Aims Apac Reit’s H1 DPU rises 1.1% to S$0.0472

Revenue for the period inches up 0.2% to S$93.7 million

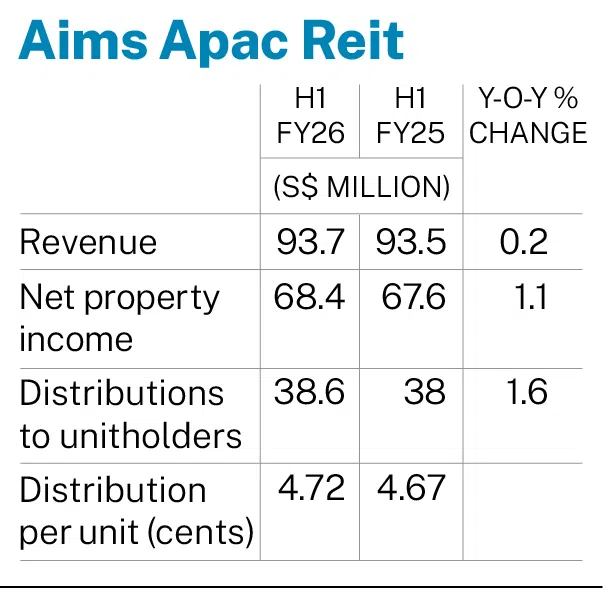

[SINGAPORE] Aims Apac Real Estate Investment Trust (Reit) on Wednesday (Nov 5) posted a distribution per unit (DPU) of S$0.0472 for the first half of FY2026, up 1.1 per cent from S$0.0467 in the previous corresponding period.

The record date of the distribution is Nov 14, and the distribution payment date is Dec 24.

Revenue for H1 inched up 0.2 per cent to S$93.7 million, from S$93.5 million in the previous corresponding period.

Net property income (NPI) stood at S$68.4 million for the first half, an increase of 1.1 per cent year on year from S$67.6 million.

This was underpinned by good operational performance and portfolio rental growth.

Distributions to unitholders rose 1.6 per cent year on year to S$38.6 million, from about S$38 million previously.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The manager executed 11 new and 36 renewal leases in H1, totalling 97,175 square metres. This represented 12.6 per cent of the portfolio’s net lettable area, with positive rental reversion of 7.7 per cent achieved.

Portfolio occupancy as at Sep 30 was at 93.3 per cent, with a weighted average lease expiry of 4.2 years. The tenant retention rate was at 68.3 per cent for H1 FY2026, down from 78.6 per cent in the same period in FY2025.

As at Sep 30, aggregate leverage was at 35 per cent. Weighted average debt maturity stood at 2.5 years, with an interest coverage ratio of 2.5 times.

The manager said that the Reit’s portfolio is supported by 188 tenants diversified across multiple trade sectors, with 82.5 per cent of gross rental income (GRI) from tenants in essential and defensive industries.

Of the GRI, 76.3 per cent is from Singapore, with the remaining income from Australia “anchored by high-quality, long-term leases”.

During H1 FY2026, the asset enhancement initiative at 7 Clementi Loop was completed, with a warehouse refurbished to attain the Building and Construction Authority’s Green Mark Gold Plus certification. This ultimately led to the securing of a 15-year master lease with a global storage and information management firm, added the manager.

Earlier, on Aug 29, the manager had also announced the proposed acquisition of a Singapore industrial property located at 2 Aljunied Avenue 1 at a total purchase price consideration of around S$56.7 million.

The proposed acquisition of the asset will deliver an NPI yield of 8.1 per cent and DPU accretion of 2.5 per cent.

Looking ahead, the manager of Aims Apac Reit remains cautious around any emerging risks due to the macroeconomic environment, on the back of the lowered overnight funds rate by the US Federal Reserve in recent months.

“We will monitor incoming data and the evolving outlook,” said the manager.

“Still, with rising occupier demand for modern logistics and high-spec industrial space, the Reit is well-positioned to capitalise on evolving supply chain needs and accelerate sustainable growth through selective investments and value-accretive asset enhancements.”

Units of Aims Apac Reit ended Wednesday trading up S$0.01, or 0.7 per cent, at S$1.39.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.