Have multi-currency account, will travel?: How far will new multi-currency players go in the payments game?

JUST a little over three years ago, a six-month university exchange programme to Switzerland had me stashing 7,000 francs (S$9,951.74) in my carry-on, all in a bid to dodge hefty currency conversion card fees abroad. It didn't help that the banknotes were denominated in hundreds - my first few weeks in the Swiss town of Lugano were met with countless rejections by shopkeepers who did not have change.

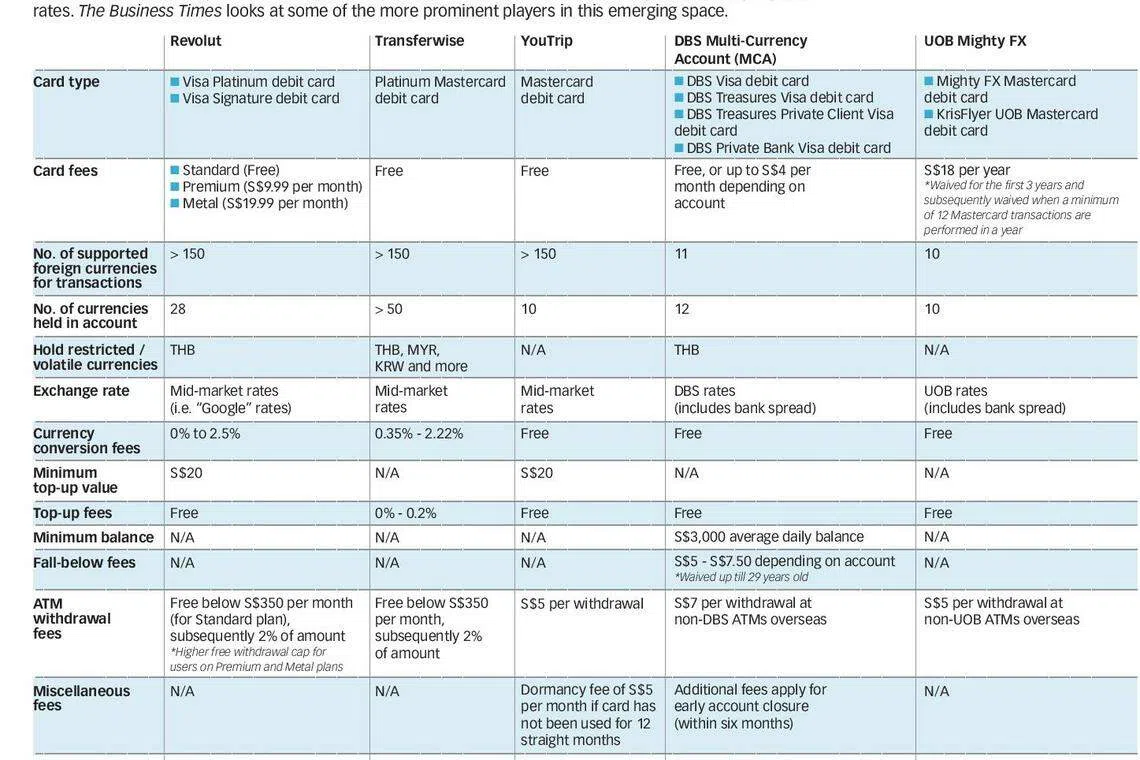

By late 2019, overseas card payment became a much more viable option for travellers, thanks to the rise of multi-currency e-wallets by tech players seeking to disrupt the opaque FX payments scene. In Singapore, local startup YouTrip was among the first to roll out its wallet in August 2018, followed by UK-based payments unicorn Transferwise last October and its high-profile peer, Revolut, two weeks later.

For the uninitiated, a multi-currency e-wallet allows users to hold and convert currencies at the mid-market "Google" exchange rate on a mobile app for much lower fees vis-a-vis conventional credit cards.

How much cheaper exactly? The average credit card transaction fee is around 4 per cent of the converted amount. The new e-wallet players have pushed base fees down to as low as zero.

A multi-currency wallet typically comes with a pre-paid debit card for users to pay for goods and services overseas, or shop on international online stores. Other common features include free overseas ATM withdrawals (capped at a fixed amount per month) and low-cost remittance services.

These cheaper alternatives to traditional credit cards clearly bode well for travellers in an increasingly cashless society.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

On a trip to Japan last November, I was carrying just a little over 15,000 yen (S$190). I swiped my Transferwise multi-currency card in most stores, paying fees which Transferwise claims is at least six times cheaper than market average.

If I needed small change to pay for street food, withdrawals were free (capped at S$350 monthly) at any local ATM that supported Mastercard.

