In a class of its own (Amended)

Land scarcity, a high population density, growing household wealth and limited supply are the primary reasons that make landed property a coveted asset in Singapore. Over the past five years, the number of landed residential properties has increased by 3.6 per cent to 72,501 units, comprising less than one third of the stock of non-landed properties.

Good Class Bungalows (GCBs) represent the apex of the landed segment. The Urban Redevelopment Authority defines a GCB as land that is 1,400 square metres (approximately 15,000 square feet) or more, and located in any one of 39 GCB areas gazetted by the government.

With a finite supply of GCBs available in the market, owners of GCBs are seemingly of an unparalleled status of prestige among home owners in Singapore.

The Residential Property Act restricts buyers to Singapore Citizens only. Under Section 25 of the Act, Permanent Residents and foreign persons with interest in purchasing landed property locally must obtain consent through the Singapore Land Authority's Land Dealings Approval Unit. Given limited land supply, such approvals might be hard to come by.

Presently, Sentosa is the sole area where foreigners are allowed to own landed homes, but even so, they are intended for occupation only. Despite its attractive lifestyle and waterfront location, Sentosa is not a designated GCB area. GCB prices on the mainland are among the most expensive in Singapore.

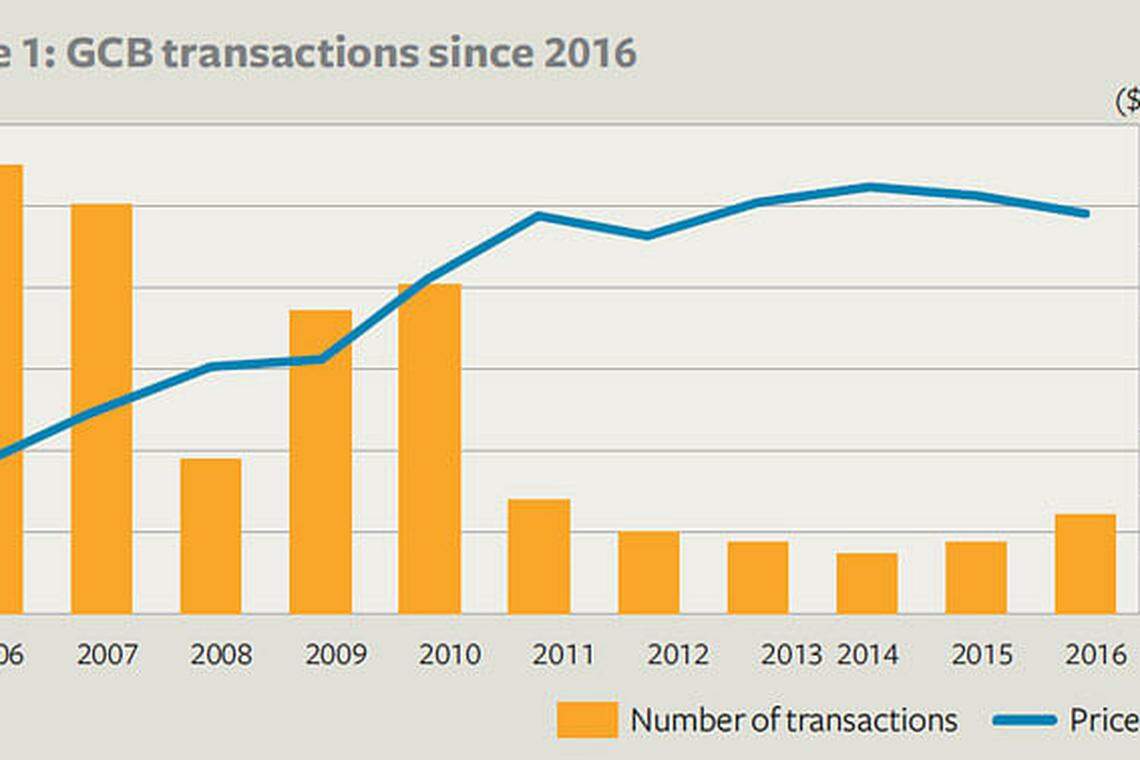

The market for GCBs Based on a study of GCB transactions since 2006 (refer to Figure 1), GCB transactions have decreased significantly since 2011. Coupled with the trend of rising transaction prices since 2006, this could have shrunk the pool of buyers able to afford GCBs. Furthermore, global events such as the European Union debt crisis, China's slowdown, and more recently, anti-globalisation sentiments have cast a blanket of uncertainty over the global economy.

