Scrapping retirement: the case for tapping the senior workforce

Keeping older employees in their jobs or finding new roles for them protects their incomes and can also be cost-effective for businesses

ONLY about a decade ago, workers nearing the age of 60 would nurture dreams of tending to a fragrant rose garden in their homes, kicking back and relaxing for the rest of their lives after a hard slog of 30 to 40 years in full-time employment. In 1990, there were 50 centenarians in Singapore.

By 2015, that number burgeoned to 1,100 and is projected to rise further, according to an Economist Intelligence Unit (EIU) survey commissioned by insurance company Prudential Singapore. Fast forward to the economically more uncertain times of today, the higher cost of living, a population with a higher life expectancy and inadequate retirement savings to fund that rose-tinted notion of segueing into the sunset - and you have a whole new paradigm shift.

In today's workplace, more companies are asking their older employees if they want to retire - if at all. And the economics seem to support retention - rather than retirement or retrenchment - of workers well into their later years.

Prudential Singapore set a new example when it announced that, effective Oct 1, 2018, it was scrapping the company's retirement age for its 1,100 employees. This decision was made on the back of its EIU survey in which 1,214 Singapore residents were interviewed together with experts on ageing. Called the Ready for 100 report, it revealed that 64 per cent of those aged 55-64 said they still enjoy clocking in at their full-time jobs.

This study, conducted in March 2018 and released in September 2018, was first conceived in the last quarter of 2017. This research was originally inspired by the groundbreaking book The 100-Year Life: Living and Working in an Age of Longevity by Professors Lynda Gratton and Andrew Scott (Bloomsbury, 2016). It introduced the idea that rising longevity necessitates a rethinking of the traditional three-stage life model of School, Career, and Retirement - in a nutshell, ditching recreation in favour of re-creation.

