Third Procurri shareholder comes out against Novo Tellus' partial offer

PROCURRI Corporation has received another letter dated April 22 from substantial shareholder Koh Swee Yong indicating the intention to vote against private equity firm Novo Tellus' partial offer at 36.5 Singapore cents per share.

Mr Koh owns approximately 5.9 per cent of Procurri's shares.

This comes after Novo Tellus released an announcement saying that its offer price of 36.5 cents per share was final, except in the case of a competitive situation, on 21 April.

Mr Koh is the third shareholder to indicate an intention to vote against Novo Tellus' partial offer. DeClout and asset manager ICH Gemini said that they both intended to vote against the offer.

DeClout, a former parent of Procurri that invests in technology companies, owns 21.2 per cent of Procurri. ICH Gemini owns about 3.9 per cent.

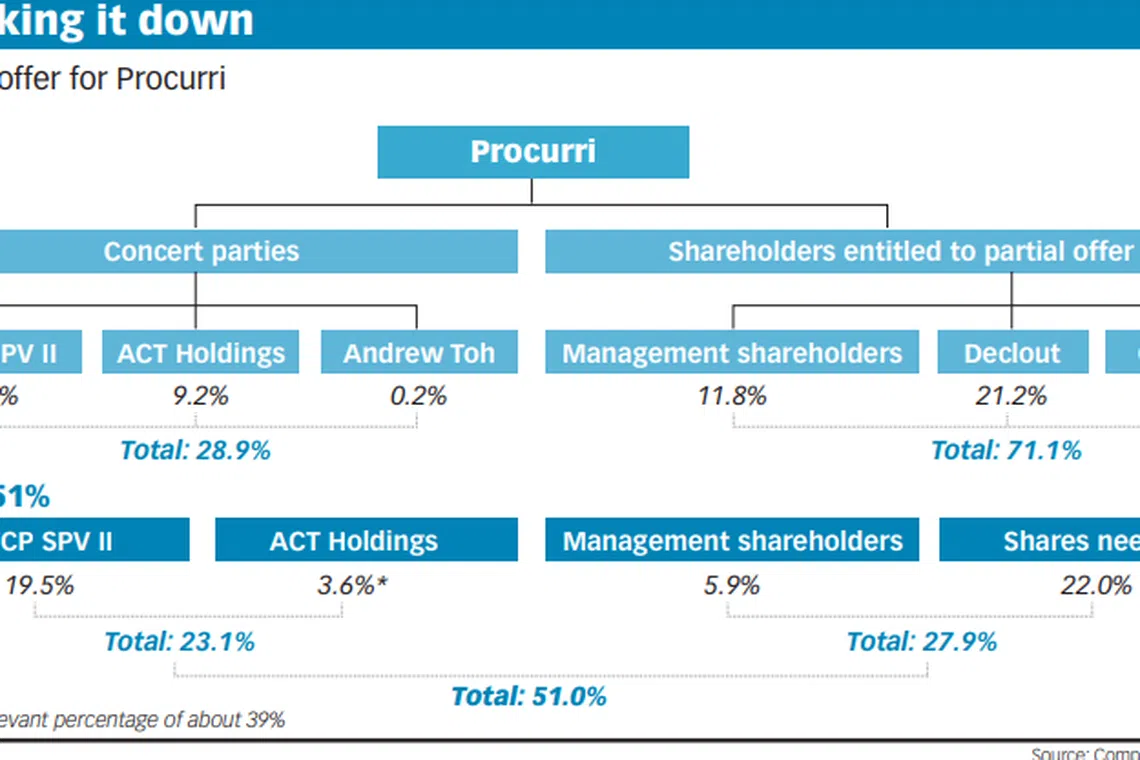

The partial offer was launched to acquire an additional 27.9 per cent of Procurri's shares. Novo Tellus held 19.5 per cent of Procurri as at the offer announcement date of March 15. A concert party, a company called ACT Holdings, held another 9.2 per cent of Procurri.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This leaves 71.3 per cent of shares that Novo Tellus and its concert party does not hold, in the hands of independent shareholders with some say in the outcome of the offer. For the offer to take place, Novo Tellus would need more than half of those shareholders - or at least 35.7 per cent of the existing shareholding base - to vote in favour of the offer.

With KSY, DeClout and ICH Gemini's intention to vote against the offer, a total of 31 per cent of Procurri shareholders are voting against the offer.

Procurri shares closed at S$0.355 on Friday, up 1.43 per cent or 0.5 Singapore cent.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.