In pursuit of growth

We approach 2017 with a sense of déjà vu as we face similar issues that confronted investors in 2016 and 2015.

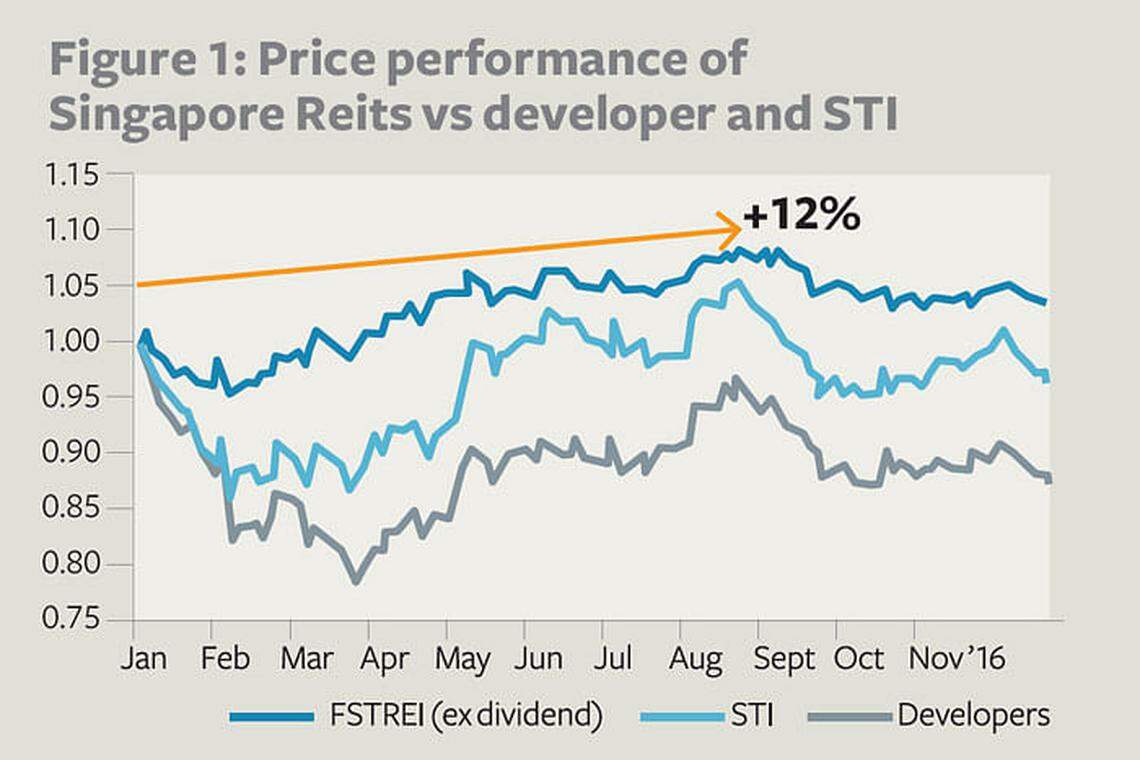

These include the risk of rising interest rates, slowing growth, higher cost of capital potentially constraining the ability to raise capital to fund growth plans, and heightened risk of write-downs of property values given falling rents. Going into 2017, we see increasing road-bumps to further outperformance for Singapore Reits (S-Reits), especially when faced with a slowing DPU (distribution per unit) growth profile of 1.1 per cent amid a rising interest rate environment.

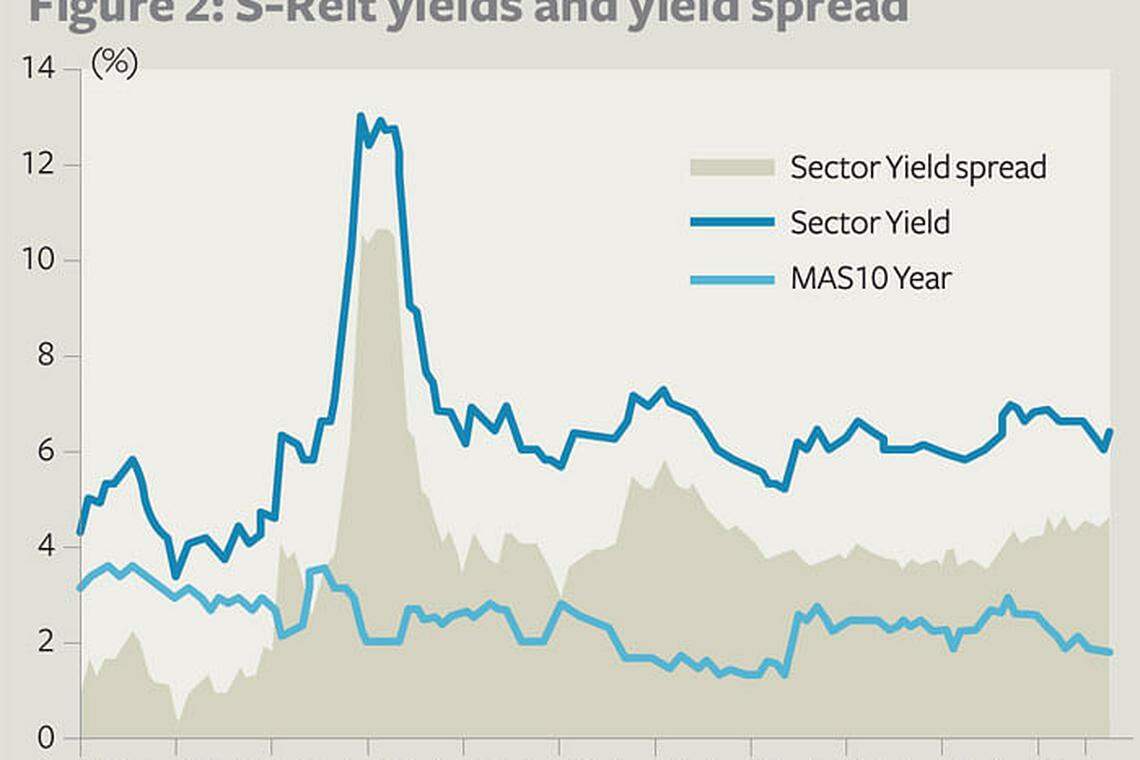

With the US economy on the path of recovery, we believe investors' attention is now focused on the pace of interest rates in 2017. DBS economists project a more hawkish four Fed rate hikes over the course of the year and as a result, the Singapore 10-year yield is expected to increase another 0.7 per cent to a normalised rate of about 3.0 per cent in one year's time.

