Reits, trusts improve governance, but some lapses draw regulator's ire

Best governance practices must keep pace as risks of trusts increase and they venture overseas

Singapore

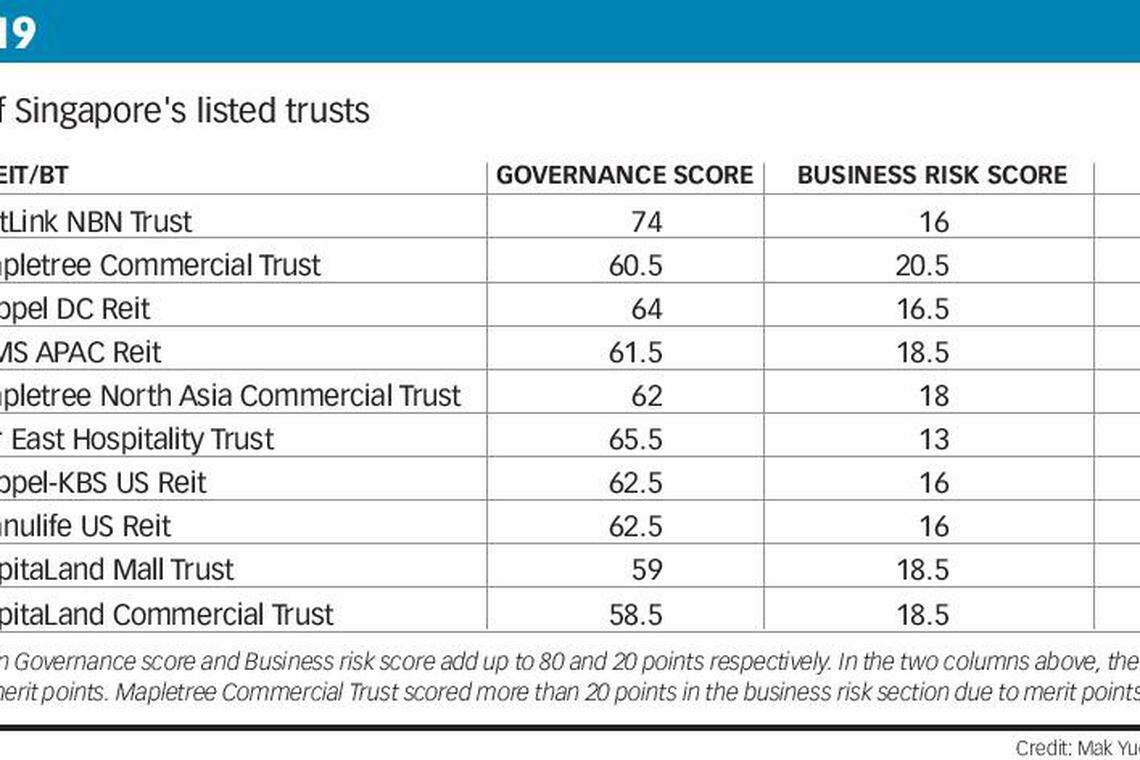

The annual Governance Index for Trusts (GIFT), out Thursday evening, showed that real estate investment trusts (Reits) and business trusts listed in Singapore have continued to improve their combined governance and business risk score since the first edition of GIFT in 2017.

NUS associate professor Mak Yuen Teen, co-author of the index, noted that the four new listings/entrants to GIFT fared well, with Netlink NBN Trust in particular debuting on the index at top spot. "Its overall score of 90 put it well ahead of all the other trusts."

"It has adopted most of the practices that we consider to be 'best practice' in the governance area, including allowing unitholders to endorse the directors of the trustee-manager before they get re-appointed at the AGM (annual general meeting) of the trustee-manager," he said.

The four new entrants were also responsible for much of the overall improvement in the combined score; excluding them, the score increased by just under one point. But there were also trusts listed for more than a year that improved their performance. GIFT's other author, Chew Yi Hong, said that Far East Hospitality Trust showed one of the greatest improvements, gaining 15 points compared to last year and jumping from 29th to joint sixth placing.

"It was able to do so through improvements in many areas, including appointing independent directors with relevant experience to replace non-executive directors who retired from the board - 83 per cent of independent directors on board, highest of all trusts. In addition, the trust was more prompt in releasing its financial results and posting minutes of its AGM - simple gestures that go a long way to improve engagement with unitholders," he said. Communication with unitholders was an area that all trusts continued to do well in, the report noted, with the greatest area of improvement in 2019 being in the posting of detailed meeting minutes on the trusts' websites, with 29 of the 46 trusts having done so.

But, there were also trusts that slipped and regressed in their performances. Without naming them, the GIFT report cites the example of a trust which stopped the practice of allowing unitholders to endorse the appointment of directors because the trust deemed that it had complied with the requirements for half of the board to be independent and that the endorsement was no longer required by the rules.

"This suggests a minimum compliance mindset," Prof Mak said.

Another trust, the report said, stopped disclosing the remuneration of each individual director, the CEO and top five executive officers on a named basis, whether in exact quantum or in bands of S$250,000, as well as the total remuneration paid to the top five key management personnel, because it felt it "will not be in the best interests" of the manager, the Reit or its unitholders. This contributed to the trust suffering one of the biggest falls in score of 11 points, compared to 2018.

Such instances drew a stern reaction from market regulator, Singapore Exchange (SGX), which supports this index.

"While the industry has grown leaps and bounds on stakeholder communications, slips in other areas have emerged, including remuneration disclosures and unitholders' right to vote on the appointment of directors," said SGX Regulation (SGX RegCo) CEO Tan Boon Gin.

"Such retrograde steps are unacceptable. Latitude given to listed issuers to progressively improve their corporate governance practices should not be exploited to regress to a less ideal state. This is particularly so in a sector that is relatively mature and which accounts for over 10 per cent of total market capitalisation of the Singapore stock market," Mr Tan added.

He also noted that, as the real estate industry gets more complex - in terms of the idiosyncrasies of sub-classes and the jurisdictions they operate in, and in aspects such as asset types, structures and requisite licences - it needs to do more to educate and inform investors of these risks.

"The industry can expect SGX RegCo to pay close attention to how the management of the trust, board of its manager and its auditors disclose the financials, explain risks and implement internal controls. In particular, the use of debt instruments such as perpetual securities will have to be clearly explained, and its impact on cashflow and bottom-line clearly illustrated," Mr Tan said.

This was a point also emphasised by Mr Chew, who said that, while he and Prof Mak are "delighted" with the improvements made by the trusts over the years, "investors still have to be selective and understand the risks of the trusts".

Prof Mak concluded: "This sector is well-regulated, and many of the trusts have good governance practices and have been improving over the years. Nevertheless, there is no room for complacency as confidence in the sector can be quickly eroded if momentum is not sustained. As the risks of trusts increase and they venture overseas, they must ensure that their governance practices keep pace. While mergers and consolidations are to be expected, the interests of unitholders must always be the key consideration."

READ MORE: Newcomers up the ante in governance index for trusts

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Banking & Finance

Money laundering accused Su Baolin to plead guilty after being handed 3 more charges

UBS flags 'serious' concern about new Swiss capital requirements

Lloyds bank says quarterly profits sink on higher costs

US seeks 36 months’ jail for Binance founder Zhao

Hong Kong bourse operator’s Q1 profit down 13% on weaker listings, trading

PBOC steps up rhetoric against long-end government bond rally