Singapore banks' loans growth outlook cut on property curbs, trade tensions

SINGAPORE'S banking sector will face greater headwinds over the coming quarters from the double whammy of the latest property cooling measures and rising trade tensions between the US and China, a research house said on Wednesday.

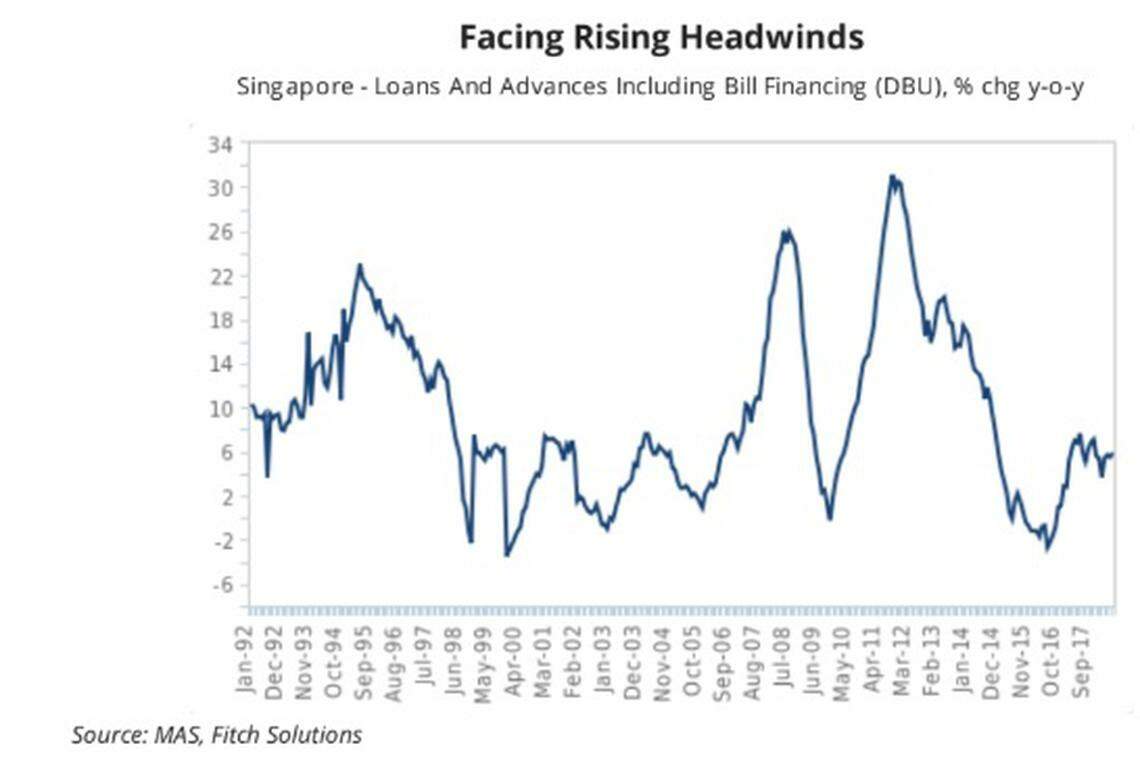

Turning cautious on the sector's outlook, Fitch Solutions Macro Research said it has lowered its 2018 and 2019 loan growth forecasts for Singapore banks to 5.0 per cent and 4.5 per cent respectively, from 6.4 per cent and 6.0 per cent previously.

Year-on-year (y-o-y) growth in Singapore dollar-denominated loans by domestic banking units hovered between 5.4 per cent and 5.9 per cent in the first six months of 2018, and "we expect it to come under pressure over the coming months", said Fitch Solutions, which combines Fitch Ratings credit insights with BMI Research expertise.