My transactions were also reflected in real-time on the Transferwise app, which spared me the rude shock that takes the form of monthly credit card statements.

Natural evolution

The aggressive emergence of multi-currency offerings in Singapore shows no signs of slowing, say market observers, amid an era of rampant digitalisation - fees driven to the bottom - where transparency is valued.

A report by Google, Temasek and Bain & Co last year said e-wallets are expected to balloon from US$22 billion to US$114 billion in 2025 in South-east Asia.

Digital remittance startup Instarem and payments service provider Wirecard are expected to launch their own multi-currency wallets in Singapore later this year; ride-hailing giant Grab's latest GrabPay card includes a currency conversion feature. "This is a natural evolution of the payments landscape transformation, which started with digitising domestic payments and local peer-to-peer transfers," Chia Tek Yew, head of financial services advisory at KPMG, tells The Business Times (BT). Advocating low fees - and along with it, a more transparent, real-time fee breakdown - has been the trump card for new players in the multi-currency battle.

"Customers are becoming increasingly aware of these newer options that are simpler, faster, transparent, and at a lower cost compared to traditional means," says Shirish Jain, payments director at PwC's strategy consulting arm.

In Singapore - where local residents are frequent travellers or shoppers on international e-commerce platforms - multi-currency wallets allow for "certainty of rates", that is, you know exactly how much you will be charged, KPMG's Mr Chia adds.

The numbers speak for themselves. Revolut has amassed over 50,000 users in Singapore since late October. Transferwise moves S$1.7 billion in and out of Singapore annually. YouTrip said it has seen more than half-a-million app downloads, and processed over 10 million transactions since its launch.

The growing uptake of multi-currency products also comes as banks continue to hike foreign transaction charges on their credit cards.

Most recently, DBS and OCBC raised fees from 3 to 3.25 per cent late last year. A study by Capital Economics found that Singaporeans lose S$1.1 billion annually to fees associated with overseas expenditure via cards and cash, as well as online purchases denominated in foreign currencies.

How fees work

Swiping your credit card overseas typically incurs two charges: a currency conversion fee and a service administrative fee.

The currency conversion fee is imposed by the respective card association (think Visa, Mastercard and American Express) at about 1 per cent of the converted amount. The card-issuing bank then levies its own administrative fee which, in Singapore, ranges from 2 to 3.5 per cent. Taken together, the market fee averages around 4 per cent of the converted amount, which can go up to as high as 8 per cent in some cases. Transferwise's fees range from 0.35 to 2.2 per cent, while YouTrip and Revolut advertise zero fees.

Card transaction fees aside, users are also subject to surcharges on ATM cash withdrawals overseas in the range of S$5 to S$7 per withdrawal, though fees may be lower or waived in some instances. Both Revolut and Transferwise offer free withdrawals capped at S$350 monthly, and impose a 2 per cent charge thereafter.

Too good to be true?

While the new wave of multi-currency offerings are undoubtedly easier on the wallet than general credit cards, customers should still be cautious of extra fees that may not be advertised.

As an example, while Revolut says it only charges a 0.5 per cent fee for anything above S$9,000 every month (for users on the free membership), it is worth noting that an additional 0.5 to 1 per cent mark-up is levied on weekends regardless. Users also have to pay at least a 1 per cent markup for Thai baht and Ukrainian hryvnia currency conversions on weekdays; this fee rises to 2 per cent on weekends.

Topping up your e-wallet balance may also come at a cost - Transferwise charges up to 0.2 per cent in fees to add money. But even with the extra fees, Transferwise remains cheaper than the average bank credit card. A quick calculation at 3pm on Feb 5 shows that spending 100,000 yen on the Transferwise card is equivalent to spending S$1,267, inclusive of top-up and FX fees. With an average bank credit card, users pay around S$1,300 for the same amount of yen.

On the risk side, an industry observer tells BT that customers have to read the fine print and "be aware of how the company makes money".

"Some fintechs might be tempted to use advertising or sell customer data to subsidise their business," says Jan Ondrus, associate professor at ESSEC Business School.

To add, both Transferwise and Revolut allow customers to hold some restricted and volatile currencies, such as the Malaysian ringgit and Thai baht, in their e-wallets.

In this case, all risks will be borne by the firms, as constraints enforced on restricted currencies often make it challenging for international companies to hedge against currency risk.

"The exchange rate can affect the profitability of the business operations," says Dewi Rengganis, industry analyst at consultancy Frost & Sullivan.

More than just a price war

For some consumers, convenience still trumps cost savings to a certain extent.

The need to register for yet another card - and constantly top up money - may be cumbersome for some, says Varun Mittal, EY global emerging markets fintech leader.

