New ways to make money: The alternative alternative assets

From cryptocurrency to crowdsourced loans to a celebrity index, technology has enabled a whole new universe of investing

WHEN one thinks about investments, stocks, bonds and cash come to mind. For the more sophisticated, derivatives and private markets are also fertile hunting grounds. Some individuals have also milked returns from the most esoteric and uncommon of assets, such as fine wine, sneakers and Lego.

But with technology taking over everything, a new breed of investments has begun to emerge. They range from cryptocurrency to mobile apps to unique digital collectibles to even celebrities.

This is the weird, wonderful world of new alternative assets made possible by the Internet.

Platforms like Flippa and Empire Flipper, for instance, came to prominence because of the boom in online businesses. These marketplaces allow people to buy and sell businesses, mobile apps and domain names with just a few clicks.

In a typical scenario, an investor buys a website, improves on its monetisation methods, then flips it about a year later. Facebook founder Mark Zuckerberg's FaceMash.com was sold for US$30,201 shortly after the release of the film The Social Network in 2010, while viral website ShipYourEnemiesGlitter.com, which offers to send anyone in the world envelopes packed with glitter, was sold for US$85,000 in 2015.

In South-east Asia, the gaps in financing for small and mid-sized businesses have led to the rise of startups that use the reach of the Internet to crowdsource loans. Called peer-to-peer lending, the concept lets people easily invest small amounts of money in loans to companies that list their details and financials on an online platform.

Singapore-based Funding Societies, for instance, lets people invest as little as S$20 in loans with tenors of up to 12 months. The weighted average investment returns in 2019 was 9.82 per cent, its website showed.

Elsewhere, alternative investments have taken on a more creative, albeit questionable, form. A platform called Celebrity Index, operated by a Nigerian entity, allows users to buy virtual "shares" in celebrities and claims to pay dividends based on scores generated by a media-ranking algorithm of celebrity news.

With digital marketplaces on the rise, listings of stakes in businesses have even popped up on Singapore-headquartered classifieds platform Carousell. As at Oct 21, such listings included an up to 15 per cent stake in "a reputable bubble tea business" and takeovers for a fried Hokkien prawn mee stall and an online toy rental business.

All this is possible because of increased Internet connectivity and the rise of cloud computing and artificial intelligence. Asset classes once inaccessible to retail investors, most accredited investors and smaller institutions, are now opening up so that more parties can have a taste of high returns and diversification options.

New alternative investments seem like an irreversible trend, but they are not without its risks. A lack of regulation and poor understanding of investments are some issues that often emerge. So which ones are simply passing fads, and which ones are here to stay?

New assets and alternative platforms

Web-based alternative assets can be understood in two ways, says Adrian Ang, partner and co-head of the fintech and public policy practices at law firm Allen & Gledhill.

A person could be purchasing or selling a fairly conventional asset through less conventional means. In this case, they can be understood as using alternative platforms, some of which open up access to assets previously reserved for institutions or the ultra-wealthy.

On the other hand, a person could be purchasing or selling an asset that is unconventional to begin with. This can be referred to as a recently created alternative asset.

"Generally speaking, the emergence of alternative platforms and alternative assets (in themselves), is a positive thing. Alternative platforms typically make it easier for users to obtain what is a desired outcome. For example, a creditor will potentially have greater choice in how to raise financing for its business needs," Mr Ang says.

"The existence of alternative assets similarly provides a consumer with a greater choice of goods and services. Instead of investing in conventional art (represented in physical form), the consumer has the option of purchasing art in 'digital' form."

A major trend in the digital assets space is tokenisation, which Deloitte believes could fundamentally change the way people invest in assets. It creates greater access to both conventional and unconventional assets.

Tokenisation refers to the issuance of a blockchain security token that represents a real tradeable asset, from fine art to buildings to even livestock.

Key advantages of this process include greater liquidity when tokens are traded on a secondary market, faster and cheaper transactions due to automation, and more transparency due to immutable records.

In a November 2018 article, Deloitte notes that tokens are highly divisible, allowing investors to buy tokens representing incredibly small percentages of the underlying assets. Lower minimum investment amounts mean that a much wider audience can now participate.

xbullion, a digital gold token, was launched on digital assets exchange Zipmex in September. Chief executive officer David Lightfoot tells The Business Times that a fair amount of organic trading is coming from Thailand and Indonesia, where gold purchases in small denominations are quite frequent.

The tokens can be fractionalised up to eight decimal places. Each token represents direct ownership of 1 gram of investment-grade gold bullion supplied by Baird & Co and StoneX, and held at vaults in London, Singapore and Sydney.

"Given the uncertainty in global markets and supply chains, our access to institutional solutions for gold management not only solves the trade off between the security of physical gold and the liquidity of paper derivatives, but solves the struggles of physical gold ownership in a turbulent post-Covid world," Mr Lightfoot says.

