AI boom lifts outbound travel as Singapore, Apac economies splurge abroad

Japan, South Korea and China see strong inbound travel amid demand for pop culture tourism

[SINGAPORE] Asia-Pacific markets exposed to the artificial intelligence (AI) boom drove outbound spending in 2025, amid an increase in their economic strength, data by Visa indicated.

In the region, AI investment is largely in semiconductor manufacturing and data centres, and economies exposed to these – such as Taiwan, South Korea, Singapore and Malaysia – are “doing really well”, said Simon Baptist, principal economist for Visa Asia-Pacific.

“Where there (are) people making money from the AI investment boom, they are spending a bunch of it on travel,” he said on Thursday (Feb 5).

Travel was “the stand-out category” in 2025, with travel merchant spend growing 2.5 times more than the average spend, while cross-border spending boomed.

This trend will likely continue going forward, as Baptist noted a permanent change in consumer preferences towards travel since the Covid-19 pandemic.

“Now, it’s the thing that everyone is protecting. Even in difficult times, people do cut back on other discretionary spending to try and protect the travel budget,” he added.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Key beneficiaries for inbound travel include Japan, South Korea and China, driven by culture tourism.

Travel patterns are also increasingly driven by currency fluctuations and geopolitics. For example, Japan and South Korea benefited from weaker currencies, while it is currently easier to travel to China due to easing visa restrictions.

Meanwhile, affluent travellers are becoming “really, really critical”, with three quarters of the additional spending in 2025 coming from markets where affluent travellers are from, such as Australia, Hong Kong and Singapore.

SEE ALSO

“Completely revolutionised”

AI is also set to change spending in e-commerce, which is the segment with the largest spending in the Apac region.

Visa defines e-commerce as spending where a physical card is not required at the point of sale.

While it is still too early to tell, agentic AI might move some spending that is currently done in person online, and it is possible that e-commerce websites no longer need to exist.

Baptist said: “Your agent is just reading the code behind, and so all traditional things like online ad spending could be completely revolutionised.”

He expects this will take off first in more tech-savvy economies such as India and Vietnam.

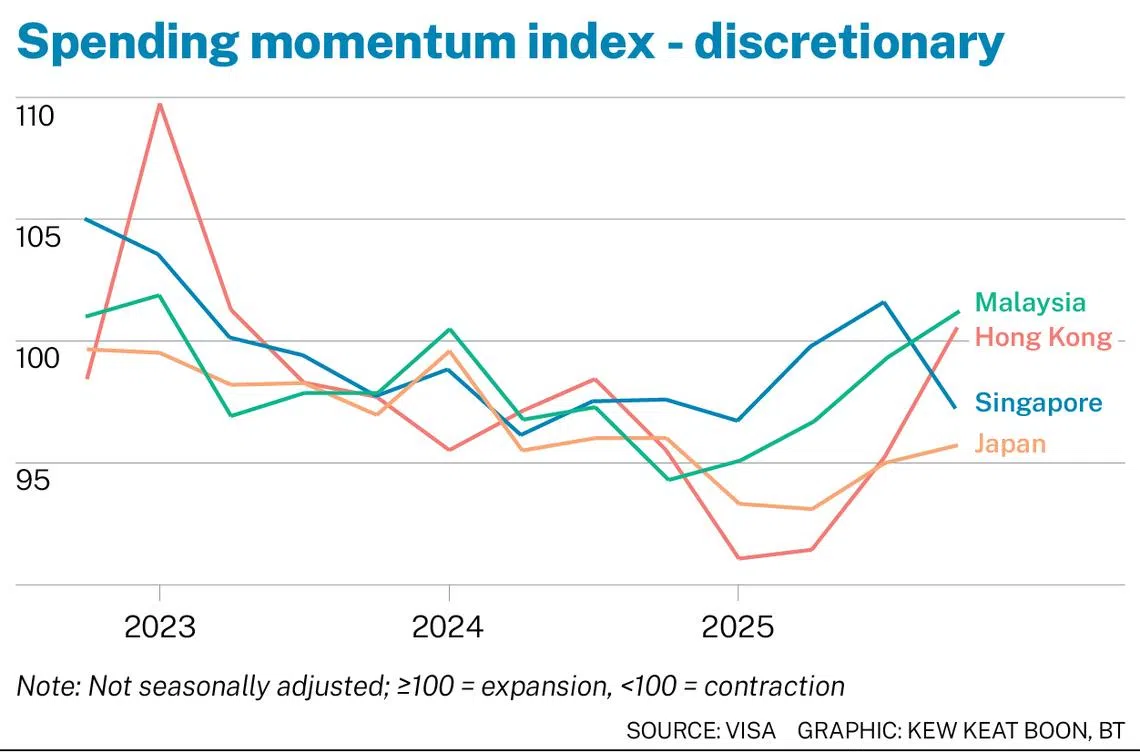

Diving into specific markets, Baptist noted increasing discretionary spending in Hong Kong, Singapore and Malaysia, as trade volumes stabilised.

But for emerging markets in Asia, spending momentum has been weak, in part due to manufacturing uncertainty as well as inequality.

While overall spending is mostly up, the typical card is not spending as much, which suggests that the affluent are doing better than mainstream consumers.

“This matches a lot of the disconnect we’ve seen in places like Indonesia, China and India, where middle classes are not seeing the benefits of that top-level growth.”

Baptist noted that growth in these three markets is not very consumer-intensive. For example, though increased mining in Indonesia has brought in money, it has not resulted in more jobs. In China, a lot of the economy is also focused on investments and exports, rather than on consumers.

“That’s an issue for Asia-Pacific in the year ahead, for the policymakers to think about, how we rejuvenate that core market,” he said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.