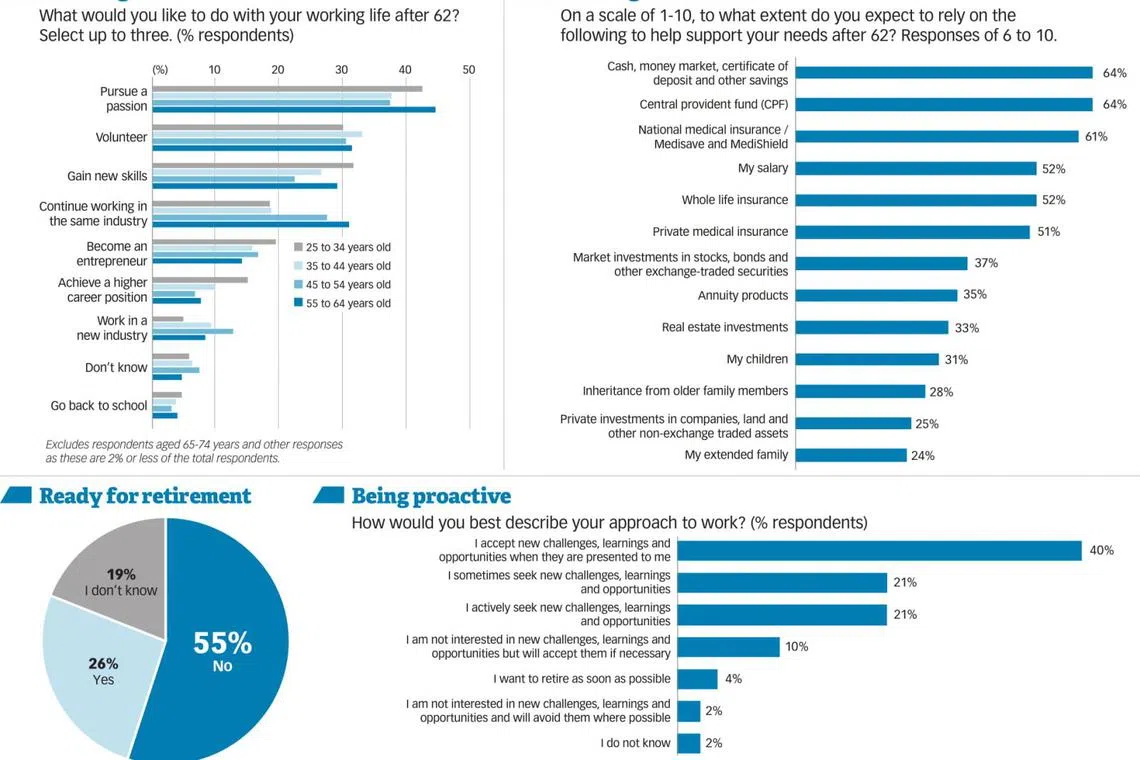

The research showed that most Singapore residents were keen to continue working after the age of 62. Only 4 per cent of the 1,214 respondents surveyed indicated they wanted to retire as soon as possible. And 52 per cent said they would rely on their salary for their needs after 62.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

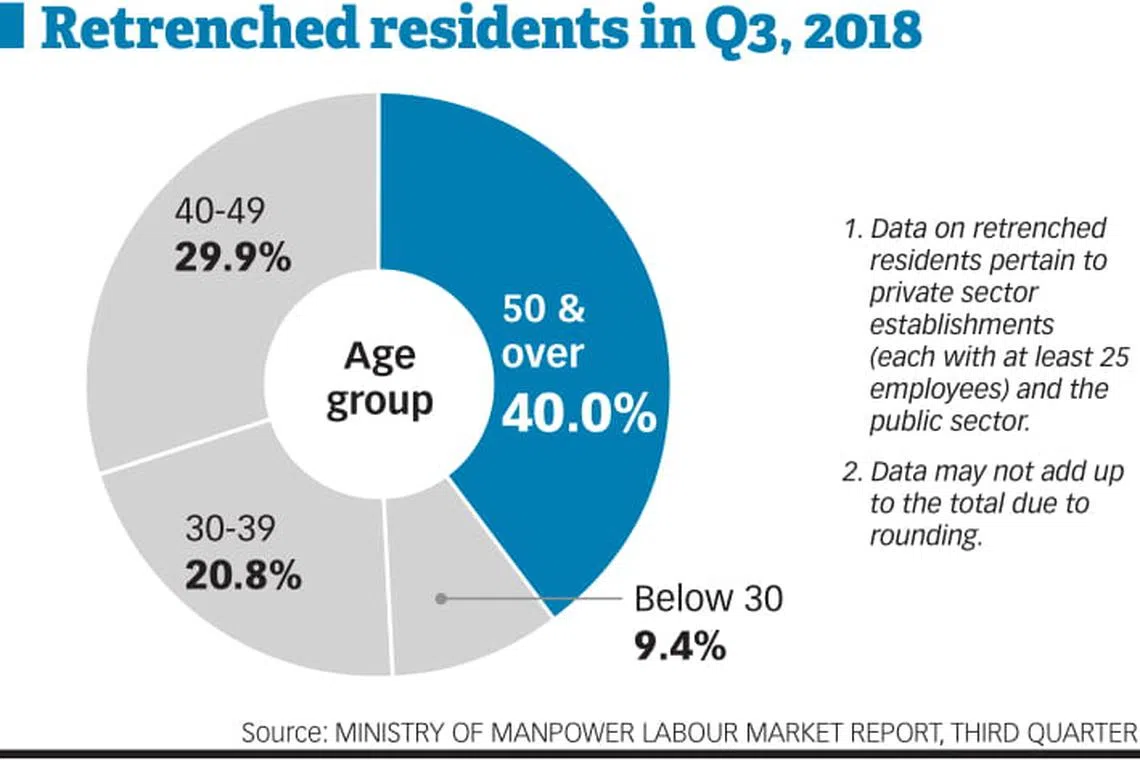

In the face of those preferences and needs, there is one sobering statistic: 40 per cent of workers retrenched in Q3 last year were aged 50 and above, according to the Ministry of Manpower (MOM), but over half re-entered the workforce within six months, post-retrenchment.

Prudential's EIU report, predicated on the fact that the average lifespan today is 83.1 years, and which is edging towards 100 in the foreseeable future, also found that 55 per cent - one in two Singapore residents - were not financially ready to live to 100 years of age.

Says Prudential Singapore CEO Wilf Blackburn: "If we stop work at 62, we are looking at nearly 40 years of retirement, if we were to live to 100.