"That means one more account to look after, and that's the trade-off. You need one more card, one more app, just to save some money that may not be worth all the effort," Mr Mittal adds.

Banks also tend to offer more attractive credit card rewards on international payments, such as cashback or miles, which may be more valuable to some consumers.

"Customers who don't really have that many miles to collect will be more inclined to take up the multi-currency cards," says Mr Mittal.

Mohit Mehrotra, strategy consulting leader at Deloitte, says that trust-led plays will "clearly" drive trade-offs between value of time (convenience) against money (total cost of transaction), which leads to different outcomes across the various consumer segments.

"The proposition of many banks have hinged on liability-led client relationships and continuous improvements in their client experience narrative," he adds.

ESSEC's Prof Ondrus notes that new players will need to "work hard" to gain the same level of trust that the big banks enjoy today: "Nobody wants to lose their money when using basic financial services."

That being said, multi-currency payment services arguably carry less risk than, say, long-term deposits or unsecured lending.

"You're just topping up your e-wallet and spending from it. You're not putting in your entire savings in that one company. These products are backed by either Visa or Mastercard so there's some level of trust there too," says Mr Mittal.

Will the banks sit up?

The incumbents, too, have made their move in the multi-currency payments space - some even earlier than the fintechs.

Notably, DBS launched its Multi-Currency Account (MCA) in late 2017, while UOB rolled out its Mighty FX wallet in January 2018.

While both products do not charge FX fees, the bank exchange rates offered may be slightly higher (around 1 per cent more) than the mid-market "Google" rates the fintechs commonly use.

The number of foreign currencies supported is also fairly limited. As an example, DBS MCA offers 11 spending currencies. Transferwise, Revolut and YouTrip allow payments in over 100 currencies around the world.

For cash withdrawals overseas, a service charge of S$7 and S$5 applies to the DBS MCA and UOB Mighty FX respectively.

Amid rising competition from its digital-only peers, how much further will banks go to develop their multi-currency products?

The incumbents hold a wealth of consumer financial data. Capital is hardly an issue. They could ramp up their cards if they wanted to.

But they probably won't. Analysts tell BT it is unlikely banks will compete at the same intensity as the fintechs in the near future, given the low-margin, price-competitive nature of the retail payments business.

"It is not a secret that retail banking is a costly business," says ESSEC's Prof Ondrus.

KPMG's Mr Chia adds: "In most cases, FX revenues of banks come from their larger corporate treasury clients rather than the retail travellers or migrant workers communities."

A slow and winding road to profitability

The long-term fate of multi-currency fintechs remains clouded by thin margins in the retail payment business. While these firms have been successful in growing their customer base, most have yet to enjoy a positive bottom line.

Consequently, the larger the customer base, the greater the losses.

Data from fintech consultancy Fincog in 2019 shows that Revolut's net loss per customer is estimated at around 5.76 per cent.

Among the big names in this space, only Transferwise has turned a profit. This is because the firm's main profit stream comes from its international digital remittance arm, which has been its core business since 2011.

Clearly, standalone payment services are not enough to churn out sustainable returns, especially if the products are mostly offered for free.

"Many of the UK challengers, for instance, have largely relied on interchange fees on card payments, but this now seems to be an insufficient source of income on its own," said Fincog in a report last October.

KPMG's Mr Chia says that multi-currency players have to be "global and present in major remittance corridors with critical mass in key currencies" to sustain the business.

Achieving scale of operations and breadth of products are key steps in the journey to profitability, he notes. While they may have started as digital wallets or digital remittance providers, these firms will have to extend their offerings to benefit from cross-sell opportunities and achieve much higher revenue per customer.

On the right track

As things stand, the fintechs appear to be on the right track. In an interview with BT last October, a Transferwise spokesman said the firm has been actively improving on its multi-currency debit card for corporates, and will expand into more Asian markets this year.

"We have more individual consumers now, but if you look at transaction volumes, they will come increasingly from businesses," says Venkatesh Saha, Transferwise head of Asia-Pacific and Middle East Expansion.

Revolut, which operates as a challenger bank in the UK, has expanded its services to include cryptocurrency trading and a savings account that offers 1.35 per cent interest.

Meanwhile, Singapore's YouTrip made its foray into Thailand last November, as part of ongoing expansion plans in the region.

All things considered, EY's Mr Mittal reckons it's still too early to foretell long-term success, given the complex nature of product and service diversification. "Payments is the lowest-hanging fruit. Then it gets tricky, if the fintechs start to offer more products," said Mr Mittal.

Copyright SPH Media. All rights reserved.