The future of digitalisation for businesses

DBS has accelerated its multi-year digital roadmap to support clients as they adapt their businesses during challenging times

Covid-19 has transformed the way businesses transact with banks around the world, accelerating digitalisation at a pace never seen before. The positive side is that we have had more opportunities to interact with our corporate customers and support them in their digital transformation journeys even as physical boundaries closed in on us.

The way business is done has changed dramatically over the past decade. Smart-phones have changed the nature of banking. With the rise of the networked economy, anyone can sit in the office or at home and become part of a global procurement and distribution system. But technology is only an enabler and will only be valuable if it can be effectively applied to help achieve organisational goals. This is where the importance of a technology partner that understands the business comes in - someone with the knowledge and experience to help businesses become more resilient while fostering enhanced transparency and efficiencies in the supply-chain ecosystems they operate in.

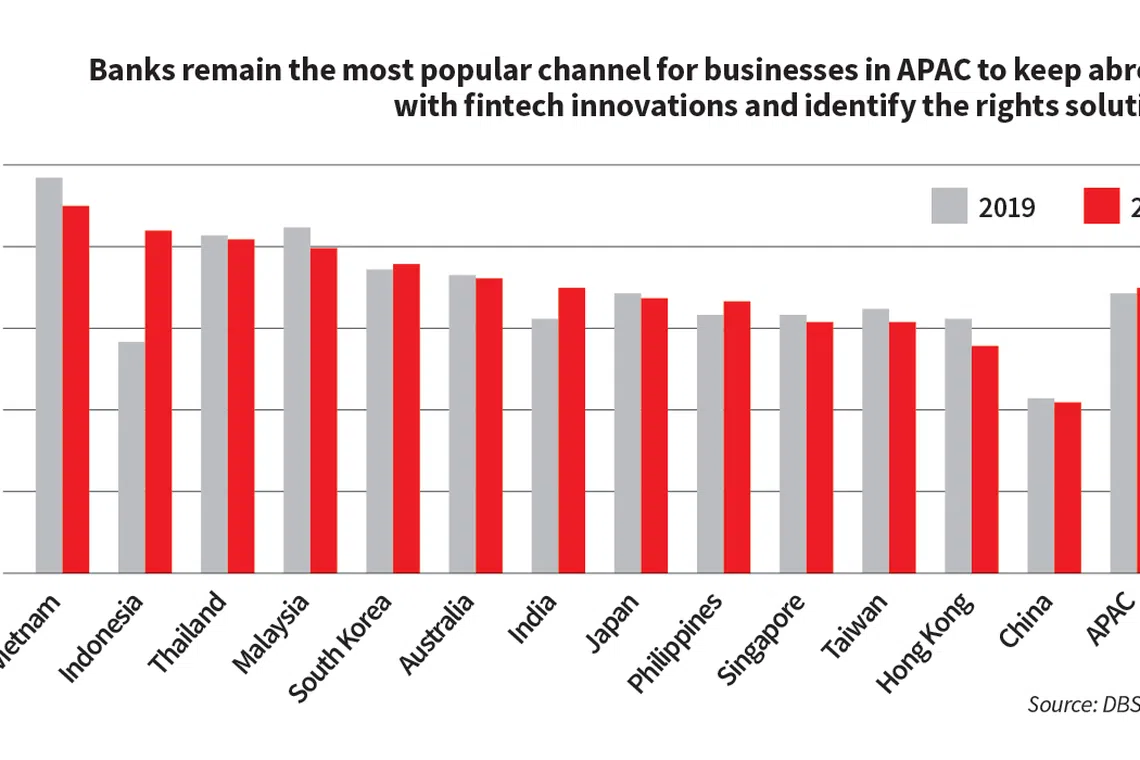

According to DBS' Digital Treasurer Survey, seven in 10 businesses in the Asia-Pacific cite banks as their preferred partner for businesses to keep abreast of fintech innovations and identify the right solutions.