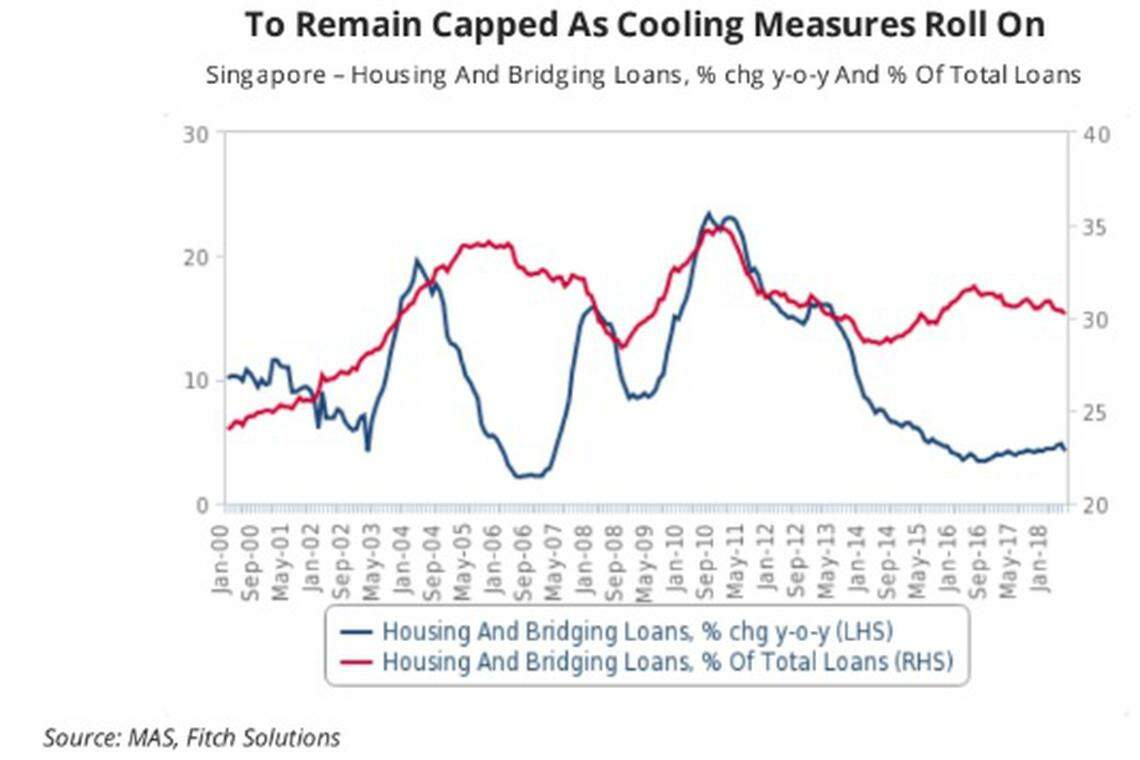

On property cooling measures, the firm said it expects the government's move to raise the additional buyer's stamp duty (ABSD) rates and loan-to-value (LTV) limits on residential property purchases, with effect from July 6, alongside rising interest rates, to dampen speculative investment appetite and consequently demand for housing loans.

With housing and bridging loans accounting for a significant 30 per cent of overall loans, and more than 75 per cent of all consumer loans, credit growth is likely to be capped by the cooling measures, said Fitch Solutions.

Mortgages and bridging loans expanded by around 4.5 per cent y-o-y for the first half of 2018, slightly higher than the average of 4.2 per cent growth in H2 2017.

Fitch Solutions noted that previous tightening of LTV ratios since 2010 has all negatively impacted mortgages. For example, after the LTV limits for buyers who already have at least one outstanding loan was cut in January 2013, the growth in housing and bridging loans headed downhill from 16.2 per cent that month, hitting bottom at 3.4 per cent in the July-September 2016 period, said the firm.

It added that of Big Three Singapore banks, UOB is likely to take the biggest hit from the latest property curbs given that it has the largest exposure to housing loans at 26.8 per cent of overall gross loans (as at Q2 2018). This is followed by OCBC at 26.1 per cent and DBS at 21.6 per cent.

On the ongoing US-China trade conflict, increased protectionism will likely weigh on Singapore's export-oriented manufacturing sector as business confidence wanes and firms adopt a cautious approach, said Fitch Solutions.

"Real growth in the manufacturing sector is already decelerating, slowing to 8.6 per cent y-o-y in Q2 2018 from 9.7 per cent y-o-y in Q1 2018," said the firm. "This has already weighed on loan demand by manufacturers, with growth in credit to manufacturers slowing substantially to 1.6 per cent y-o-y in June 2018, from a peak of 11.1 per cent y-o-y in September 2017."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Banking & Finance

Ping An profit falls as market declines hurt investment returns

BOJ will hike rates if trend inflation accelerates, says Ueda

Binance’s rivals muscle in on Bitcoin trading around the world

Citi picks Amit Dhawan to head Singapore commercial bank operations

China finance ministry echoes Xi’s call for bond trading at PBOC

Thai PM asks banks to lower interest rates to help economy