Meanwhile, the tokenisation of funds has been gaining more popularity for addressing the issue of liquidity. For instance, investment manager Wave Financial Group is partnering with Singapore-based digital securities firm InvestaX for its whisky fund.

The fund has a total capacity for 20,000 barrels of Kentucky bourbon from Wilderness Trail Distillery worth US$20 million. After a year, the fund will be tokenised, and aims to be tradeable on select exchanges.

While traditional whisky asset transfers require bonded notes and extensive legal contracts, token trading settles almost instantaneously, Benjamin Tsai, president and managing partner at Wave, says.

"The purchase or sale of shares representing whisky barrels can be done in partial quantities, rather than requiring the transfer of whole barrels. Without the token, investors would be locked up until all barrels are sold, after significant ageing has occurred."

Starting as early as year three, Wave Financial plans to liquidate some barrels through brokers and other channels to cover expenses and service demand, with the goal of all barrels being sold after around six years.

But what about assets that are unique - where, unlike gold or whisky, one piece can't simply be traded for another?

Therein lies the appeal of non-fungible tokens (NFTs), which contains an unalterable record of what makes that particular asset special. NFTs have been used to represent ownership of digital art, collectible game cards, sneakers and even virtual pets. In October, a collection of NFT-based Batman artwork was auctioned for a record US$200,000 on marketplace MakersPlace.

While tokenisation is becoming more widespread, challenges remain. A huge issue revolves around regulation.

Security regulations are typically technology-agnostic, meaning that security tokens, depending on their features, can fall under regulations that vary significantly across jurisdictions, the Deloitte article highlights.

"International regulatory alignment is an unlikely milestone in the near future, but adding clarity to the regulatory environment for security tokens and facilitating compliant involvement in the token economy is a possible and necessary path forward if the opportunities are to be realised," it says.

Regulations specific to tokens are also lacking, while concerns that relate to cybersecurity and governance remain.

That said, there are signs that regulators are adapting to the rise of tokenisation. The Monetary Authority of Singapore (MAS), for instance, issued guidance on the offers of digital tokens in Singapore. Offers or issues of digital tokens may be regulated by MAS if they are capital market products under the Securities and Futures Act.

This year, the central bank also began requiring businesses providing a digital payment token service to be licensed.

And in a mark of the technology becoming more mainstream, Singapore's largest lender DBS is now working on a digital currency exchange, BT reported on Wednesday. If approved, it could be one of the world's first crypto exchanges backed by a traditional bank.

A better alternative?