At DBS, our digital transformation over the past decade has put us in a position to add value and deliver on services our customers need. Leveraging on DBS' digital leadership and strong Asian connectivity, the bank has accelerated its multi-year digital roadmap in just a few months to provide even greater support to our corporate clients to ensure they build back better from these challenging times. We continually upskill our employees and digital infrastructure to ensure that we are able to pre-empt what businesses need and deliver on any last-mile gaps to provide a seamless end-to-end journey for our customers.

To provide greater support for corporates, with lockdowns in most markets, we fast forwarded our development of remote loan and account acceptance processes for digital loans application and account opening, and made it completely contact-free. We also focused on developing solutions for small and medium enterprises (SMEs), many of which have been affected by the pandemic.

According to a DBS survey in October, around seven in 10 SMEs polled from industry sectors most acutely affected by Covid-19 - retail, food and beverage (F&B), building and construction - cited working capital as top priority to tide them through the downturn. This represents a 35-percentage-point rise from 30 per cent when the same question was asked at end-May as Singapore was emerging from the extended Circuit Breaker.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

DBS rolled out a range of digital solutions tailored to the needs of SMEs across different sectors and geographies throughout the year. Some examples include:

March 2020 DBS F&B Digital Relief Package introduced: F&B set-ups can go digital and create new income streams online within three days. Digital solutions for e-invoicing, accounting, HR and payroll follow, re-branded as DBS Resilience Package for F&B.

May 2020 Singapore's first cashless purchasing card for logistics sector.

July 2020 Partnering business cloud software global leader Infor to integrate digital trade financing capabilities into Infor Nexus global network. First joint programme goes live in October with major global apparel company, providing faster and more cost-efficient digital trade financing to its suppliers, which are mostly SMEs.

September 2020 First Asian bank partner on AntChain's new blockchain trade platform, Trusple, giving SMEs access to digital finance and trade services.

October 2020 First bank to launch real-time online tracking of cross-border collections in Asia, giving more than 240,000 corporates and SMEs in Singapore and Hong Kong real-time visibility to incoming cash flows.

November 2020 DBS IDEAL: New version of DBS' corporate banking platform lets customers open new accounts online with hassle-free integration into their accounting tools and ERP systems. Customised dashboard gives market insights, product recommendations and preferential forex rates and alerts.

December 2020 Enhanced DBS MAX provides one-stop shop for all merchant-banking needs, such as payments collection via credit cards, PayNow and DBS PayLah! Merchants can track collections to better understand collection patterns. Enables real-time refunds with greater convenience and security.

Creating digital solutions of relevance

More importantly, this holistic suite of digital solutions DBS developed has proven to be highly relevant to businesses, resulting in strong pick-ups in volumes across various services. For instance, DBS MAX's seamless and instant payment collection solution for merchants across Singapore, Hong Kong and India, saw rapid adoption with more than 10,000 merchants generating almost half a million transactions for the first ten months of the year.

Into the next decade

In terms of trending technologies in the new normal, the use of APIs and enterprise cloud solutions in bank connectivity is expected to continue gaining traction among businesses large and small across the region. APIs remain the most popular mode for bank connectivity with almost half of businesses in the Asia-Pacific adopting it in their current operations as compared with cloud-based solutions. But a big shift to cloud is expected in the next three years as it has proved to be a useful tool for businesses to migrate data seamlessly during the pandemic months with six in 10 businesses in the region looking to implement cloud-based solutions in the next three years, according to a DBS survey.

The advent of artificial intelligence (AI) and data analytics, combined with a sharp fall in data storage costs, has also given companies that adopt new technologies a massive competitive advantage and will continue to be a strategic focus for all businesses, regardless of industry or geography.

It is, therefore, important that businesses stay up to date and be open to embrace tomorrow's innovations as digital solutions have proved essential to banking and business continuity during this crisis - and will continue to play an integral role in driving the recovery of businesses, industries and economies into the next decade.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services