Temasek upsizes bond offer to S$500m; extra S$100m goes to retail investors

IN view of the "strong demand" for its first retail bonds, Temasek Holdings has upsized its S$400 million bond offer by S$100 million, with the extra allocation all going to the public tranche.

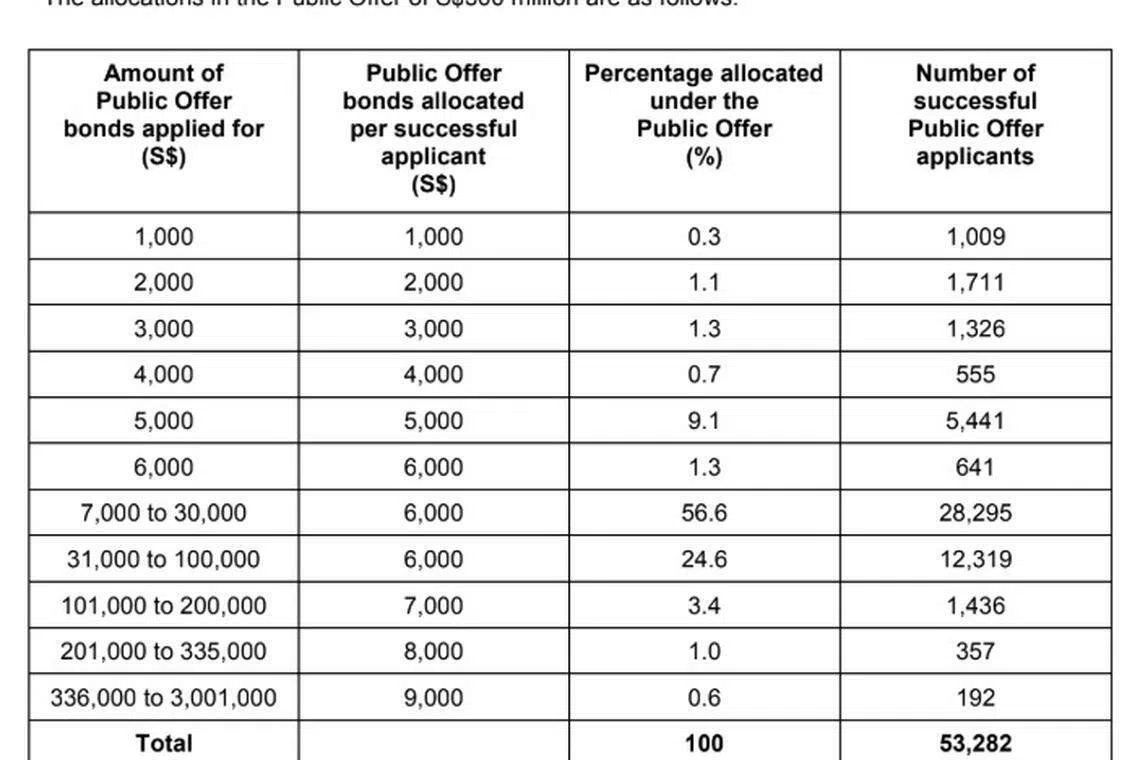

The exercise of the upsize option was done to enable all 53,282 valid retail applications to receive some allocation, said the Singapore investment company in a media release on Wednesday.

Those who applied for S$6,000 and below received the full amount, while those who applied for S$7,000 to S$100,000 were allocated S$6,000 each.

About 70 per cent of bonds in the public offer went to applicants who applied for S$30,000 or less, said Temasek.

