Asia equities battered again by US-China trade spat

Singapore

ASIAN equities are back on the defensive as tensions between the world's largest economies reared their ugly head once again - just weeks after the US and China held a round of trade talks.

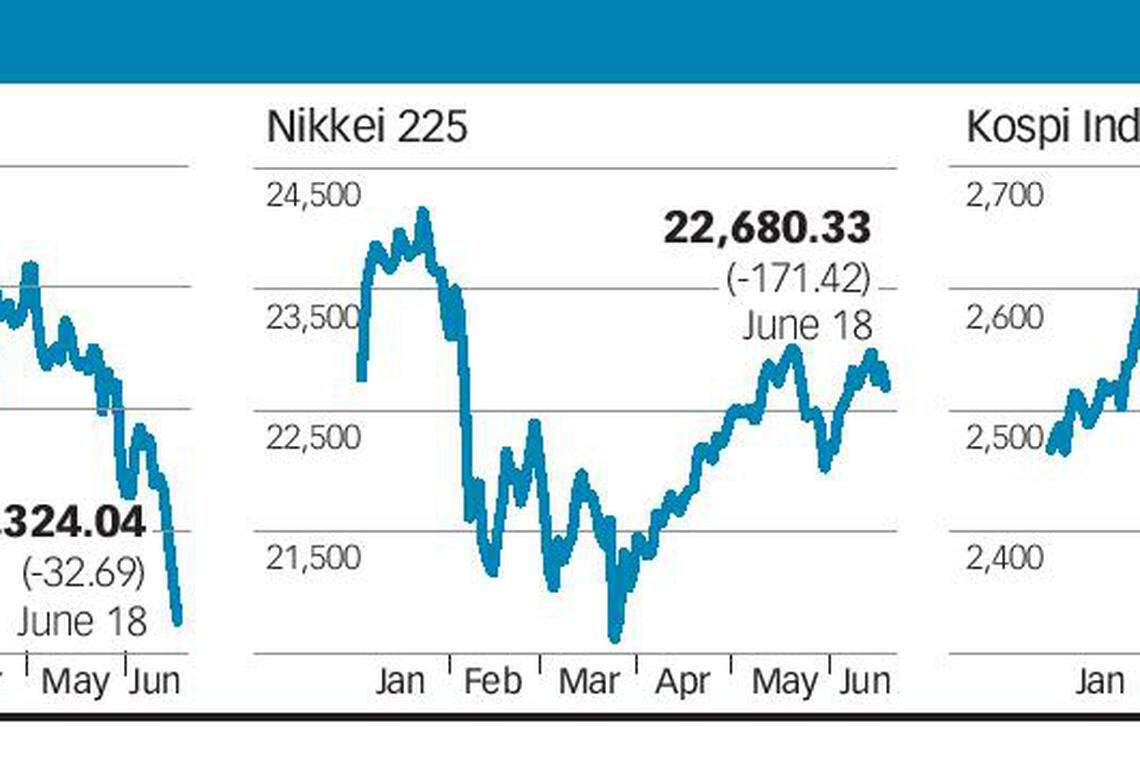

Singapore's Straits Times Index slipped by 0.97 per cent on Monday, with the Singdollar also faltering against the greenback. Tokyo lost 0.75 per cent and Seoul, 1.16 per cent. Chinese markets including Hongkong were closed.

US President Donald Trump has said he will levy US$34 billion in tariffs on Chinese imports on July 6 - a threat swiftly countered by an equal response from China, which is Singapore's largest trading partner. Morgan Stanley recently flagged Singapore companies' exposure to China as about one-quarter of revenue in all.

Maybank Kim Eng analysts noted in a morning report that "with China and Hong Kong onshore markets closed, the Singapore dollar is feeling the brunt of market reaction".

AxiTrader chief market strategist Greg McKenna said: "Many folks will tell you this isn't a trade war. But when one side whacks a bunch of tariffs and the other side retaliates with its own set of tariffs against the other side, that looks very much to me like the battle has been joined."

Asia is "likely to face collateral damage" from the trade spat, DBS foreign exchange strategist Philip Wee warned. He noted: "For first time in half a year, Asia's export-dependent currencies, the Singapore dollar and (South) Korean won, depreciated past 1.35 and 1,100 respectively."

Eli Lee, head of investment strategy at the Bank of Singapore, said any direct impact from this first round of duties "appears manageable", but further escalation "could ultimately result in considerable economic harm". "We expect heightened market volatility in the meantime," he cautioned.

United Overseas Bank's global economics and market research analysts agreed that "while there is still hope yet for de-escalating of trade tensions, financial markets are likely to be under pressure from such uncertainty which could worsen rapidly if both sides take further reciprocal actions".

The UOB team predicted that equity markets would see out-flows into assets perceived as "safe havens", such as the US dollar, Swiss franc, Japanese yen, and US Treasury debt.

As for which industries will feel the heat, IG Asia market strategist Pan Jingyi said that "for markets, the scrutiny would be on many of the targeted sectors, with China focusing on farm products, cars and crude oil, among others that would likely find reactions cutting across US markets". She added: "A sea of red can certainly be sighted across US futures, making for weak leads for Asian markets."

Bank of Singapore's Mr Lee said: "The Singapore economy is heavily dependent on global trade, and the scenario of a trade war would pose extensive headwinds for domestic equities. Manufacturing and export-oriented sectors, in particular, would be more affected."

Hi-P International, which counts China home to almost half of its manufacturing plants, saw its share price slide by 7.94 per cent to S$1.16.

Meanwhile, Yangzijiang Shipbuilding slipped 3.11 per cent to 93.5 Singapore cents, China Sunsine Chemical lost 2.45 per cent to S$1.59 and China Aviation Oil Singapore dipped by 1.89 per cent to S$1.56.

Also among the potential victims of Chinese import taxes are soya beans from the US. Singapore-listed agribusiness Wilmar International, a key crusher of the crop in China, closed flat at S$3.28 on Monday.

Standard Chartered projected in a special report in late April that Singapore's gross domestic product could take a hit to the tune of 1.1 per cent should China cease all its US exports.

Sharing a view that only deepens the gloom, Reuters quoted Mizuho Securities senior technical analyst Yutaka Miura as saying: "The US is not only after China. It's after a lot of countries in the world. Investors are worried that the trade war would eventually hit global demand."

Another storm cloud lingering over markets this week is the Organisation of the Petroleum Exporting Countries (Opec) meeting on Friday. The oil-producing cartel has been riven by internal disagreement over whether to raise its supply, even as US oil was singled out by China as a candidate for retaliatory duties.

"Although trade war concerns between the United States and China will likely act as the headline risk for this week, there are a number of different events that investors will need to monitor," said Jameel Ahmad, global head of currency strategy and market research at currency broker FXTM. He cited the Opec session and a Bank of England meeting, among others.

READ MORE:

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Capital Markets & Currencies

Singapore stocks end lower after US market wobbles ahead of CPI data; STI down 0.2%

LSEG reports in-line first quarter as Microsoft partnership progresses

Japan brokerage Daiwa’s Q4 profit more than doubles as markets recover

South Korea readies new system to detect illegal short-selling

Asia: Markets mixed as global rally stalls, eyes on yen

Singapore shares retreat at Thursday’s open; STI down 1.1%