Logic over emotion: Navigating a new macroeconomic era

Wealth-building is less about timing the market and picking the right stocks, and more about allocating assets in the right manner

UNCERTAINTY is the new normal for investors, as the world enters a new macroeconomic era. But even as anxieties run high, technology offers a solution for navigating volatile markets.

Today's headlines paint a dim picture of global financial markets: Central banks around the world struggle to combat rapidly rising inflation, which has continued to soar despite aggressive rate hikes. And fears that these rate hikes will lead to a global recession are weighing on investor sentiment.

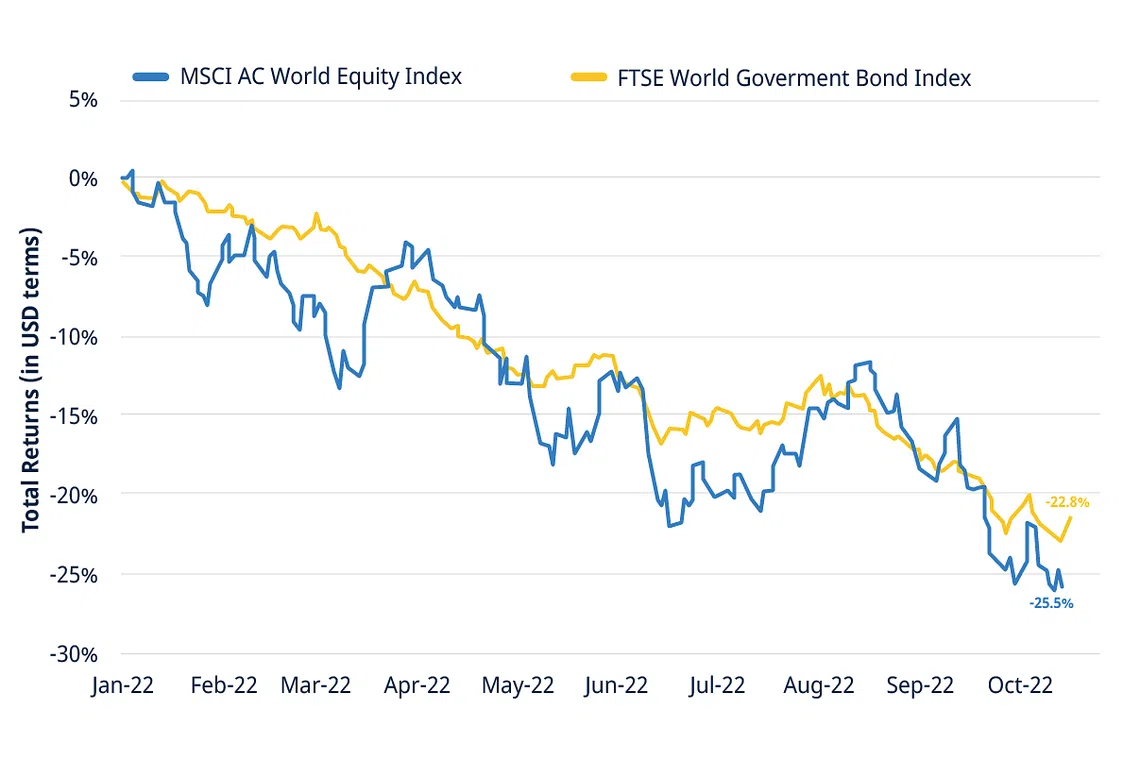

Now, we're witnessing a rare synchronised drawdown of both stocks and bonds. Both large cap equities and 10-year US treasury bonds posted negative returns this year - which is only the fifth time this has occurred in the past 100 years. This is also the only year when both have posted double-digit declines.

On top of this, high inflation is steadily eroding the value of cash. Even gold, which many see as an inflation hedge, has fallen.

In short, 2022 has been a painful year for investors. But this is no reason for investors to abandon their holdings. Logic, not emotion, should be the guiding force in these tough times.

This is where technology comes in. Without fear and greed clouding the picture, investment apps might just be the answer for investors looking to keep calm and carry on their wealth-building journey, even in this bear market.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

StashAway, a local first-mover in this space, takes the same approach as institutional investors: wealth-building is less about timing the market and picking the right stocks, and more about allocating assets in the right manner, based on your risk appetite.

It's all about strategy

Several long-term studies, including one from the CFA Institute, have shown that asset allocation is responsible for 80 to 96 per cent of a portfolio's returns.

Active asset management also has its limits. The S&P Indices Versus Active (SPIVA) scorecard shows that only 10 per cent of active unit trust managers have outperformed the relevant market over the last 15 years, net of the high fees they charge.

