Developers' private home sales soar

Singapore

THE latest government figures on private home sales point to a turnaround in the market.

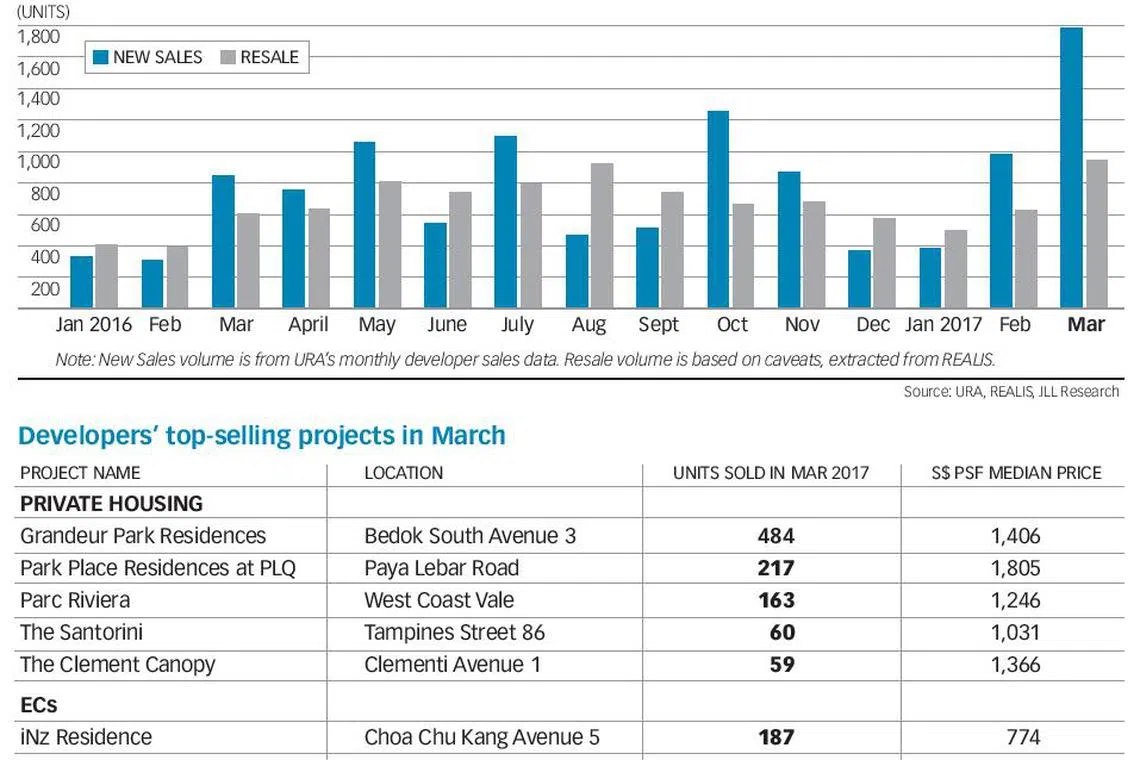

Figures released on Monday showed that, in the primary market, developers sold 1,780 new private homes last month. This was the strongest showing since the 1,806 units they moved back in June 2013, when sales were still buoyant just before the rollout of the Total Debt Servicing Ratio (TDSR) framework towards the end of that month.

The March 2017 sales volume is up nearly 82 per cent from February's 979 units, and a 111 per cent jump from the 843 units sold in March 2016.

Last month's stellar showing was on the back of two well-received new launches (Grandeur Park Residences and Park Place Residences at PLQ), continuing sales in earlier projects (such as Parc Riviera, The Santorini and The Clement Canopy), as well as the confidence-booster from the government's maiden tweaks to the cooling measures announced on March 10.

The jubilant home-buying mood was reflected not only in the data from the Urban Redevelopment Authority (URA), based on its survey of licensed developers, but also in the secondary market.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Resale transactions of private homes rose to 942 units in March, translating to increases of more than 50 per cent month on month and year on year, going by JLL's analysis of URA Realis caveats data. The URA's definition of resales includes developers' sales in delicensed projects.

Summing up the overall mood uplift in March, Edmund Tie & Co's chief executive Ong Choon Fah said: "People are more optimistic that the worst is over, based on the strong turnout at state land tenders and the way developers have been bidding.

"And when the government tweaked the seller's stamp duty and the TDSR effective on March 11, the initial market reading was that it would not move the needle much, but it has certainly helped to boost sentiment."

Based on the latest data released by the URA yesterday, the preliminary Q1 2017 figure for new sales of private homes stands at 3,141 - up from 2,316 units in Q4 2016 and 1,419 units in Q1 2016; the Q1 2017 figure was also the strongest showing since Q2 2013's 4,538 units.

Developers also sold 578 executive condominium (EC) units last month, higher than the 329 units moved in February, and the 485 moved in March last year. The preliminary Q1 2017 new EC sales by developers is 1,091 units, surpassing the 734 units in the previous quarter and the 762 units in Q1 2016.

ECs are a public-private housing hybrid.

On the back of the stronger-than-expected March and Q1 new sales of private homes, some property consultants have revised their full-year forecasts upwards. JLL national director Ong Teck Hui expects an increase of over 20 per cent from the 7,972 units last year - if the current buying trend continues.

Cushman & Wakefield Singapore research director Christine Li has upped her forecast to 8,000-10,000 units, from 8,000-9,000 units.

Prices are expected to firm.

Ms Li said that developers have "not really made much downward adjustment to prices" except in selected projects with looming regulatory sales deadlines under the Qualifying Certificate and Additional Buyer's Stamp Duty rules.

In fact, she argued that last month's maiden tweaks to the cooling measures bridged the pricing gap. "Buyers are more willing to be price-takers after realising that sellers/developers are unwilling or unable to lower their asking prices."

CBRE executive director of residential Joseph Tan noted that demand for private homes has been muted in the past three years and prices have softened. "Those who have stayed on the sidelines for a clearer picture to emerge have decided to enter the market - drawn by the release of projects in good locations.

"Moreover, developers have been bidding aggressively to replenish their land and buyers see this as a sign that current home prices are still at reasonable levels."

In the resale market, based on anecdotal evidence, some owners have also started to be firmer about their asking prices because of the perception that prices are bottoming out.

ET & Co's Mrs Ong said: "This is especially the case for properties of up to S$1.5 million; for bigger-ticket properties, demand is still quite fragile because of affordability concerns, as the TDSR is still in place and because of the need to manage risks."

In the primary market, the best-selling private-housing project in March was Chip Eng Seng's Grandeur Park Residences next to Tanah Merah MRT Station, with 484 units sold at a median price of S$1,406 psf; this was followed by Park Place Residences at PLQ, where 217 units were transacted at a median price of S$1,805 psf.

ERA Realty Network's key executive officer Eugene Lim said: "Quantum remains a strong determining factor of sales, with small units the main contributor of sales at newly-launched projects."

Among ECs, Qingjian Realty's iNz Residence in Choa Chu Kang was the top seller; it sold 187 units at a median price of S$774 psf.

This month, developers' new private home sales are expected to be supported by at least two major new launches - Seaside Residences in Siglap Road and Artra next to Redhill MRT Station.

C&W expects sales momentum to remain relatively strong in the 1,000-unit monthly range in the coming months, with the expected launches of those two projects as well as others in Bukit Batok West Avenue, 6, Martin Place and Fernvale Road.

Copyright SPH Media. All rights reserved.