Fed’s rate cut positive for Asean+3, but near-term risks remain: Amro

Potential resurgence of inflation is a key risk to watch

GLOBAL financial conditions eased in the first half of 2024, but experienced increased volatility in the third quarter. For the near term, Asean+3 economies should remain vigilant against a resurgence of inflation, escalating geopolitical tensions and a slowdown in global growth.

These were among the key findings in a new report released by the Asean+3 Macroeconomic Research Office (Amro) on Thursday (Oct 10).

This financial stability report delved into recent market developments and potential risks, while providing analysis of key challenges confronting the region.

Asean+3 comprises the 10 member states of the Association of Southeast Asian Nations, as well as China, Japan and South Korea.

Amro chief economist Dr Khor Hoe Ee said in a news release that the overall risk to financial stability across Asean+3 this year “appears lower” than in 2023.

“The current climate of robust growth and disinflation presents regional policymakers an opportunity to reduce debt, rebuild policy space and strengthen fiscal capacity to better manage potential shocks,” he said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The US Federal Reserve commenced monetary easing in September, but uncertainties over inflation and global growth remain.

At a media briefing on Thursday, Amro lead economist Kevin Cheng noted that, as of now, the impact of the Fed’s rate cuts has been very positive for the region.

If it is a result of disinflation efforts being successful and wanting to preserve the robust labour market, the effect of further cuts will be a plus for the Asean+3 region, said Cheng. This will strengthen equities and currencies, leading to capital inflows and easing financial conditions.

He pointed out the potential resurgence of inflation as a key risk to watch.

He said: “While inflation has continued to ease in 2024, the disinflation effort has proceeded at a pace slower than market expectations. The final stretch of achieving disinflation has proved difficult, largely because service inflation has been persistent.”

Meanwhile, geopolitical uncertainties have intensified, with the situation in the Middle East remaining fragile, said Amro. The US presidential election on Nov 5 will also have a significant influence on policies, which could impact Asean+3 economies.