S-Reits currently trade at a forward FY17 yield of 7.0 per cent, which implies a yield spread of 4.0 percentage points above the forecast 10-year bond rate. At near its five-year historical mean levels, we believe that valuations for Reits have priced in the interest rate uncertainty at current levels.

Interest rates and S-Reits While interest rates are anticipated to rise, the majority of S-Reits have hedged 75-85 per cent of their borrowings and with a weighted average debt maturity of two to three years. For FY17, on average about 9 per cent of debt is due to be refinanced, thus the full impact of higher costs of borrowings will not be felt in 2017, but over the next few years.

In addition, the impact from a rise in interest rates is likely to be felt by the Reits which predominantly borrow in Sing dollar. In contrast, Reits with exposure to European, Japanese and Australia assets with commensurate debt in euro, Japanese yen and Australian dollar, may even report declining, or face a slower increase in, borrowing costs as they refinance their debt. This is due to current interest rates in Europe, Japan and Australia being lower than when the Reits first borrowed in the respective local currencies.

Assuming a one per cent lift in the cost of borrowing above our current estimates (we have already assumed up to a 25 basis point increase in cost of debt compared to FY16) and the impact only occurs when the various S-Reits refinance 9 per cent and 21 per cent of all loans outstanding in 2017 and 2018 respectively, as well as only impacting the current outstanding floating rate debt, we estimate up to 2.9 per cent and 4.9 per cent impact on FY17F and FY18F overall S-Reit DPU respectively.

Preferred sectors On the back of an increasingly uncertain economic environment, supply pressures across various property segments and an uptick in borrowing costs, growth in distribution will increasingly become more challenging in 2017. Nevertheless, we still expect S-Reits in general to grind out a 1.1 per cent year-on-year growth in distributions and we see differing fortunes for S-Reits in different real estate sub-segments.

In terms of real estate sectors, our preferences are office, retail, industrial and hospitality, ranked in order of preference. Despite expectations of decline in office rents, we believe that negatives are priced in with office Reits currently trading at 20 per cent discount to book value and 10 to 30 per cent discount to recent market transactions.

In fact, investors are already looking forward to the possible bottoming of office rents in 2017, in anticipation of the strong take-up rates in new office buildings and the lack of new supply in the coming years. Supported by data-points turning in favour of landlords, we believe that office Reits will continue to do well in 2017.

The retail sector could potentially be next in preference as it offers a resilient income stream (especially exposure to suburban necessity shopping malls) and trades close to 1x P/BV versus the sector's typically 10-20 per cent premium to book value. We see a tiering in market performance for retail malls, led by malls in the suburban space with scale and those with good locations that serve a wide primary and secondary catchment. This will mean higher recurring traffic and retail sales, implying that retailers will likely continue to see stronger demand for space.

We are selective in the industrial space with a positive view on the larger Reits which offer a combination of strong balance sheets, decent yields and growth options. Despite a drop in supply in 2017, we believe that it will be a year of consolidation for the sector given time to absorb the spike in new supply completions last year. We continue to expect landlords to give incentives to retain tenants in order to maintain portfolio occupancies and thus performance will likely remain flattish at best.

Lastly, while the hospitality sector is trading at huge discounts to book, we believe there is limited re-rating catalyst at least in the first half of 2017 as hotel room rates remain under pressure. However, the second half of 2017 may offer re-entry opportunities for a potential 2018 recovery, once the supply picture clears up as the year progresses.

Strategies to employ It will be a year for stock selection especially on the back of a soft economic outlook than at the start of 2015 and 2016. Therefore, we believe that investors will continue to prefer S-Reits that can offer stronger relative growth and these will command an increasing premium. In addition, S-Reits which offered resiliency in the past and trade at a premium but are now only able to offer flattish DPU growth might be vulnerable, given rising risks of earnings disappointment.

If history were a guide, we found that amidst the volatility anticipated in the coming year, S-Reits that can grow could potentially see higher share prices (or compressing yield spreads), counter to conventional wisdom that higher interest rates equal lower share prices for share prices. Using CapitaLand Mall Trust (CMT) as an example, from 2004-2007, CMT's yield spread fell from over 4 per cent to 0.4 per cent in mid-2007, while the US Federal Reserve raised the Fed Funds Rate from one per cent to a peak of 5.25 per cent, and CMT generated annual DPU growth in excess of 7 per cent.

Derek Tan is Vice-President, DBS Group Research

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

New Articles

Digital Core Reit Q1 distributable income slips 2.4% to US$10.6 million

BT subscribers can now share 5 premium articles a month with unlimited number of non-subscribers

First Reit reports 3.2% lower Q1 DPU of S$0.006 amid interest rate, forex headwinds

Vietnam holds first gold auction in 11 years to stabilise market

How Hudson Yards went from ghost town to office success story

Hot stock: Nanofilm jumps 13.1% amid heavy trading on improved Q1 results