Singapore, the fintech prodigy

This tiny island is skipping grades to become the world's top fintech hub.

Two years ago, Jim Reichbach found himself working his way through a crush of entrepreneurs at a networking do in New York City. It was cocktail hour. Some 60 upstarts from the fintech scene were mingling, likely drunk on a heady mix of gin and contempt for Big Banks.

But Mr Reichbach remembers now, that the fintechs - financial technology firms - only vaguely understood what they were rebelling against. And it wasn't just the effects of gin.

"They had fundamentally no clue how banks operated," says Deloitte's global banking sector leader. "They didn't understand the environment that banks operated in, and what it truly meant to be a regulated entity."

Even the fintechs that did want to cosy up to the banks had no inkling of the kind of glass-walled bureaucracy they would face. The contractual relationships. The intellectual property pitfalls. Limitations and liabilities. An avalanche of business terms that small shops had never grappled with, Mr Reichbach says.

Most fintechs have now sobered up and are recovering iconoclasts. Once a feared force of disruption rippling through the financial sector, nine in 10 fintechs today are likelier to be fixing banks' problems, instead of creating more of them.

The timing of this new wave of collaboration suits Singapore just fine, as the city-state has made a sudden dash to be ahead of several hubs in this fintech race.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The Monetary Authority of Singapore (MAS) has been leading the fintech charge, and the biggest showcase of its resolve will be at the Singapore FinTech Festival in November. The festival will be the world's first large-scale gathering of fintechs, bankers, regulators and investors.

Here, there is no slavish fawning over fintechs (though there has been a growing number of men dressing down on Shenton Way). MAS has a clear strategy: fintechs are welcome, but mainly to help banks and other financial institutions to survive.

The five-day FinTech Festival is more cram school, less Coachella. There are conferences upon conferences, and innovation lab-hopping - think a teetotaller's pub crawl. Participants can choose to wrap up one of the nights over a fireside chat with a top minister.

MAS has also gathered hundreds of problems that financial institutions have - big, small, common and esoteric - and distilled them into a tidy list of 100 problems. These 100 items are called problem statements - or one suspects, the first chapter of a fintech 10-year-series.

They define the banking sector's problems such as compliance, financial literacy, credit for small businesses, customer service, and payments. Fintechs will compete to solve these problems, and from there, MAS hopes to play matchmaker among banks with problems to solve, fintechs with solutions, and investors with money in their pockets.

This programme promotes a culture of innovation in the financial sector, says an MAS spokesman, as Singapore builds a smart financial centre where "technology is used pervasively in the financial industry to increase efficiency, create new opportunities, manage risks better, and improve people's lives".

The regulator has also set S$225 million aside over the next few years for fintech experiments, outlined rules for crowdfunding and cloud computing, and is rejigging strategies to attract venture capitalists. It has its own chief fintech officer.

If Singapore were a student, she would be the class monitor, the head prefect, and the top scorer of the cohort. The governance approach is pragmatic, studious, and calculated.

