent from a year ago.

Month on month, factory output dipped a seasonally-adjusted 6 per cent in January 2017.

Ms Ling said: "After a somewhat disappointing domestic industrial production data in January 2017, it was clear that the manufacturing recovery was not yet running on broad-based engines as electronics output rose 14.8 per cent year-on-year, but pharmaceuticals fell 18.3 per cent year-on-year.

"Still, we remain upbeat on manufacturing growth to hit 6.2 per cent year-on-year in Q117, with full-year growth tipped at 3.4 per cent year-on-year, partly due to the low base in 2016 and the ongoing electronics recovery."

UOB economist Francis Tan attributed the slight drop in expansion rate in manufacturing PMI to the Chinese New Year effect. Factories were closed for the festive period, which meant fewer working days and thus more backlog.

"As long as the PMI reading shows expansion, I will not read too deeply into the data," he said.

Copyright SPH Media. All rights reserved.