Dedicated body to level up corporate governance standards

18-member Corporate Governance Advisory Committee unveiled on Tuesday; it will act mainly as an advocacy body

Singapore

IN A first for Singapore, the Monetary Authority of Singapore (MAS) - the country's apex financial regulator - has established a permanent, industry-led body responsible for "levelling up corporate governance standards and practices" here.

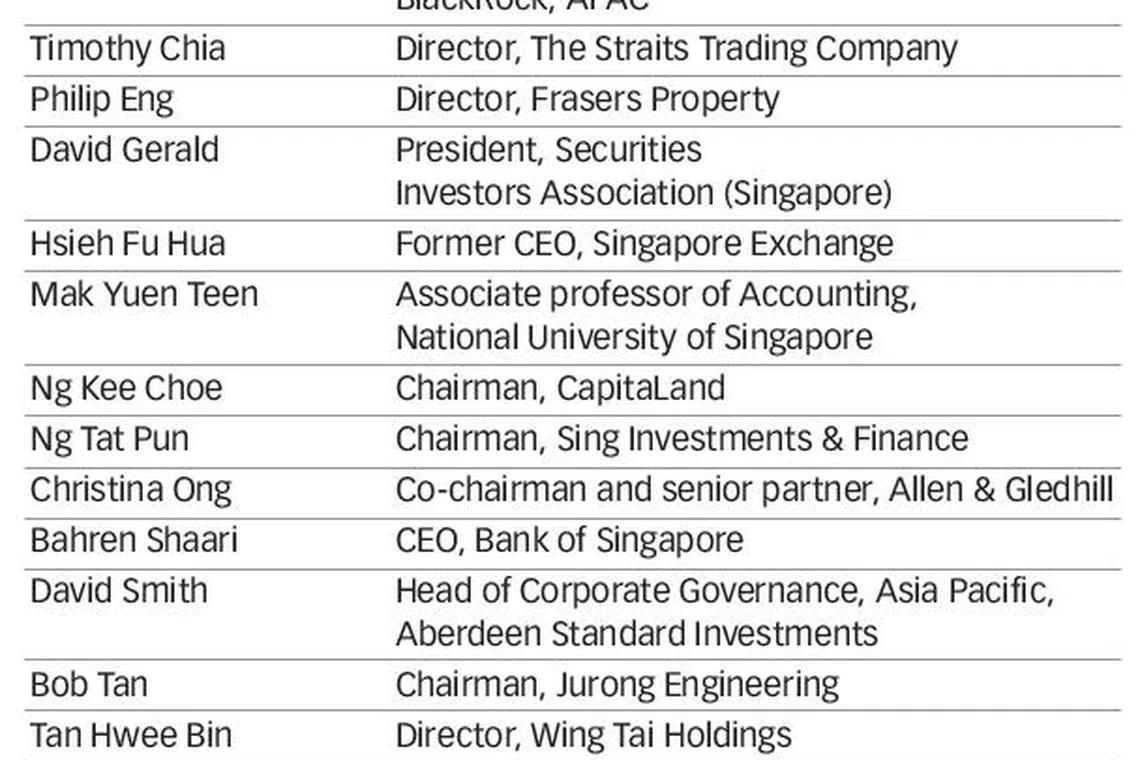

The 18-member Corporate Governance Advisory Committee (CGAC) - the formation of which was a recommendation by the Corporate Governance Council (CG Council) that reviewed the Code of Corporate Governance (CG Code) last year - was unveiled on Tuesday.

Led by well-respected corporate figure Bobby Chin - who serves on the board of Singtel, and who's also known for having chaired the MediShield Life Review Committee and the Committee to Develop the Accountancy Sector (CDAS) - the complement of the CGAC is a mix of the familiar and the inspired.

The appointments are meant to represent the key stakeholder groups in Singapore, while encompassing the expertise and standing needed for such an advocacy group. Mr Chin told The Business Times that the individuals chosen "have the relevant experience and are both able and willing to serve".

