Second agency merger in two months fans talk of further consolidation

OrangeTee and Edmund Tie & Co teaming up to form JV with over 4,000 agents

Singapore

CONSOLIDATION appears to be underway among Singapore's real-estate agencies.

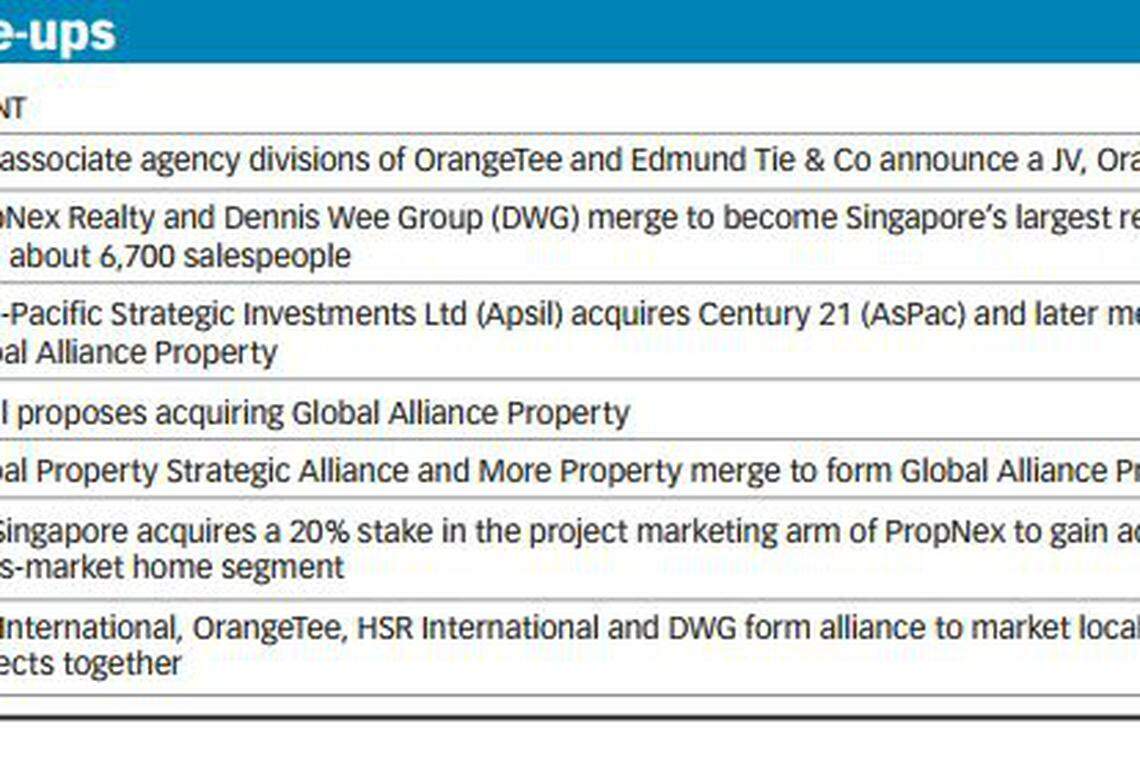

The associate agency divisions of OrangeTee and Edmund Tie & Company (ET&Co) on Monday announced that they will merge to form a joint venture (JV) company, and have just over 4,000 property agents in this stable, leapfrogging Huttons Asia to become the third largest agency here.

The setup of the JV, named OrangeTee & Tie, comes two months after homegrown property agencies PropNex Realty and Dennis Wee Group (DWG) announced their merger to form Singapore's largest real estate agency. It has a 6,700-strong pool of salespeople.

At a press briefing, both OrangeTee and ET&Co declined to reveal their respective proportion of stakes in the JV. They also did not want to say whether there was any monetary value pegged to the JV formation, or if there was any equity transfer between them, saying these details were confidential.

OrangeTee's managing director Steven Tan cited digital disruption and the emergence of platforms that attempt to eliminate property agents in the transaction process as one reason for the decision to merge.

"Real estate and the wider economy are going through structural changes. Digitisation and the sharing economy have disrupted many traditional modes of commerce, and the market has responded by consolidating and rationalising," he said.

Economies of scale - the spreading of sunken costs over a larger pool of agents - is one thing, but the company also wants to leverage technology to maximise the efficiency in its agency business.

OrangeTee's agency unit is a major arm of its entire business; ET&Co, on the other hand, has a larger suite of other services such as property management, valuation, research and consultancy and investment sales.

OrangeTee has a platform called "Property Agents Review" that lists the track records of its agents, whom customers can rate and review; it also plans to develop customer-centric applications to help customers make informed decisions. It is also looking into developing platforms that can enter into collaborations with other online portals, and equipping its agents with in-depth, up-to-date market research.

Agreeing on the threat of digital disruption, Ong Choon Fah, ET&Co's chief executive officer, said: "We know a lot of disruptions are taking place, and we do have to take a very different course to change our direction, with the consolidation that's happening, with the proptech that's coming in."

Asked how long the talks took in the lead-up to the merger, she said: "We haven't courted each other for a very long time, but have known each other for quite a while."

With the combined portfolio of the two firms, OrangeTee & Tie will have more than 50 existing residential projects, and at least six upcoming launches.

Before coming together, OrangeTee had about 2,900 property agents, and ET&Co, about 1,100 as at this month.

After the merger, their number still falls short of the approximately 6,700 salespersons that the merged entity of PropNex and DWG has; ERA Realty Network's has about 6,200 sales agents.

Ismail Gafoor, chief executive of PropNex, which on Monday announced a S$5 million training and development roadmap for its salespersons, said: "Unlike previous years, we are witnessing a change in the real-estate industry scene in 2017. Many small to mid-sized firms might not continue operating on their own, choosing instead to consolidate their business with those of bigger players.

"I believe that at best, the market today can afford to have only four bigger agencies operating successfully. Over time, only two agencies will eventually dominate the industry."

Like most people, he thinks more consolidations will take place in the sector, although no one can guess who the next candidates might be.

Dentons Rodyk & Davidson senior partner Lee Liat Yeang said mergers are easier to execute between local firms than global ones, because the decision can be made at the local level, without needing approval from a foreign parent or having to fulfil obligations to shareholders in another country.

He also believes that digital disruption gives less impetus to merge than simply the desire to compete more aggressively for project development work with the current "Big Three" - PropNex, ERA and Huttons Asia, which has about 3,200 agents.

"If they want to go for the new project launches, the developers look and ask: 'How big a team do you have? What's your coverage?' And if you have only 1,000-plus agents, it'd be difficult."

It is thus more of a numbers game than the need to tackle digital disruption, which has not yet hit the real-estate sector here, he said.

If the younger, IT-savvy generation can do a transaction without a salesperson, they will do it, so tech disruptors have a space in the market, he said.

"But at the same time, buying and selling property is a once- or twice-in-a-lifetime event. Many consumers and investors still want to be guided by professional salespeople, so while digital does have a space in the industry, salespeople who are professionally-trained and able to add value can co-exist."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Condo rents inch up after 7-month decline; volumes recover: SRX, 99.co

Apple to invest US$250 million into expanding Ang Mo Kio campus

High Court dismisses China businessman’s claims against Huttons and agent in misrepresentation suit

URA awards Zion Road, Upper Thomson sites to sole bidders at lower-than-expected offers

DFI puts its last 2 Singapore properties up for sale at S$48.5 million

Delfi Orchard up for collective sale at S$438 million guide price