BT Explains: Reverse mortgage with a CPF twist

DBS's latest mortgage product offers flexibility to seniors seeking more annuity payout off CPF Life, with the leverage capped - the optionality comes with an interest of 2.88%

DBS has introduced a way for seniors to take a reverse mortgage against a fully paid private home, and for these seniors to channel that borrowed amount into CPF Life, Singapore's insurance annuity scheme.

The latest solution has drawn much chatter online, from concerns about whether retirees will struggle to repay the loan at the end of the loan tenure, and whether they will risk being forced out of their homes if that were the case. Some also question the wisdom of taking out a loan at an old age.

The Business Times looks at various concerns, how this scheme stacks up with other options for retirees, and the considerations in deciding which to take up.

What's a reverse mortgage?

To own a home, we take debt to afford it.

A mortgage is typically the single-largest debt that any household would need to take on, to ensure a roof over one's head. The mortgage amount is a ratio to the property value, known as the loan-to-value ratio (LTV).

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

There are rules and credit assessments done by banks to ensure that households do not take on too much debt to purchase a home. This is done by adjusting the LTV available to borrowers, and ensuring that the final household debt is a sustainable portion when compared against the household income.

In a reverse mortgage, seniors who have already paid up their mortgages on their properties can seek out a bank to have it lend money to them, with them borrowing against the home value against much lower LTV limits compared with a conventional mortgage.

This form of financing allows borrowers to unlock some immediate cash out of their property, but comes naturally with interest that needs to be paid, commonly by selling the house later.

Reverse mortgage and CPF

In August, DBS tied up with Singapore's Central Provident Fund (CPF) to help seniors unlock equity from their private homes while they continue to live in them.

Singaporeans and permanent residents aged 65 to 79 who own and reside in fully paid private properties can take out such a loan to top up their CPF retirement sums.

The borrowed amount is then used to raise the monthly payouts these customers receive for life under CPF Life. This is done by topping up a lump sum into these individuals' CPF retirement accounts. These customers then apply to the CPF Board to up their monthly CPF Life payouts.

With the loan up to 30 years, the property must have at least 30 years left on the lease when the loan matures. The lump sum is paid only at maturity.

Customers can also sell their property any time and repay the loan without a penalty fee.

Doing the sums

DBS maintains that it has instituted safeguards for the new package. For instance, with the loan quantum capped at each individual's CPF Enhanced Retirement Sum - S$279,000 for 2021 and S$288,000 for 2022 - the likelihood of seniors or their estates not being able to repay is low.

The fixed interest rate, now at 2.88 per cent, is markedly higher than prevailing mortgage rates. For illustration purposes, for a couple who needs to borrow S$290,000 together to top up their CPF Life monthly payouts, they will have to pay back S$540,560 after 30 years.

One netizen asked if it would be a better option to downsize and invest sales proceeds in fixed deposits and other investments. Another asked why a property owner would not just sell the fully paid private home, and get a HDB flat.

In response to this feedback, DBS's head of consumer deposits and secured lending P'ing Lim said the new scheme is but one more option for seniors who want to "buy some time to think through what they need".

"With this product, they are not in a hurry to sell just to get the cash flow they need when they are, say, 65 years old. At that stage, they are still quite young, independent, mobile and so on. It buys them time to do what will be suitable for them at different life stages in their retirement years," she said.

For added perspective, the loan amount will be used for CPF LIFE premiums, which earn a higher interest rate of 4 per cent per annum.

Ms Lim noted that the solution would be suitable for those who are "comfortable with CPF and appreciate the proposition of a monthly payout". "One of the reasons why CPF was chosen was because the lifelong payouts are quite generous and the return on the premiums is 4 per cent. CPF has hardly moved in the last few decades in their interest rates," she said.

There is also little chance of debt left to inheritors given the property's worth should far exceed the final debt.

Other equity term loan options typically provide the borrowed money in one lump sum, but with customers having to make monthly repayments. This is sometimes called cash-out refinancing.

Target audience

The latest reverse-mortgage solution is targeting the "asset-rich, but cash-poor" part of the population here - seniors living in properties that have likely gained substantially in value, but who do not have liquid cash to tide them through medical bills and other expenses in their twilight years.

According to CPF data, over a third of CPF members have less than the basic retirement sum when they turn 55 years old.

It also speaks to the demographic shift of Singapore, and how this ageing society has had a sizeable number of people building up "substantial equity" through the housing market through the years, a working paper published recently by the Wharton Pension Research Council showed.

Data from property consultant Savills Singapore showed that the number of residents aged 50-69 living in private properties almost tripled in the last two decades, from 82,000 in 2000 to 221,000 last year.

