Developers' private home sales set to jump in October

Singapore

AFTER a relatively quiet August and September amid an absence of fresh project launches, developers' private home sales are expected to soar this month, possibly to the highest monthly level this year, on the back of a few big new-project launches.

Already Forest Woods near Nex mall and Serangoon MRT station and The Alps Residences in Tampines, both released earlier this month, have sold well; at least one other substantial private residential development, the 736-unit Queens Peak next to Queenstown MRT station, could begin sales this month.

To put things in perspective: Although there were no fresh launches in September, developers still managed to move a decent number of units from earlier project launches.

In all, 509 private homes were sold by developers in September, up 8.8 per cent from the 468 units in the month before; the 509 was also 49.3 per cent more than the 341 units sold in September 2015, going by data from the Urban Redevelopment Authority (URA), which is based on submissions by licensed housing developers.

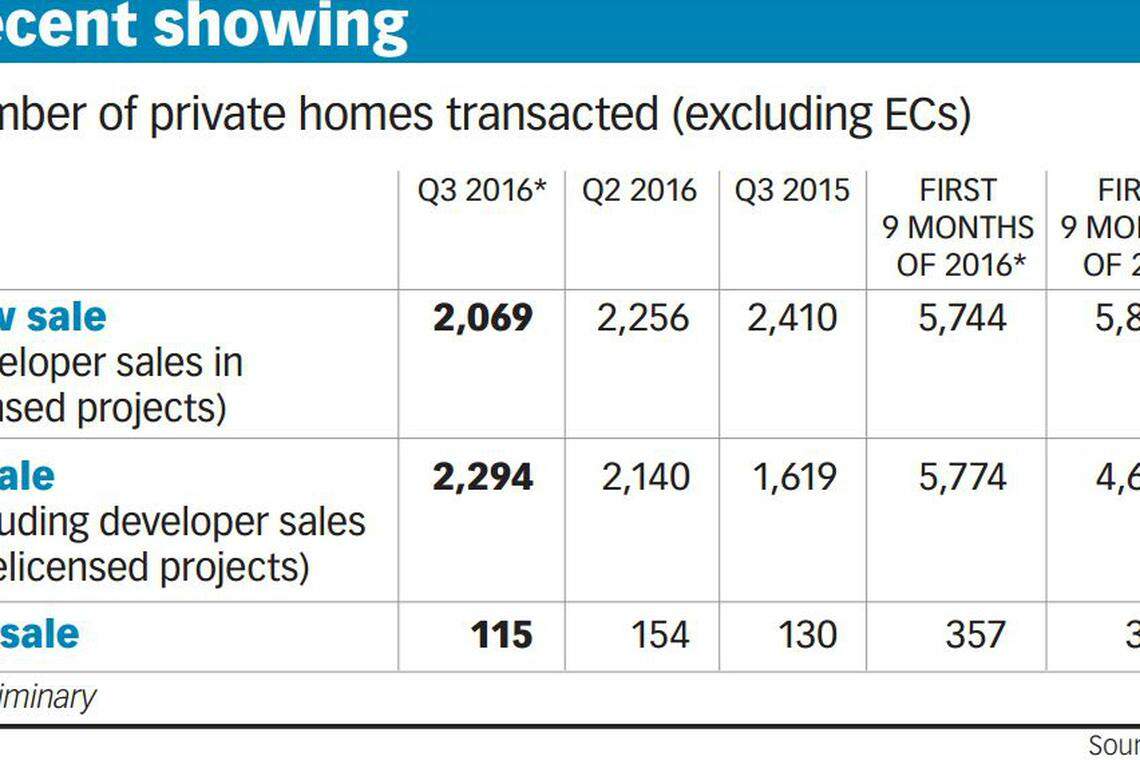

The preliminary tally for Q3 2016 stands at 2,069 units, down from the previous quarter's 2,256 units; the figure was also lower than that a year ago, at 2,410 units.

In the first nine months of this year, developers found buyers for 5,744 private homes, just 1.6 per cent shy of the 5,837 units in the corresponding period last year.