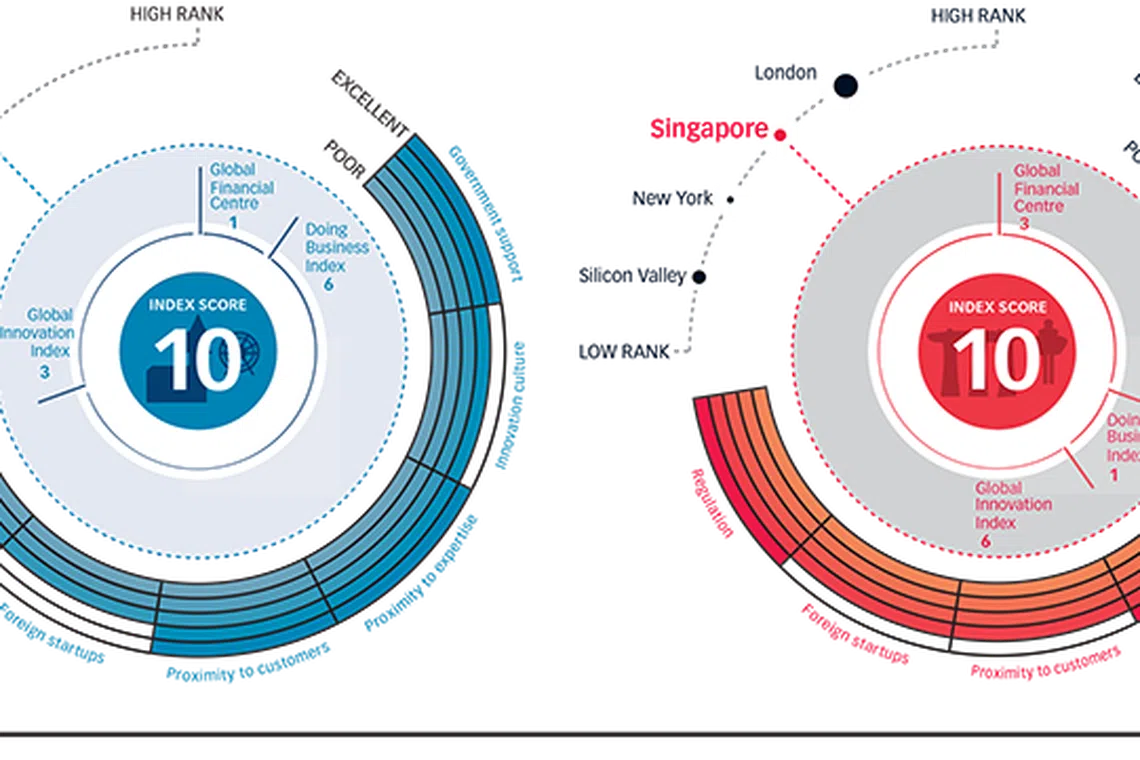

This degree of establishment-type involvement is miles away from London's laissez-faire, freewheeling landscape, but it has a clear competitive advantage. In September, Singapore tied with London for pole position as a fintech hub in a Deloitte report. Both cities scored a 10 - the best score among all 21 hubs surveyed.

"London happened. London had all the prerequisites," says Neal Cross, chief innovation officer at DBS.

"The global head of finance in the world. You've got the city, and it's compacted...The regulators reacted quickly, not so much to drive this forward, but more to get out of the way, and not to screw it up, because it had momentum."

But in Singapore, nothing just "happens". And to be sure, that MAS can coax the tight-lipped firms that it regulates into admitting they have problems speaks to a hand-on-heart reverence that bankers have for MAS.

"We are doing it in a very Singaporean way," says DBS's Mr Cross. "It's (a) very structured, process-driven way. Nobody's done it before.

"Could I email Mark Carney and say, 'I've got an idea, can I have a chat?' I can guarantee I won't get a response. I could email Ravi (Menon), and I would get a response," says Mr Cross. (Mark Carney is the governor of the Bank of England and Ravi Menon is MAS's managing director.)

Asked to name another regulator that is like Singapore's, Michael Gorriz, group chief information officer at Standard Chartered, pauses and struggles. The London regulators have some similar "tendencies", he says. China and Hong Kong have fintech clusters.

But Singapore is a far more involved authority. It doesn't just try to bring the right people together, it is also developing education programmes to meet the talent shortage, he says. "The fact that (MAS is) methodical - it should deliver better results," says DBS's Mr Cross. "It relies on banks' challenges, and there, at least there are problems to solve. I'm always amazed at people who give up their jobs and use their seed funding to do a start-up that is actually not solving a problem."

Darwin is pleased

It is about time that banks are getting help with their problems. "Why do fintechs exist? They are fulfilling voids that we may not have addressed in the past," says Susan Hwee, UOB's group head of technology and operations.

Banks seem to have lost sight of their customers' preferences, she believes. At the same time, tech firms such as Amazon have greatly raised the bar for banks' services.

The city-state is also attracting some mature fintechs with a disruptive spirit - few as they may be, today. Remittance company TransferWise is slated to set up shop here. XTX Markets, one of the world's top spot currency traders, is already in Singapore. US unicorn Stripe, another payments player, will be coming to town, too.

StanChart's Dr Gorriz points to a structural shift in the way consumers interact with banks. Bankers used to be the affable face of lenders. But in a post-Lehman world, what counts is institutional reputation. Consumers are used to getting things done without meeting the person on the other end of the transaction. "Trust has been transformed into a series of fulfilled expectations," says Dr Gorriz.

Banks have been buying technology services for decades, and to them, fintechs are an extension of these services. But the early buzz of disruption that fintechs created had forced banks to demystify these new creatures. With free open-source software, cloud services, and big data services, banks too could try to redefine their stodgy approach to service.

It is entirely in MAS's interest to support banks that are made stronger by innovation - either through disruption or with better technology bought from fintechs and developed from within. And with the big push from the Singapore government, banks have better odds of succeeding. This also plays into MAS's looming presence as a regulator. It says it "strives to be close" to developments in fintech, while staying alert to the potential risks posed by new technologies and business models.

The beauty of today's technology is that a problem can be tackled in a piecemeal and less costly way. And for large institutions, that approach can reduce the risk aversion towards investing in new ideas. Where the tougher issue lies is in breaking institutional culture, and in using technology to crack a puzzle that sounds ridiculously basic: how to serve customers.

This is where fintechs come in - their pitch is that they are much better than banks at imagining customers' pain points. But at the same time, banks are learning from fintechs in creating their own in-house prototypes of solutions in a matter of hours, and quickly switching to another solution when one fails.

