Digitalisation drives SMEs and start-ups to leverage new multi-currency corporate banking products

Multi-currency corporate cards such as YouBiz offer business owners an affordable, convenient and globally accessible expense management platform in an increasingly digital economy

In recent years, the adoption of digital channels has become necessary to survive in an increasingly contested business landscape.

With the onset of the pandemic, there has been an accelerated shift to broaden digital services. Research has shown that eight in 10 consumers in South-east Asia are now going digital, and there is a crucial need to adopt digital-first strategies to tackle the challenges of a fast-evolving economy.

Technology has become especially useful in addressing not only the pain points of customers but also the digital needs of their businesses. Through technology and innovation, companies can cut down and manage rising costs of more manual operations, redirecting resources to expansion and development plans.

Post-pandemic, companies find themselves dealing with the challenges of remote working. Many businesses are also setting up digital storefronts that cater to a worldwide audience as operations start to move online as well. Additionally, with travel opening up once more, global partnerships and expansion into overseas markets have become strategically important.

Hence, both small and medium-sized enterprises (SMEs) and start-ups are tapping technology to remain relevant in an increasingly competitive landscape and to secure better business opportunities. In South-east Asia alone, start-ups were able to raise over US$8.2 billion (S$11.3 billion) in capital in 2021, and are predicted to achieve a combined value of US$1 trillion by 2025.

To align themselves with the breakneck speed of digitalisation and internationalisation, start-ups and SMEs can leverage tech platforms and tools that add value and reduce costs for their businesses.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

One such trending tool is multi-currency cards, specifically cards for cross-border corporate expenses. Multi-currency cards and the corresponding expense management platforms offer myriad features such as competitive exchange rates, cashback and little to no fees.

Digitalisation of businesses made easy

Whether you are an SME owner or start-up entrepreneur, opening a multi-currency corporate account offers numerous benefits such as the issuing of corporate cards and easy expense management. Businesses also save on foreign exchange fees for currency transactions with these fintech platforms.

SMEs with any overseas supply chain or remote outsourcing of work are often at risk of foreign exchange volatility. With multi-currency corporate cards, businesses save on unnecessary FX fees on all card spend and free up their resources to grow their business regionally and globally.

Worrying about tedious processes and hidden costs as the founder of a start-up? You can expect a business banking tool that is free and easy to use, with free local transfers and transparent access to business credit.

