Sembawang site for sale by public tender under GLS Confirmed List

Tender for a site at Fourth Avenue under Reserve List will be launched soon

Singapore

THE government has launched the public tender for the sale of a site at Chong Kuo Road under the Confirmed List of the second-half 2017 Government Land Sales (GLS) programme. It will also be launching the tender for a site at Fourth Avenue under the Reserve List soon.

That trigger for the Fourth Avenue site, which consultants viewed as a very attractive site, followed an application lodged by a developer to bid for the site at no less than S$448.8 million.

Separately, another land parcel under the Reserve List along the upscale Cuscaden Road in prime district 9 is now open for application. It will be triggered for tender when the Urban Redevelopment Authority (URA) receives a minimum acceptable bid.

JLL national director for research and consultancy Ong Teck Hui reckoned that these sites are unlikely to dent demand for collective sale sites as there is still pent-up demand for sites by developers.

"Moreover, the Chong Kuo Road site is a small play providing modest revenue while the Cuscaden parcel involves higher risk relative to sites in fringe or suburban locations," he said.

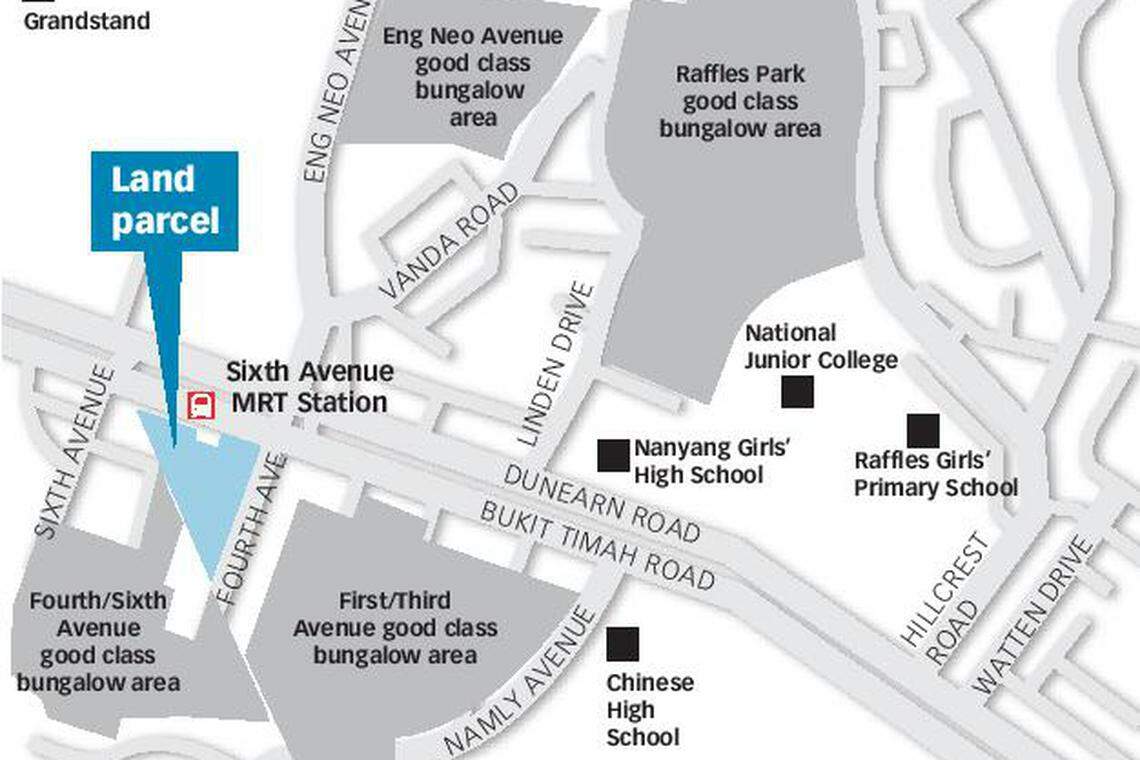

Lee Nai Jia, who heads research at Edmund Tie & Company, noted that the land parcel at Fourth Avenue is very attractive as it is next to the Sixth Avenue MRT and close to reputable schools.

"There has been much interest in the site, and we have anticipated the site - together with the Jiak Kim site - to be triggered in February," Dr Lee said. "Based on the current market conditions, we expect the winning land bid to be around S$567 million (S$1,580 per sq ft per plot ratio). We expect about eight to 10 bids for the site."

More bullish projections for this site came from ZACD Group executive director Nicholas Mak, who is expecting a hot contest by 10 to 15 bidders, with the top bid coming in at S$500-550 million (S$1,392-1,532 psf ppr).

Though Mr Mak viewed the site at Chong Kuo Road in Sembawang as being the least attractive among the six parcels under the Confirmed List since there may be future competing sites nearby, he still expects its tender to draw about seven to 10 bids, and a top bid of S$38.7-42 million (S$600-650 psf ppr).

The tender for the site at Chong Kuo Road will close on Jan 30, 2018. URA said this is "batched with" the tender closing for two other residential sites at Handy Road and Sumang Walk (executive condominium) under the Confirmed List, which will be launched for sale in November and December 2017 respectively.

Mr Mak perceived the "batching" approach as a sign that the government is trying to encourage more prudent bidding. This strategy may work for bidders with limited resources and can only bid for one of the sites. "Such strategy would not stop a very focused bidder to submit a super bullish bid for a site that he is very determined to acquire."

Still, there is the possibility of URA "batching" the tender closing date of the Fourth Avenue site with the Jiak Kim Street GLS site on Dec 5. The site at Jiak Kim Street was earlier triggered for sale under the Reserve List after a developer offered the minimum price of S$689.35 million.

Consultants noted that the location of the Cuscaden Road site is the most upscale among sites in the Reserve List. If triggered, it will be "a test of sentiments in the upper prime market", Mr Ong said. "So far, most of the collective sales have been in the fringe and suburban markets where demand from buyers is more assured. The site is near the future Orchard Boulevard MRT station, and surrounded by abundant amenities. It could fetch a top bid of S$1,600 to S$1,800 psf ppr."

Dr Lee is similarly expecting a winning bid of S$1,650 psf ppr (about S$284.6 million) for the Cuscaden Road site if it is triggered for sale.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

US mortgage rates jump above 7% for the first time this year

Far East Shopping Centre back on market at unchanged S$928 million asking price

London mansions sold at 30% discount spell gloom for luxury market

Delfi Orchard up for collective sale at S$438 million guide price

US existing home sales drop in March; median price increases

German home building permits tumble 18% in February, extending rout