The ambition is to combine the agility of a fintech with the balance sheet of a bank. "(Banks) can pay our employees every month. It's not too bad if you need to feed a family," Dr Gorriz quips.

Darwin would have approved of Singapore's banks, which have held their own in the digital arms race. DBS was crowned world's best digital bank by Euromoney this year.

Banks here have also tidied up their backend systems, so new technology from fintechs can be plugged into older banking systems. This is done through application programme interfaces (APIs), which are forms of computer messaging that let the banking system communicate with third-party systems.

MAS, ever the overachiever, is also eager to use API to disseminate and collect regulatory data.

The pace of revolution in banking will only increase over time. "Many of those who call themselves banks today will not survive," Dr Gorriz says.

He believes services such as deposits and mortgage sales will be digitised in time. "There is no excuse to say regulation is prohibiting me. This argument is no longer valid, at least, not (in Singapore)," Dr Gorriz says.

As banks evolve, what then, will become of fintechs? Already, the Young Turks of fintech have moved from wanting to annihilate banks, to simply wanting their business.

The maturity comes as some fintechs' business models are unrealistic. At the same time, the cost of attracting customers is high. VCs have also become more sceptical.

In fact, DBS's Mr Cross has this wry prediction: "I see VCs moving more towards companies which could make - and it's a rare thing among start-ups - this thing called profit?"

Still, Richard Koh, M-Daq's founder, wonders if the proclivity for acquisitions might hurt the future of fintechs here. A fintech that is too quickly absorbed into a bank may not be able to recycle the capital to create the next fintech.

"The company (might have) hit a mini payday but it could have been a unicorn," says Mr Koh, whose firm helps e-commerce firms profit by selling in their customers' home currency. A unicorn is a start-up valued at more than US$1 billion.

Some banks insist they are not bent on taking out the fintechs, at least not now. "We know that if we acquire them, we will kill them," says Pranav Seth, OCBC's head of e-business and business transformation.

"In that creative tension, those guys are not bound by rules and have the ability to question everything. Once the bank comes in, that questioning disappears. So we go to great lengths to say, we don't want a stake."

London calling?

In London, the timezone has worked in the city's favour, as has its access to the European Union market, says TransferWise's head of banking Lukas May.

"Access to the best talent in the world is essential when you're building a global company and the single market for financial services means that with one licence, companies can operate across Europe," Mr May adds.

Even so, Brexit has placed that access in jeopardy. The fintech scene in London had been partially fuelled by happenstance. It remains to be seen if happenstance continues to help London more than hinder it.

Now, Brexit angst is fanning interest in Singapore as a fintech hub. As it is, the city-state is an attractive base for fintechs to access Asian markets. More Russian, Australian and Israeli start-ups are reaching out to accelerators and VCs in Singapore, says Chia Tek Yew, head of financial services advisory at KPMG Singapore.

Deloitte's Mr Reichbach says: "There's absolutely a scenario that says the banks migrate out of London, and what do the fintechs do behind that? Singapore is uniquely positioned, because of the strength of the banking sector here."

Asean could eventually be to Singapore's fintechs what the European Union market had been to London's. The region's explosive growth will work in Singapore's favour.

For all its endeavour, there is sometimes a point at which Singapore runs up against its own bespectacled self. The Deloitte report that had crowned Singapore and London joint fintech hub champions also noted that Singapore still lacks entrepreneurial drive, for example.

"The trouble is, Singaporean companies do not do well in Silicon Valley," Mr Cross says. "You've got to be a story-teller, an aggressive salesperson who maybe doesn't tell the truth all the time."

Even so, OCBC's Mr Seth says a few good fintechs from Singapore will find their groove. Already, Singapore has fintech start-ups that have already quietly attracted funding from high-profile investors. These include M-Daq and V-Key, a security services firm for e-commerce sales.

"The society already has a view of failure, like all Asian societies. It will take a few success stories. I think we need heroes," says Mr Seth.

MAS, and all regulators, seem intent on keeping the barriers to entry fair - and high - for mature fintechs, to level the playing field, says Mr Reichbach. At the same time, banks have been forced to reinvent themselves to stave off fintech competition. Both sides have had to grow up.

MAS's watchfulness, coupled with the constant thrum of urgency on this island, means Singapore can be both deliberate and swift.

"It's that openness, for the common good focus that the government has, which is not even close in other countries," DBS's Mr Cross says.

"Because there are no resources, it's a small island... they have to be very sophisticated in how they think about programmes here. There is no fallback solution. If they do something wrong, and it's badly wrong, it will hit five million people very, very, quickly."

As the tide of fintech disruption turns towards Singapore, the country will be waiting. And it will have done its homework.

Copyright SPH Media. All rights reserved.