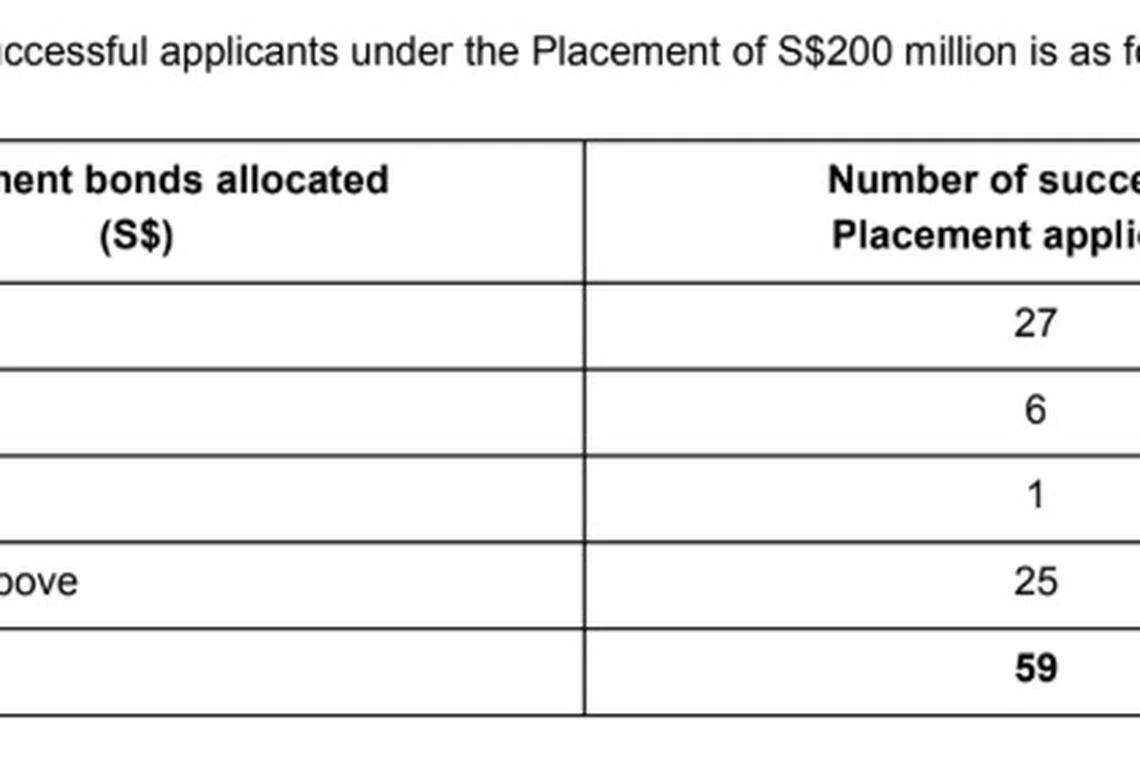

Total bids from from institutional, accredited and other specified investors for Temasek's T2023-S$ Temasek Bond placement of 2.70 per cent guaranteed notes due 2023 were about S$1.438 billion, Temasek said.

Leong Wai Leng, Temasek's chief financial officer, said: "We would like to thank all the applicants for their support for our T2023-S$ Temasek Bond. We appreciate the confidence they have all shown in us. The demand for both the public offer and the placement was robust, amounting in aggregate to about S$3 billion.

"In particular, we very much welcome members of the public who applied under our inaugural public offer. We are pleased to provide Singapore retail investors an opportunity to invest in a Temasek Bond. We very much welcome our first retail investors as a new set of stakeholders for Temasek."

The S$1.68 billion in valid applications received under the public offer tranche means the final public offer size of S$300 million was about five times subscribed, or just over eight times the initial public offer size of S$200 million.

The T2023-S$ Temasek Bond will be issued on Thursday and begin trading on the Singapore Exchange's mainboard on Friday at 9am. Retail investors can check their allocations by logging into their CDP (Central Depository) accounts from Thursday.

Invalid applications, or applicants who did not receive the full allocation for which they applied, will have their application amounts or the balance refunded without interest, and credited to their DBS, POSB, OCBC or UOB bank accounts within 24 hours after the balloting of the public offer bonds.

Copyright SPH Media. All rights reserved.