Singapore's financial sector to create 6,500 roles in 2021

SINGAPORE'S financial sector has plans to create 6,500 jobs this year, but the "large mismatch" between demand and supply of technology workers means the industry will continue to depend on foreign tech talent over the next few years, said Ravi Menon, managing director of the Republic's central bank.

"There are simply not enough Singaporeans applying for tech roles. The problem is not jobs, it is skills," said Mr Menon, who on Tuesday delivered a webinar on the employment outlook for the sector in 2021.

Singapore's financial sector has shown that technology creates far more jobs than it displaces, he added, noting that the Monetary Authority of Singapore (MAS) expects between 2,500 and 3,500 new tech roles to be created for the sector annually, over the medium term.

But many of the tech skills required to do the jobs are in short supply locally, he stressed.

That said, there is strong demand for non-tech roles among the 6,500 new jobs to be added to the sector this year, with close to 4,800 hiring opportunities in functions such as relationship management, product sales, compliance and risk management. Relationship managers account for over a quarter, or 1,300, of the hiring opportunities in non-tech roles.

The demand for financial planners and relationship managers is likely to be sustained, Mr Menon said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"Singaporeans are becoming increasingly conscious of the need for proper financial planning such as ensuring against health risks and saving and investing for retirement," he said.

About 6,000 of the newly-created positions this year are permanent jobs, and about half of these roles are in technology and consumer banking. Mr Menon also highlighted that 44 per cent of the 6,500 roles are open to mid-careerists with adjacent or no experience.

These numbers were obtained from a survey late last year by the MAS and the Institute of Banking and Finance, where some 800 financial institutions shared their hiring projections from January to December 2021.

Turning back to the dearth of local tech talent, Mr Menon noted that while the technology workforce in the financial sector has expanded by 30 per cent since 2014, currently standing at about 25,000, Singaporeans make up just over one-third of this number.