Debt landscape

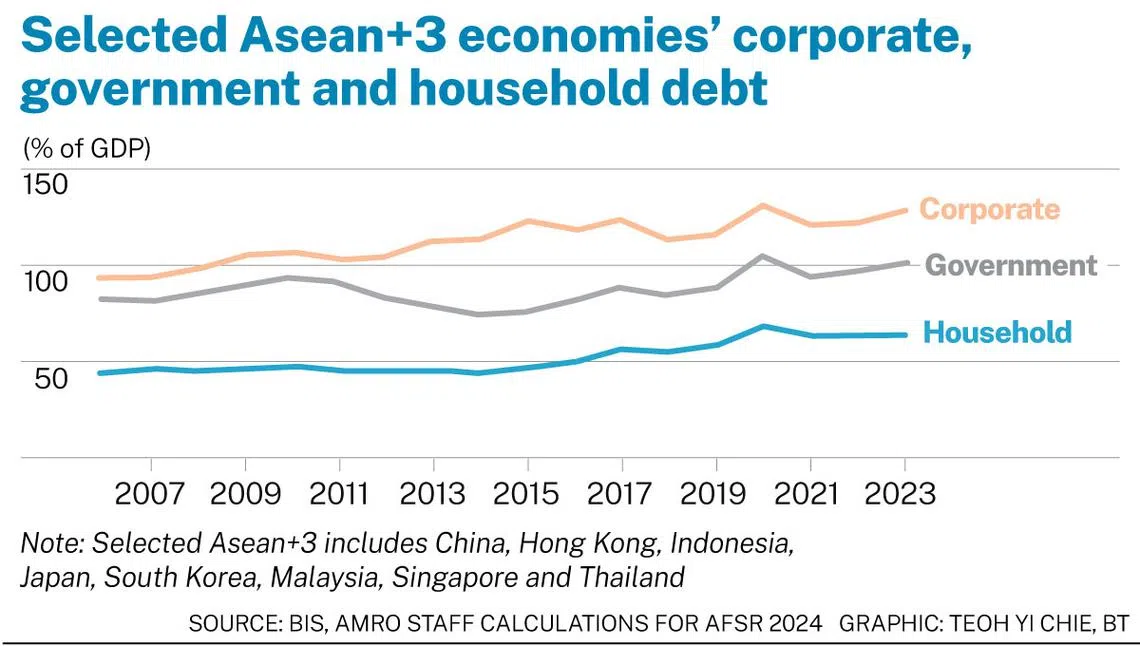

Total debt – comprising corporate, household and government debt – of the Asean+3 region exceeded 290 per cent of the region’s gross domestic product last year, climbing by 10 percentage points from 2022.

This was driven by corporate debt, which remained concentrated in the property and construction, manufacturing as well as raw materials sectors. Another contributing factor was government debt, which continued to rise in Asean+3 economies, noted the report.

Amid higher interest rates, household debt burdens in the region generally increased last year, with the exception of China, Japan and South Korea, which all saw a slight decline.

Although interest rates in some Asean+3 economies have started to decline, Amro expects the overall debt burden to remain high, due to increased debt levels and the slow pace of rate cuts.

To deal with increasing debt, Cheng highlighted that central banks and regulators must monitor financial imbalances, rebuild policy buffers as well as prevent risks from building up through macroprudential tools.