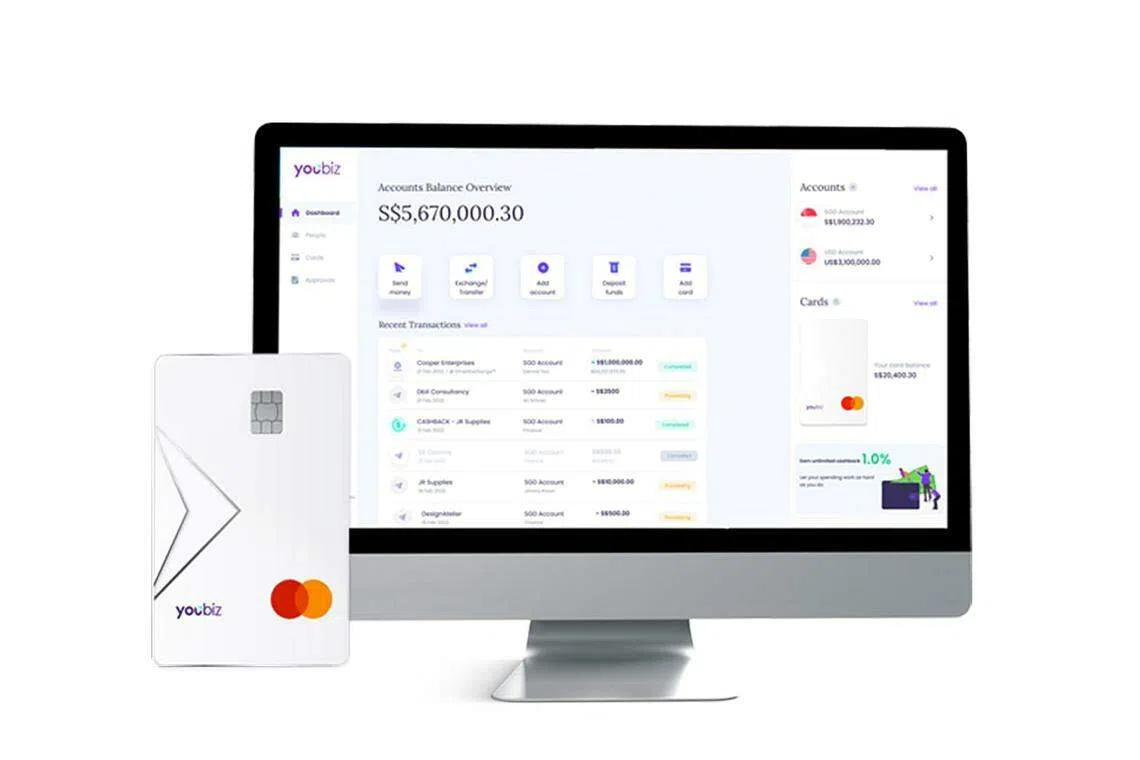

As a business owner, one specifically affordable and cost-saving tool to consider is YouBiz, an unlimited cashback corporate card with a multi-currency expense management platform. YouBiz is a B2B payments product from YouTrip, Singapore's first multi-currency mobile wallet with a prepaid Mastercard that allows users to pay in more than 150 currencies with no fees.

1. Banking made affordable

Enjoy zero annual and monthly fees, with no minimum transaction volumes or minimum balance required. Save with the card's unlimited 1 per cent cashback and zero FX fees on all card spend.

You can also cash in on free local transfers while overseas transfers are pegged to low, transparent fees and wholesale exchange rates.

2. Convenience - making business growth much easier

Beyond affordability, YouBiz can help simplify business management. Its real-time expense tracking allows SME owners and start-up entrepreneurs to easily keep tabs on cash flow.

On a single platform, business owners have a better overview of corporate expenses across various projects and departments with customisable spend limits and multi-user authorisations.

3. Get access anywhere, and everywhere

Lack of access to foreign currencies and cash flow can make managing overseas staff and offices difficult.

With YouBiz, users can create multiple currency accounts for free and lock in favourable rates across nine major currencies including the United States dollar and euro. Additionally, users can create multi-currency accounts in more than nine currencies for free.

More than just a payment card, businesses also have the flexibility to issue virtual and physical cards in each account for spending abroad in local currency without any hidden fees, says YouTrip's chief operating officer Kelvin Lam.

Every YouBiz account comes with perks from partners such as Google Ads and Booking.com to open more doors for your businesses.

A secure and trusted platform

With YouBiz, SME owners and start-up entrepreneurs have reason to sleep well at night. Safety features such as a one-click lock system to lock or deactivate YouBiz cards immediately in case of exigencies, and 3D Secure authentication protocol to protect all online transactions are included.

"YouTrip takes our customers' security and reliability needs very seriously. The security of all business and user data is of utmost priority to the company," says Mr Lam.

YouTrip has amassed accolades such as the Asean Start-up of The Year and Asean's Best Fintech Start-up at the Asean Rice Bowl Start-up Awards in 2019. With exponential growth and strong demand for its services, YouTrip received US$30 million in series A funding in 2021.

YouBiz has impressed users such as Mr Jia Hui Lu, founder of GETMARKED, an AI start-up that helps teachers automate the creation of online assignments. YouTrip offers "amazing exchange rates with no fees" and now YouBiz is his preferred expense management platform.

New features are in the works. According to Mr Lam, SMEs and start-ups will be able to remit the Malaysian ringgit, Indian rupee, Vietnam dong and New Taiwan dollar from mid-August. Businesses can also expect constant upgrades to the user experience via "integrations with leading software and improving key features including cashback transactions and user management".

Visit YouBiz to open an account and make the first move to get a business edge.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.