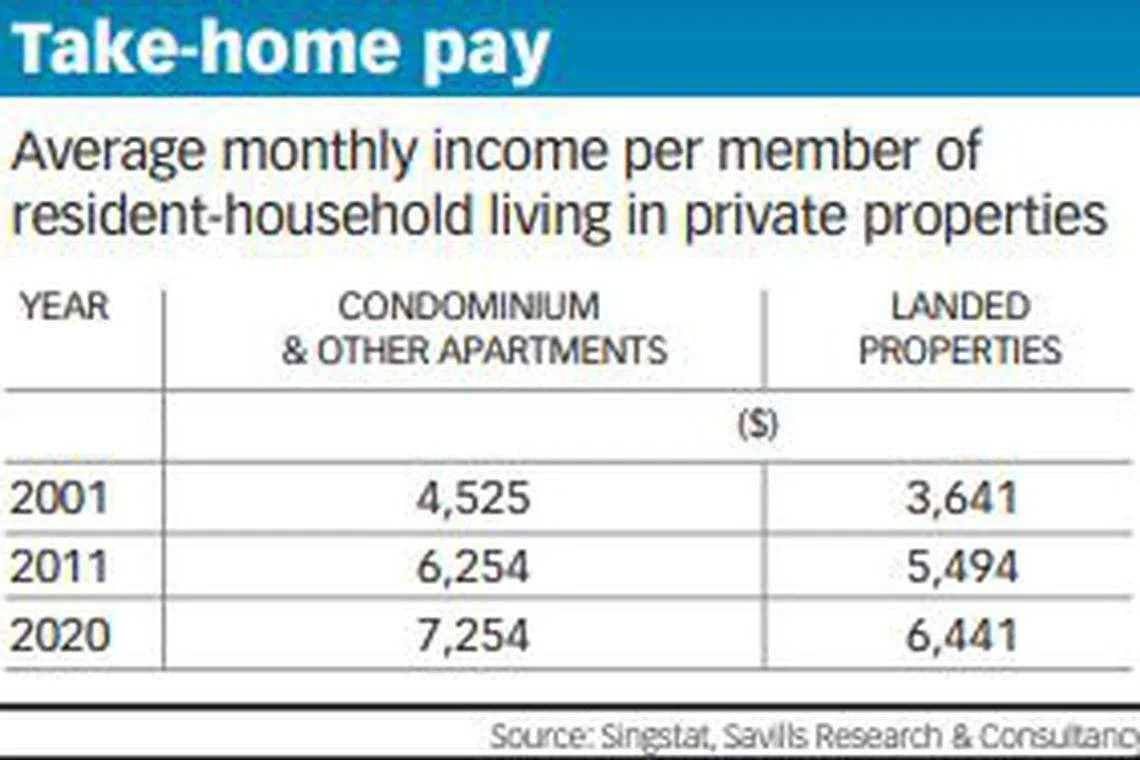

A separate set of data from Savills also showed that in 2020, the average monthly income per member of a resident-household living in private properties stood at S$6,441 for those in landed properties, and S$7,254 for those staying in condominiums and other private apartments.

The working paper from the Wharton Pension Research Council - done by three researchers from NUS, SMU, and the University of Pennsylvania - meanwhile showed that an average homeowner above age 50 in Singapore holds some 60 per cent of their total net wealth in housing equity. This 2020 paper found that this was "suggestive" of high demand potential for reverse mortgage products, should more awareness of such products be built.

"Nevertheless, actual interest in such products was much below potential demand," said the paper, noting that only one in four older homeowners indicated interest in commercial reverse mortgages if these were to become available and easy to understand; a larger majority had never heard of the financial product.

Reverse mortgages are not new in Singapore, but take-up rates for previous schemes were lacklustre. In 2006, NTUC Income had offered reverse mortgage plans for owners of HDB flats, but only 24 households signed up for it. The insurer later stopped offering the product.

More safeguards

DBS has said that if the value of the property declines during the loan period, borrowers are not required to make any payment to reduce the outstanding loan amount if there is no event which triggers early termination of the loan

If there is an early termination of the loan - such as borrowers passing on during the loan period - or if borrowers outlive the loan, DBS will further commit to not repossess the property until after it exhausts all other mutually acceptable options with the borrower or their estate.

So seniors who outlive their loan tenure can first explore other options of repaying, likewise for the children who have inherited a property that is held under a reverse mortgage.

To qualify for the loan, borrowers are required to have or set up a Lasting Power of Attorney. This will allow the borrower to appoint one or more persons to make decisions and act on their behalf should they lose mental capacity.

Risks to watch

NUS economics and real estate professor Sumit Agarwal advised retirees to refrain from taking on new loan obligations if they are able to downsize or rent out space in their apartments.

But he acknowledged that a segment of the population may want to retain a certain level of comfort, or don't want "intrusion" by renting out a room. There may be other personal reasons for not wanting to leave their current living environment. In those cases, DBS's new solution could offer a "good middle ground", said Professor Agarwal. Offering staggered payments via CPF Life ensures greater prudence, he added.

Still, the onus is on DBS to ensure that customers do not borrow beyond their financial capabilities, Prof Agarwal said.

Lena Teng, head of solutions at financial advisory firm MoneyOwl, said renting out space or investing in sales proceeds may give homeowners more flexibility in managing their monies. But there are added costs in searching for suitable tenants and managing investment portfolios.

Ms Teng acknowledged that some may have a desire to retain control over their property. To add, changes in the living environment can sometimes be psychologically disruptive for seniors.

That said, retirees who opt for equity term loans or DBS's new scheme must likewise be "psychologically comfortable" with having an outstanding loan, she cautioned.

Clarification: The story has been clarified by removing an earlier quote, as the quote was based on the assumption that the interest is compounded. DBS has clarified that that assumption is incorrect - the interest is not compounded. The story has also been clarified to say that there is little chance of debt left to inheritors given that the property's worth should far exceed the final debt. Other mortgage rates have been removed as they are not comparative, due to the unique nature of DBS's reverse-mortgage product.

READ MORE:

- Is a wealth tax on property values justified?

- New DBS loan lets private property owners borrow against homes to fund retirement

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.