Property developer financing

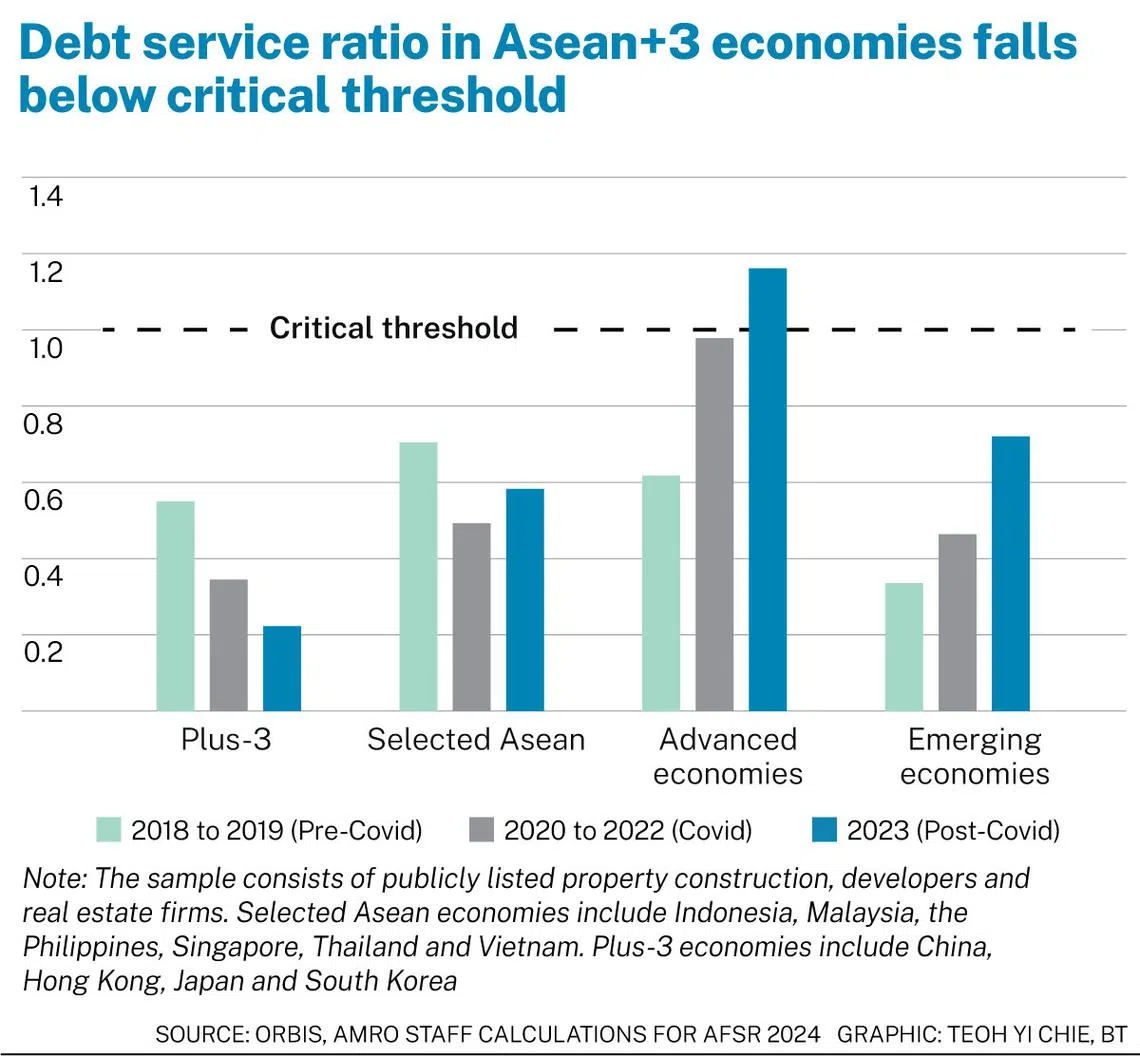

In the property market, many developers maintained high leverage in an environment of low interest rates and ample liquidity before the pandemic.

The Covid-19 pandemic, however, hit property markets across the region, resulting in widespread downturns. This has accentuated the risks faced by property developers, said the report.

Developers’ financial health – in terms of profitability, liquidity, debt servicing capacity, refinancing risks and leverage – worsened between 2021 and 2023, compared with the period before the pandemic.

Property companies in the Asean+3 region are less able to meet their debt obligations, thus facing higher solvency risks. This is exemplified in the debt service ratio, which assesses a business’ capacity to use operational profits to meet all debt payments for the year.

The ratio has fallen below the critical threshold of one in the Asean+3 economies. It is also “particularly low” in the plus-3 economies of China, Japan and South Korea.

“This indicates that firms are not generating sufficient revenue to service their debts on schedule,” noted the report.

Findings have suggested that negative shocks in the property market would aggravate stress in the financial market, and vice versa.

Robust capital buffers in the banking sector have helped to mitigate spillover risks from the property market. However, small banks, regional banks and savings banks are still highly vulnerable to property market shocks.

To minimise the financial stability risks from property developer financing, Amro suggested that authorities can consider facilitating access to credit for companies with sound financial health – by offering guarantees to viable projects and reducing immediate debt redemption burdens.

Smaller financial institutions, such as regional banks and savings banks, can consider diversifying their business models beyond real estate investments to reduce risk, the report added.

US dollar reliance

Financial systems in the Asean+3 region are highly susceptible to US dollar movements, as the region relies heavily on the greenback for cross-border financial activities.

Since the global financial crisis, the worldwide financial system has faced a persistent US dollar shortage. This could potentially destabilise financial markets and intermediaries.

Instead of absorbing shocks for financial markets, risks can also be spread and magnified through the greenback, especially in times of monetary tightening and geopolitical tension.

The US dollar funding stress alone may not directly affect the region’s domestic financial stability, as Asean+3 banks are generally well-capitalised and have strong domestic balance sheets. However, the spillover effects cannot be ignored, said the report.

In the short term, the focus should be on improving economic fundamentals to mitigate spillover effects; strengthening surveillance and risk-management strategies; and enhancing regional financial safety nets.

Over the medium to long term, the region should reduce its reliance on the US dollar by promoting the use of local currencies. Advancing cross-border payments and transactions will be key, where many regional central banks have already started to explore central bank digital currencies.

Said Dr Khor: “To tackle the near to long-term risks and challenges to Asean+3’s financial stability, the region must come together as one and strive for resilience and stability.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.