Nevertheless, the increase in transaction volumes for a third consecutive year since bottoming in 2014 suggests that buyers are willing to make a commitment, if the price is right.

2016 has been a good year for GCBs. Based on a search on homes with a land area of 1,400 sq m and above, a total of 25 GCB caveats were recorded, marking the highest number of such transactions since 2011. The pickup in transactions figures can be traced to lower price expectations of GCB sellers, reflected in the decline of average transacted prices for a second consecutive year.

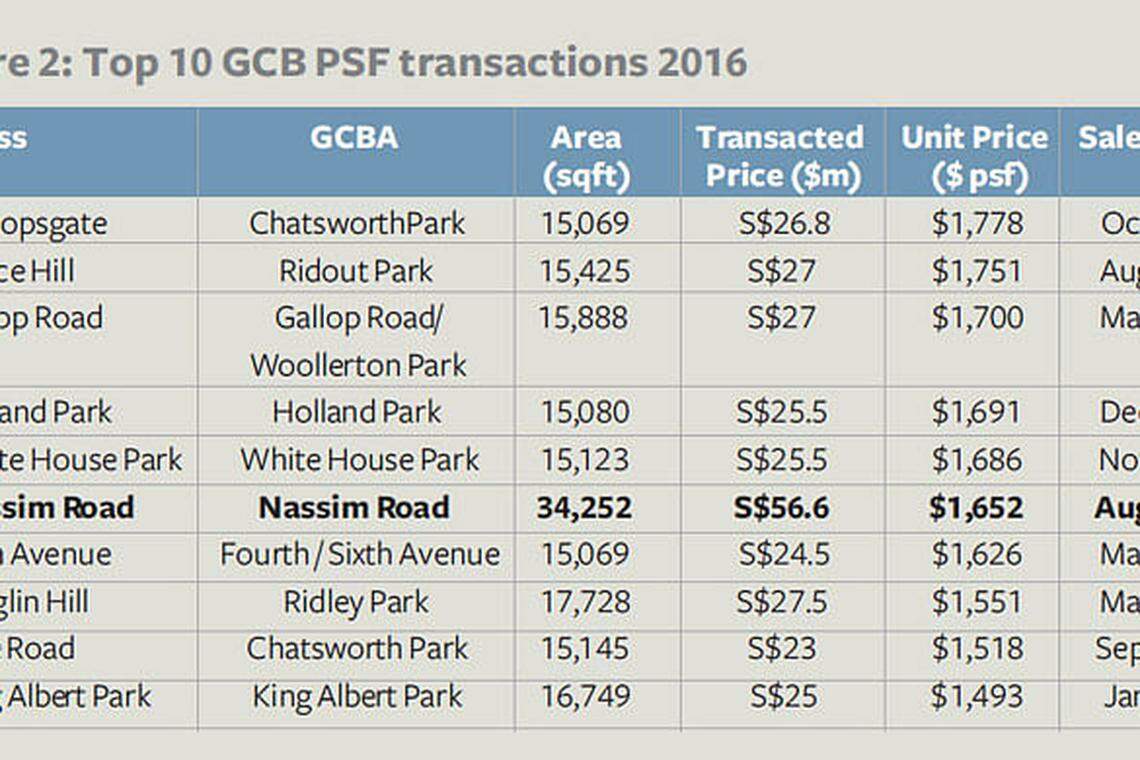

Some developers have also been acquiring GCBs, presumably for redevelopment. Larger GCB land plots of 30,000 sq ft and above present better opportunities for redevelopment and subdivision, with the most notable acquisition in recent times being the purchase of two land parcels along Nassim Road, by OUE Limited.

The freehold land parcels spanning 34,252 sq ft of land area were part of the site belonging to the British High Commission. Transacted in October 2016 at a bid price of about S$56.6 million and average transacted price of S$1,653 per square foot, it ranks among the top 10 highest GCB transactions per square foot for 2016 (refer to Figure 2).

One difficulty in assessing GCB transactions boils down to the heterogeneous nature of such properties. Given the quantum, size and buyer preferences, no two GCBs are the same. Often, the difference in prices transacted can be accrued to site specific factors such as land plot shape, elevation and the condition of the homes.