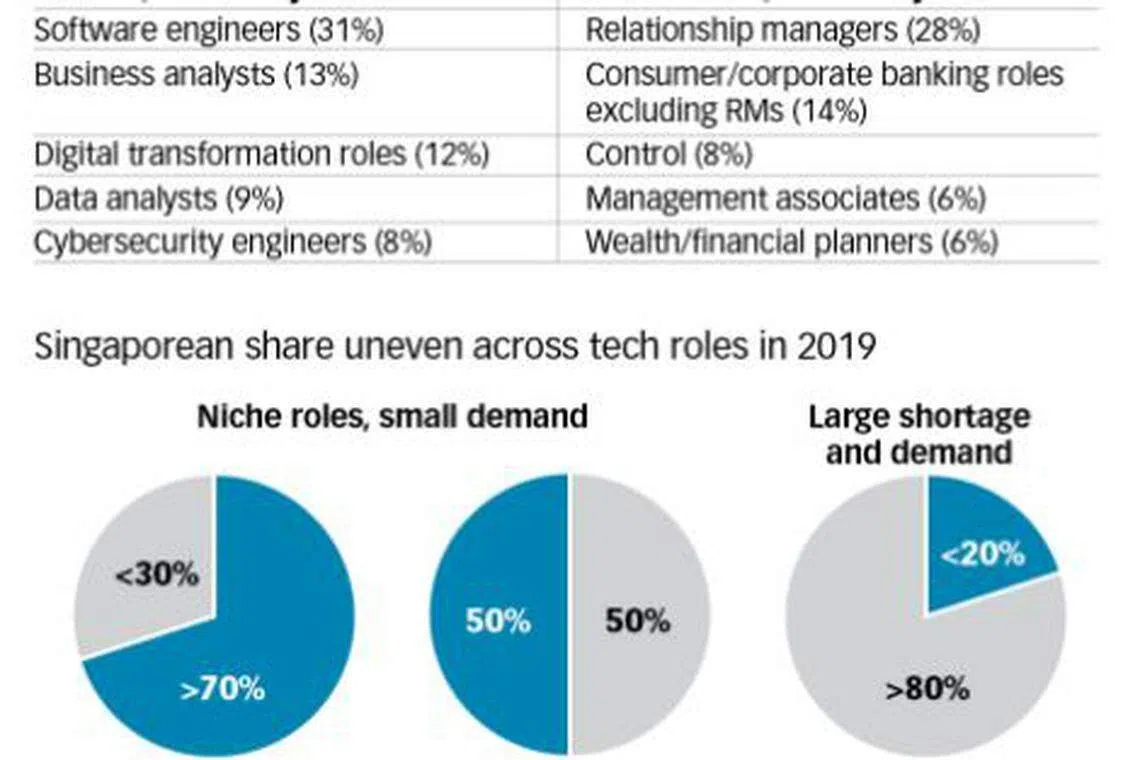

The proportion of Singaporeans taking on technology jobs is uneven across different roles, he said.

While Singaporeans account for a majority of "niche" tech roles where hiring numbers are relatively small, they tend not to fill roles with the strongest demand, such as in software engineering.

For instance, Singaporeans account for 70 per cent of the net job growth for cybersecurity engineers and UX/UI (user experience and user interface) designers, and about half of the net job growth for data scientists and data analysts.

But when it comes to software engineering, which saw more than 10 times net job growth than for UX/UI designers in 2019, less than 20 per cent of the jobs went to Singaporeans.

Mr Menon said: "These jobs require strong programming skills and in-depth business domain and system knowledge. There are not enough Singaporeans applying for these jobs in the first place, let alone qualifying for them."

Software engineers make up about 30 per cent of the 1,700 newly-created tech roles for the sector in 2021. Business analysts and jobs in digital transformation account for another 25 per cent.

While the financial sector's demand for tech talent will persist, competition will also strengthen as most sectors across the economy embark on digitalisation, Mr Menon pointed out.

The Infocomm Media Development Authority (IMDA) estimates that 19,000 tech jobs across the economy remain unfilled each year.

The pipeline of technology graduates is not enough to meet this demand, Mr Menon said.

He noted that undergraduate enrolment for information and communications technology specialisations across the six autonomous universities stood at just 2,800 last year, while graduates from polytechnics and the Institutes of Technical Education accounted for another 4,500 each year.

And while technology jobs can also be well filled by engineering and science graduates, most of them move on to non-tech jobs, he said.

This large mismatch between demand and supply of technology workers means Singapore will have to continue to depend on foreigners to fill the growing vacancies over the next few years.

"If we tightened this inflow excessively, it will impair not just the competitiveness of our financial centre, but dampen the prospects for creating good jobs in the future, especially for Singaporeans," he said.

There needs to be a collective effort in building a strong local tech talent pipeline, Mr Menon added.

He cited how financial institutions have been collaborating with local varsity institutions to prepare students for technology jobs.

For instance, JPMorgan's Singapore one-year apprenticeship programme takes on 30 polytechnic graduates to train them in operations and technology functions, while DBS has a skills development programme for individuals with Stem backgrounds to take on roles in areas like product development, platform infrastructure or information security.

The government plays its role, he added, by facilitating capability transfer from foreigners to the local workforce when global financial institutions set up new technology functions in Singapore.

The MAS also works with financial institutions to help individuals outside the financial sector transit into tech roles within the sector, he said, citing the Technology in Finance Immersion Programme which has seen its number of trainees more than double to 190, up from 70 in 2019.

About 400 traineeships across more than 20 financial institutions will be offered this year under the programme.

Since 2016, more than 500 professionals have been trained and placed into tech roles in the financial sector via the IMDA's TechSkills Accelerator initiative.

The financial sector is on track to create many jobs in technology for the next few years, said Mr Menon.

"They present a great opportunity for Singaporeans, provided we acquire the skills necessary to take on these jobs.

"The answer does not lie in restricting the inflow of foreign tech expertise. On the contrary, it is by attracting the best tech talents from around the world that we can anchor new tech capabilities and functions that expand job opportunities for Singaporeans," he said.

READ MORE: How are banks building tech talent in Singapore?

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.