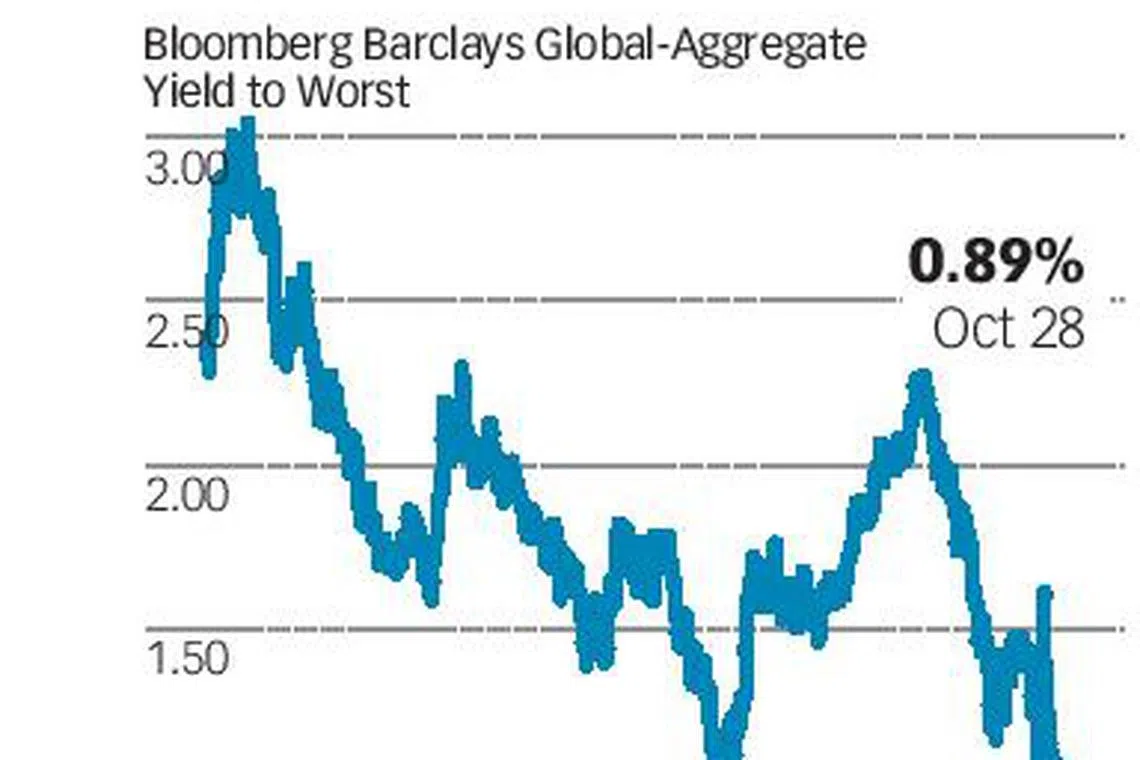

Tightening bond yields (see chart above) have forced investors to look further afield in the search of higher returns or means to better diversify their portfolio. Fortunately for them, new technologies have made linking investors to alternative assets much easier.

Singapore-based Incomlend was founded as banks retreated from most trade finance deals following the implementation of Basel I and II banking regulations. With small and medium enterprises facing a widened financing gap, Incomlend built an online invoice trading platform to connect funds and family offices to suppliers looking to finance their export invoices.

The startup raised US$20 million in a Series A round led by Sequoia India. It is now focusing on crossborder transactions to provide investors with more chances for diversification.

Like Incomlend, many startups that offer alternative investments aim to help a wider pool of investors gain access to assets normally reserved for large institutions. Yieldtree, which was founded in October this year, is seeking a capital markets services licence in Singapore with the vision of democratising investments in asset-backed loans.

Backed by financial services firm Aura Group, Yieldtree will originate loans of up to S$20 million through partners, fund the loans (which will be secured against property, for a start), then syndicate deals in smaller sizes to accredited investors. It plans to charge a 0.25 per cent fee for structuring the deal and will take 15 to 20 per cent of coupon payments.

The startup is aiming for a net yield of 6 to 12 per cent for minimum investments of S$100,000 to S$250,000. The loan to value ratio will be capped at 70 per cent for property deals, excluding loans that rank junior to Yieldtree's, says chief executive Philip Le Pelley.

Technology and venture capital funding might have created a new wave of attractive investment opportunities, but they come with risks.

Financial disclosures for publicly listed securities are onerous, yet cases of fraud still emerge. "We can expect an even higher likelihood of fraud in these unregulated sectors. Data could be fake, or sellers on these platforms may not disclose important caveats," says Peter Oh, the founder of finance commentary website The InvestQuest.

Because these asset classes are recently established, there are zero to few third parties doing analysis or providing commentary on the investment risk and probability distribution of expected returns. This results in a wider information asymmetry between the seller and buyer, Mr Oh points out.

It is unclear whether amateur investors - even accredited ones - understand just how much risk they are taking on in exchange for higher yields.

US-based Yieldstreet (unrelated to Yieldtree) recently became a cautionary tale when its investments in old ship vessels went bad. The platform sold US$89.2 million in notes linked to loans for ship-breaking, which involves dismantling ships to sell the scrap parts. But about a dozen of those ships subsequently went missing.

In a letter to Yieldstreet, a group of investors accused it of providing six months of "excuses and extensions" when the principal payment failed to materialise, Bloomberg reported in May. Yieldstreet later won a judgment on Oct 5 when a British high court ordered the Dubai-based borrowers to pay Yieldstreet US$76.7 million.

Mr Ang from Allen & Gledhill says that one of the main legal challenges involving alternative platforms and assets is to determine if existing legislation actually applies to these novel services and products.

"Besides considering the actual literal wording of the legislation, one would look at the policy rationale underpinning such existing legislation and consider if the alternative platforms and alternative assets pose similar regulatory risks that the existing legislation is meant to address," he says.

Many different factors such as investment risk and return, diversification potential, liquidity and protection of investor rights are instrumental in determining the quality and sustainability of these new alternative investments, says Ryosuke Hayashi, CEO and managing director of SBI Ven Capital, which is raising an early-stage fund with fintech partner Sygnum for digital asset opportunities.

Mr Oh highlights the trend of stock delistings in the past decade, which impacts investor appetite for new investments. The Singapore Exchange has experienced net delistings for seven of the last nine years. In the US, the Wilshire 5000 comprised 5,000 stocks in 2005; as of Sep 30, 2020, it held only 3,445 stocks.

"What this means is that the investible universe has shrunk for stock investors. In my view, the eventual success or failure of these new investment markets will depend on how well they can satiate the demands of investors who are already in traditional markets," says Mr Oh.

"Granted, some of these new investment markets may be able to survive on the interest of hobbyists. In that case, perhaps they should be treated less as investment platforms and more as platforms for interest groups."

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.