In its press release, MAS said the CGAC will be an integral part of the corporate governance ecosystem in Singapore. "It will play an important role in levelling up corporate governance standards and practices and help to strengthen investors' confidence in our capital markets and uphold Singapore's reputation as a trusted international financial centre," it said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

MAS stressed, however, that the CGAC would not hold any regulatory powers but act mainly as an advocacy body, whose role is advisory in nature.

"The CGAC will identify current and potential risks to the quality of corporate governance in Singapore, and take a leading role in advocating good corporate governance practices. It will also monitor international trends, revise the Practice Guidance to clarify the CG Code, and recommend updates to the CG Code," it said.

The Practice Guidance was included in the latest review of the CG Code and, as its name suggests, provides practical guidance to aid stakeholders in adhering to the spirit of the Code.

Mr Chin said: "The changes introduced under the 2018 review of the CG Code have helped ensure that Singapore's corporate governance framework kept pace with market developments (but) the effectiveness of the CG Code will require sustained commitment in both substance and form by companies and stakeholders."

He added that he would like the CGAC to do its part in raising the standard of corporate governance in Singapore with "practical and good recommendations".

The CGAC will, however, not carry any regulatory or enforcement powers, nor will it provide specific opinion, advice or guidance to listed entities on ongoing cases and investigations.

MAS said: "Singapore Exchange Regulation, the MAS, and the Accounting and Corporate Regulatory Authority remain responsible for taking regulatory actions against corporate governance-related breaches. The CGAC will work closely with these regulators to uphold corporate governance standards."

The CGAC can act as a resource for the regulators, which would include advising them on corporate governance issues referred to it by the regulators. These could include case-specific issues or issues of broader public interest.

The committee can provide opinions on corporate governance practices, including highlighting areas for improvement for listed entities in general, and also consult stakeholders, including listed entities, on proposed changes to the CG Code or Practice Guidance.

Commenting on the formation of the CGAC, associate professor Mak Yuen Teen - who is a member of the CGAC and served on the last CG Council - said: "It's good to have a permanent committee looking at corporate governance on an ongoing basis, rather than having a new council formed every few years - since governance standards are constantly evolving and it's easy to fall behind. I hope the CGAC can will make a real difference in raising corporate governance standards and that it's bold enough to recommend standards and practices that may be unpopular but needed."

He also praised the inclusion of Prudence Ann Bennett, corporate governance consultant and former head of investment stewardship at BlackRock, APAC, on the committee. "It's quite refreshing that we have added someone from outside of Singapore with significant experience in corporate governance in the region at the biggest asset manager in the world. It will give us an added perspective of where we are compared to the rest of the region and world."

But not all aspects of the CGAC's composition have elicited the same laudatory reaction.

Stefanie Yuen Thio, joint managing partner of TSMP Law Corporation, who served on the last CG Council, said: "The inaugural CGAC is clearly made up of industry folks with a wealth of experience. Notably, trusted henchmen of Singapore Inc are not in short supply. However, given Singapore's objective to develop into an international financial and economic hub, I would have liked to see a greater representation from international players - including investors, fund managers and academics - who could share their experience from the global arena."

Jamie Allen, secretary-general of the Asian Corporate Governance Association (ACGA), whose biennial CG Watch rankings are closely followed in the region, said the ACGA welcomes the formation of the CGAC as a standing committee with a long-term goal of improving corporate governance in Singapore. "It is disappointing, however, to see so few investors represented on the committee. We hope it will be open to a dialogue with a wide group of investors and corporate governance stakeholders in future," he added.

It was a point echoed by Prof Mak: "Corporate governance, after all, is about enhancing the long-term value to shareholders and other stakeholders, and the accountability of boards and management -- we should never lose sight of that. I hope the committee will put investor protection at the forefront when considering recommendations because strong investor protection underpins any strong capital market."

READ MORE: SIAS's Hyflux rap: A wake-up call for corporate Singapore

Copyright SPH Media. All rights reserved.