"Such a long retirement period may pose financial challenges should you outlive your savings. A prolonged period of inactivity may also lead to health and social problems. We wanted to empower them to decide when or if they want to retire at all."

Growing chorus against company retirement policies

There is a growing chorus against retirement: Professor Sumit Agarwal, from the Department of Finance, NUS Business School, says: "With an ageing population, where employers are also finding it hard to find young employees who see a long-term career at any company, it is inevitable to retain older employees who are good at their jobs. In general, adjusting for experience, older employees are most cost-effective to retain.

"With younger hires, who may be looking out for a better offer, the higher turnover that results in this cohort could prove to be more costly for companies."

He adds: "Scrapping the company's retirement policies will help firms large and small fight the labour crunch."

Currently, the statutory retirement age of 62 provides protection by the government for Singapore resident employees - in both the private and public sectors - against being terminated prematurely by an employer who cites age as a factor. As of July 1, 2017, by law, eligible employees who reach the age of 62 must be offered re-employment till the age of 67. To be eligible for re-employment, an employee must:

* Be a Singapore citizen or Singapore permanent resident;

* Have served his/her current employer for at least three years before turning 62;

* Have satisfactory work performance, as assessed by the employer;

* Be medically fit to continue working. (There are jobs that are exempt from these terms, including positions in public service such as the Police Force and Civil Defence, and cabin crew working on commercial flights.)

If re-employment is accepted, the terms and benefits can be adjusted to suit both parties as long as it is found to be fair and reasonable. However, employers who are unable to offer eligible older workers re-employment due to a lack of suitable vacancies would have to pay an Employment Assistance Payment to help workers tide over a period of time while they look for another job.

Since re-employment was introduced in 2012, the employment rate of older residents aged 55 to 64 has increased from 64 per cent in 2012 to 67 per cent in 2017, according to MOM. Government data also shows that about 98 per cent of private sector local employees who wished to continue working were offered re-employment at age 62.

While some may argue that medical costs may spiral with older employees who may require more medical attention than their younger colleagues, Prof Agarwal disagrees. "If you adjust for the cost of retention of younger workers, seniors might not be all that expensive to hire as they are less upwardly mobile and less prone to job-hopping. In my view, it is a good policy to scrap retirement altogether."

Mentors among colleagues

Jasmine Cheoh, 22, a management associate at Prudential, says working with her older colleagues has given her an opportunity to learn from their experience: "I was pleased to hear this announcement because I have always viewed my senior colleagues as mentors with rich life and professional experiences to share. Having the opportunity to work alongside them for longer now means I can continue to benefit from their knowledge and guidance."

Another Prudential employee, Noreen Wee, 62, who is a lead writer in policy contracts, was originally slated for retirement in December this year after 18 years with the company. "To have the choice to retire whenever I feel I want to retire, is empowering," she says. "To retire at 62 is really too young as I'm still healthy and know that I can still contribute to the company. More importantly, I want to have the choice to retire at any age and not be forced to stop working simply because I'm 62.

"What makes it better is that I won't get a pay cut and will continue to enjoy the same employee benefits as before."

Already, this groundswell of support for retention of older workers has found resonance with the government. As far back as 2016, Deputy Prime Minister & Coordinating Minister for Economic and Social Policies Tharman Shanmugaratnam said at a World Cities Summit that investing in Singapore's human capital is a life-long commitment for the government: "We have to think of human capital as something to be developed throughout life, where you keep re-investing in people at different stages of their career."

He added that governments have to help people who are "losing out" - for example, those retrenched and displaced by technologies to provide them with training and resources to equip them with the right and relevant skills.

Older workers in Singapore aged above 55 currently contribute less to their CPF, ranging from 12.5 per cent to 26 per cent of their wages, compared to 37 per cent for those who are younger.

In view of all this, on May 28, 2018, a new tripartite work group comprising high-level representatives from unions, employers and the government was announced by Manpower Minister Josephine Teo to study issues related to older workers as Singapore's workforce ages. This group will look into Singapore's next moves on the retirement and re-employment age, and review the longer-term relevance of its current policies. It will also examine the Central Provident Fund (CPF) contribution rates for older workers and their impact on retirement adequacy. As Mrs Teo noted in a speech last year, one in three of Singapore's resident employees today is aged 50 and above.