There are two types of asset allocation essential to an investor's long-term returns that StashAway employs, similar to sovereign funds, pension funds and family offices.

One is Strategic Asset Allocation (SAA), which focuses on deploying capital into a mix of assets that suits an investor's risk tolerance and life goals.

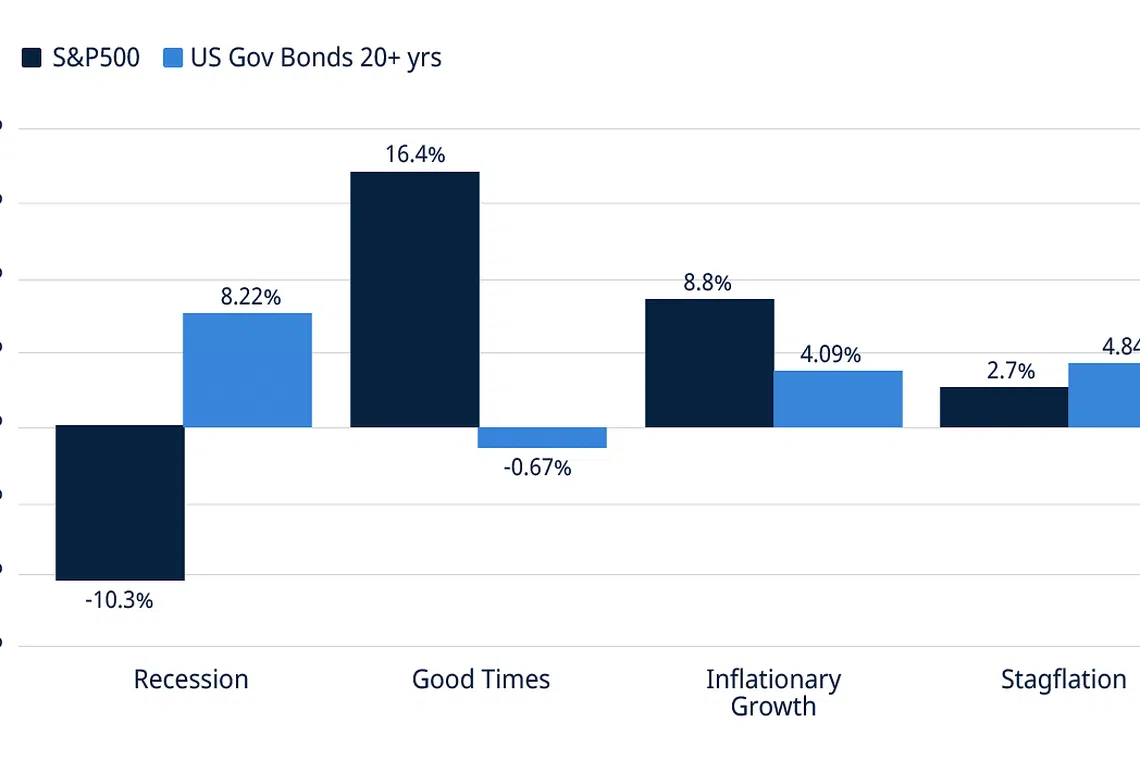

The other is Tactical Asset Allocation, which is about tilting an SAA portfolio depending on economic and market conditions. This could involve increasing one's allocation to US stocks when the economy is doing well, and decreasing it in favour of bonds during recessionary periods.

Enter ERAA®

Nearly four decades' of data shows that assets' returns vary throughout different economic regimes: the good times, inflationary growth, recessions and stagflation (see graphic).

So rather than deciding whether to buy more shares of General Motors or General Electric, investment platforms like StashAway focus on having the right asset allocation for each economic regime.

This is possible through its proprietary framework, known as Economic Regime-based Asset Allocation (ERAA®). Through its data-driven approach, ERAA® anticipates macroeconomic trends to keep risk constant while optimising for long-term returns.

For instance, from mid202 1, StashAway's ERAA® detected rising inflation pressures in the US and elsewhere.

As Stephanie Leung, StashAway Co-Chief Investment Officer, wrote in the company's January 2022 CIO Insights: "Inflation is outpacing growth not only in the US, but also across global markets. And in the US, inflation continues to deepen, reaching its highest level of inflation in nearly four decades."

ERAA® then increased its allocation to inflation-sensitive assets, including energy equities, inflation-linked bonds, gold and exposure to commodity-exporting countries.

It also allocated a larger share of global portfolios to US dollar-denominated assets. This overweight US dollar allocation has since allowed ERAA® portfolios to take advantage of the currency's "safe haven" status, as well as its higher yield, as the Federal Reserve continued to aggressively hike interest rates.