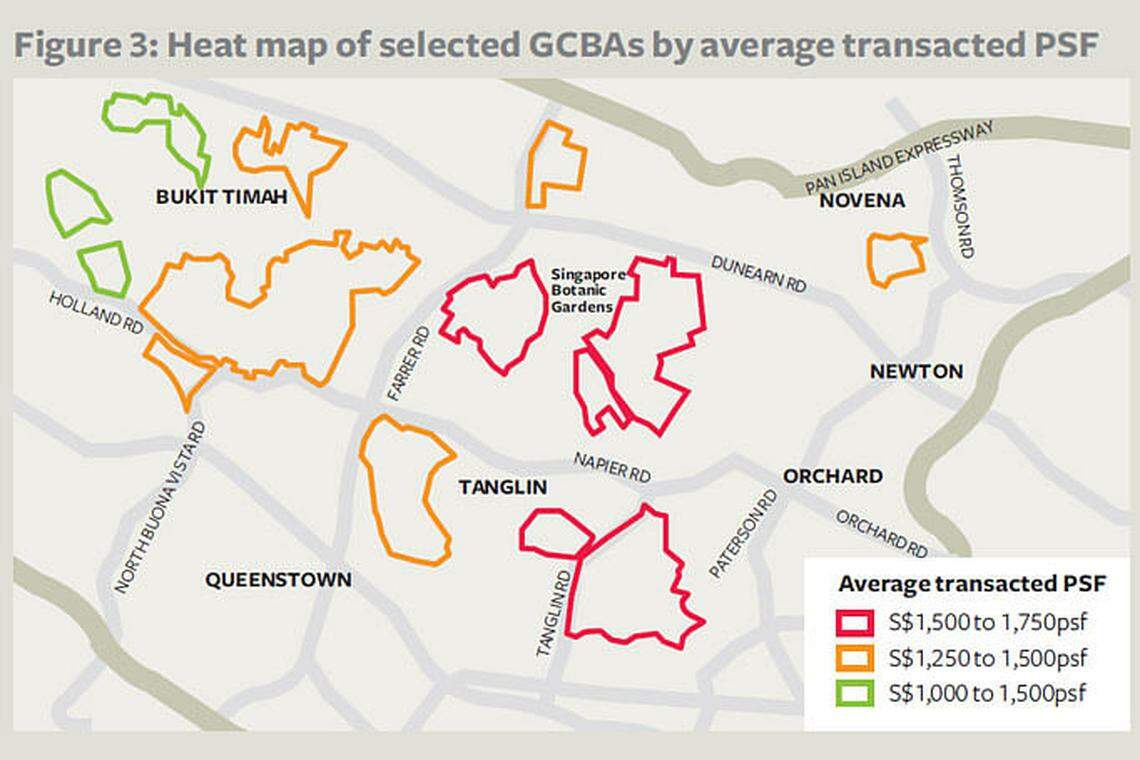

A further study of the transactions of GCBs over the past five years also suggests that there is a price hierarchy among GCBAs. In other words, the market recognises that even within GCBs, there are differences which make some more attractive than others.

While government cooling measures remain in place amid vast economic uncertainty globally, the GCB market is expected to remain stable, supported by its scarcity and undoubted status as the pinnacle of the Singapore property market. A GCB home is undoubtedly, always in a class of its own.

Amendment Note: In an earlier version of the article, permanent residents and foreign persons with interest in purchasing landed property locally must obtain consent through the Ministry of Law's Land Dealings Approval Unit. This is incorrect as consent must be obtained through the Singapore Land Authority's Land Dealings Approval Unit instead. The article has been amended to reflect this.

Tay Kah Poh is the Executive Director and Head of Residential Services, Knight Frank Singapore

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

New Articles

Digital Core Reit Q1 distributable income slips 2.4% to US$10.6 million

BT subscribers can now share 5 premium articles a month with unlimited number of non-subscribers

First Reit reports 3.2% lower Q1 DPU of S$0.006 amid interest rate, forex headwinds

Vietnam holds first gold auction in 11 years to stabilise market

How Hudson Yards went from ghost town to office success story

Hot stock: Nanofilm jumps 13.1% amid heavy trading on improved Q1 results