Besides Queens Peak, another major project launch in the offing is EL Development's 752-unit Parc Riviera in West Coast Vale.

OrangeTee forecasts that developers' sales volume for this month may surpass 1,100 units; if so, this would be higher than in any month so far this year.

The firm's head of research and consultancy Wong Xian Yang said: "Despite the dim economic outlook and falling property prices, buyers are still very keen on new homes as evidenced by recent launches. With the rental market still in the doldrums and interest rates remaining low, demand is gravitating towards buying off-plan in an uncompleted project from a developer, where buyers can put aside worries about the rental market for the time being."

Cushman & Wakefield research director Christine Li agreed, saying: "The stock of unsold units has come down and prices are stabilising. And with lower mortgage rates recently, it seems an opportune time to invest in an uncompleted property, to take a long-term view of the market."

That said, sentiment will be tempered by rising unemployment, she added.

JLL national director Ong Teck Hui said that the current momentum of the market is likely to result in both launches and take-up in the fourth quarter of 2016 exceeding the 1,333 units launched and 1,603 units sold in fourth quarter 2015.

He estimates that 7,500 to 8,200 private homes will be sold in the primary market in 2016, exceeding last year's 7,440 units.

ERA Realty Network's key executive officer Eugene Lim also predicts that "possibly 8,000 units" will be sold this year.

JLL's analysis showed that September's best-selling projects were Lake Grande near Jurong Lake (29 units at a median price of S$1,312 psf), The Trilinq in Clementi (28 units at a median price of S$1,405 psf), Kingsford Waterbay (23 units at a median price of S$1,202 psf), The Glades (21 units at a S$1,456 psf median price) and Sophia Hills (20 units at a S$1,892 psf median price).

In the segment for executive condominium (ECs), a public-private housing hybrid, developers sold 260 units in September, down 21.5 per cent from the previous month and almost 10 per cent lower than the 288 ECs sold in September 2015.

The preliminary primary-market EC sales tally for Q3 2016 is 1,429 units - higher than 1,105 units in Q2 and the 1,212 ECs sold in Q3 last year.

For the first nine months of 2016, developers moved 3,296 new EC units, reflecting a year-on-year increase of 66.7 per cent from the 1,977 ECs sold between January and September 2015. This is despite developers launching fewer ECs - 2,656 units in the Jan-to-Sept 2016 period than the 3,245 in the year-ago period.

Treasure Crest in Sengkang was the top-selling EC project last month; 38 units were taken up at a S$746 psf median price.

Other EC projects that fared well included Sol Acres in Choa Chu Kang (36 units at a median price of S$800 psf), The Terrace in Punggol (28 units at a median price of S$787 psf) and Wandervale in Choa Chu Kang (24 units at a S$767 psf median price).

Analysts credit the improved quarterly EC sales chiefly to more realistic pricing by developers. JLL said the median price of new ECs has contracted 6.4 per cent from S$826 psf in Q1 2015 to S$773 psf in Q3 2016.

CBRE Research's head of Singapore and South-east Asia Desmond Sim noted that there has been strong take-up in existing EC projects in the past few months. "Buyers continue to find value in the EC market as they will be able to take advantage of an expected long-drawn market recovery to capitalise on selling their EC unit after fulfilling the minimum occupation period."

R'ST Research director Ong Kah Seng recalled that following a tightening of rules in December 2013 for new EC buyers, demand for new ECs shrank. This, coupled with mounting EC supply, forced developers to trim average EC prices from S$800 psf in the first half of 2015 to S$780 psf or less in H2 2015. This has helped to spur demand.

For the whole of this year, Mr Lim of ERA expects 4,000 EC units to be sold by developers - up significantly from last year's 2,550 units.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Apple to invest US$250 million into expanding Ang Mo Kio campus

DFI puts its last 2 Singapore properties up for sale at S$48.5 million

High Court dismisses China businessman’s claims against Huttons and agent in misrepresentation suit

Delfi Orchard up for collective sale at S$438 million guide price

US 30-year mortgage rate rises to a four-month high of 7.13%

US homebuilding retreats as housing recovery stalls