"Indeed, with the US dollar up nearly 18 per cent year-to-date as of mid-October, this exposure has supported our portfolios' performance year-to-date," says Leung.

New investors' first recession

While some investors may be having deja vu of a past bear market or recession, many new investors are now experiencing it for the first time. This experience may come as a shock after the bull run following the Covid-19 crash in 2020.

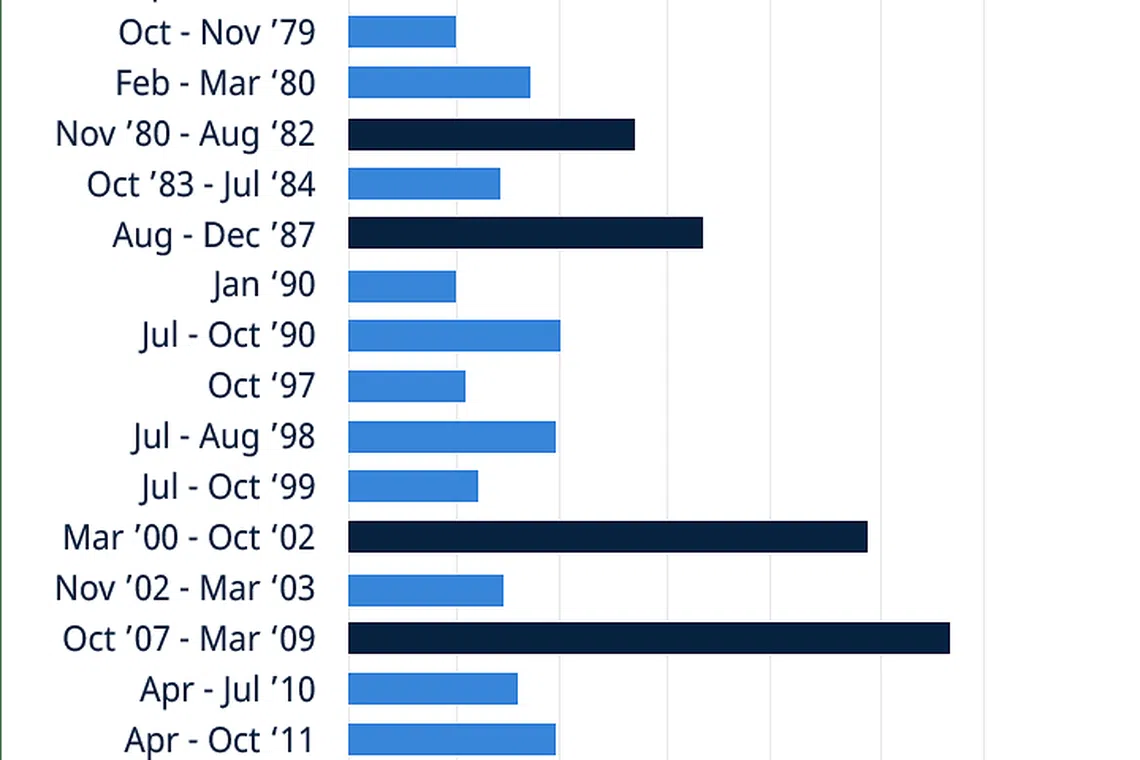

But bear markets and market corrections are relatively common, as illustrated by this chart.

Michele Ferrario, StashAway's CoFounder and CEO, says: "All of us will go through four to five bear markets in our investing timeline, and 15 to 20 market corrections. What's more, the best days in the market are usually very close to the worst days. It's almost impossible to time the market, so the adage, 'time in the market beats timing the market' still holds true."

Since its launch in 2017, StashAway has evolved to offer a holistic solution to weather changing markets. The platform offers both cash management and long-term investing solutions, allowing investors to grow their cash at low risk for the short term while investing for the long term. This year, it introduced broad market-exposure portfolios guided by BlackRock®, allowing investors to further diversify their long term investing strategies.

"At the same time, as clients grow their investment knowledge, they also want to marry their own views with that of experienced asset managers", adds Ferrario. "That's why we introduced Thematic and Flexible Portfolios in the last year."

StashAway's new Thematic Portfolios lets investors put money into long-term trends while maintaining their risk preference. The platform's customisable Flexible Portfolios allow investors to build their own portfolios.

StashAway continues to anticipate the growing financial preferences of everyday investors, evolving its product suite to meet customers' financial goals.

It's no longer enough to offer a single investment offering, or a less-than-intuitive experience. Today, more investors demand holistic, all-in-one solutions and professional guidance - and that's not likely to change with a volatile 2023 ahead.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.