The creation of the tripartite work group came in the wake of calls for Singapore's retirement and re-employment ages to be relooked. There were also concerns about whether older workers have enough to retire on. The work group will be releasing its initial set of findings soon.

Voluntarily raising the retirement age

While not many have followed in Prudential's groundbreaking footsteps, the insurer is not entirely alone. Gardens by the Bay management pledged to raise its retirement age to 65 from this year. Gardens by the Bay is a unionised company under the Attractions, Resorts & Entertainment Union (AREU), and has 20 workers above the age of 60.

Secretary-General of National Trades Union Congress (NTUC) Ng Chee Meng said: "NTUC fully supports this initiative by the Gardens. It is something that we hope other employers will follow. (Older workers) have experience and are valuable assets. Employers should value and re-employ our older workers."

Mr Ng also said that NTUC will work with Mrs Teo's work group to consider issues that affect older workers, including the need to develop clearer guidelines on adjustments to the employment terms of re-employed workers.

NTUC revealed that other companies that have made similar moves to raise the retirement age or that do not stipulate a retirement age in their employment contracts include the Singapore American School, Novotel Clarke Quay Singapore and ComfortDelgro Group.

Apart from ensuring income stability for older Singaporeans, there is also the broader picture of challenges that Singapore faces, as painted by Manpower Minister Mrs Teo - one of which was "the demographic disruption", due to the twin trends of falling birth rates and lengthening life expectancies.

Singapore's fertility rate dropped to 1.16 in 2017, the lowest figure since hitting 1.15 in 2010. The number of Singaporeans aged 65 and older is expected to double to around 900,000 by 2030. This means one in four Singaporeans will be a senior citizen. Also, the ratio of Singaporeans of working age to those aged 65 and above is forecasted to fall from 4.2 in 2018 to 2.4 in 2030.

She said Singapore needs to make the best of its ageing population to strengthen the workforce. "For employers... how to make sure we help them adjust HR (human resources) strategies to better tap the senior workforce."

Upskilling, reskilling - and regrouping

The challenge now for MOM is to strike a balance between being pro-worker and pro-business on issues arising from retirement adequacy, employability of older workers to jobs lost because of disruption.

MOM has rolled out WorkPro, which funds companies' adoption of progressive practices, such as age-management practices, job redesign and flexible work arrangements. These practices support companies' employment of workers, especially older ones. In addition, it provides for the Special Employment Credit, which provides wage support to encourage employers to employ Singaporean employees aged above 55 years and earning up to S$4,000/month.

Prudential Singapore is going all out to lead the charge in championing the cause for older workers by making sure they stay relevant to their jobs in the long term and also without sacrificing their scope for employment or their benefits because of their age.

For companies looking to downsize, there are alternatives to consider, reskilling being one. With reskilling, companies can redeploy employees within the organisation where they can fill more suitable positions.

At Prudential, for instance, its internal mobility programme ensures that every employee, regardless of his or her tenure in the company, can look forward to a long-term career. Last year, 10 per cent of its employees moved into new roles as part of career progression and personal development.

Says Mr Blackburn: "Employees who choose to continue working after 62 will be entitled to the same benefits and salary as before. Their remuneration will be based on their job scope and performance, regardless of age.

"Through the company's various upskilling, reskilling, and internal career mobility programmes, our employees can keep themselves relevant at the workplace and explore different roles within the organisation that complement their skill sets. We also have a 'flexi-working' environment that allows our employees to work from anywhere, and at any time."

He adds: "The key to managing extended careers at the workplace is to view older employees as assets. Continuing their employment should not be viewed as a challenge, but an opportunity to retain valuable human capital in the workforce."

How will this new scenario - with more older workers pulling their own weight alongside younger colleagues in the future workplace - play out for organisations as a whole? Says Prof Agarwal of NUS Business School: "I think while this will put some pressure on the younger members of the labour force, it will, however, augur well for employers overall.

"It will also help boost the nation's CPF contributions and put less pressure on the government to support the elderly who may not have enough for retirement."

* Watch the Prudential Ready For 100; and the Ready-for-100 Infographics videos online at businesstimes.com.sg

Copyright SPH Media. All rights reserved.