Institutional investors to prolong defensive play on debt ceiling, rate volatility woes: State Street

Yong Hui Ting

INSTITUTIONAL investors are taking on the defensive stance, despite hopes of a containment on the banking crisis.

The defensive behaviour is also likely to continue if debt ceiling concerns, interest rate volatility or stagflation fears flare up again, analysts at State Street Global Markets said in a report on Wednesday (May 3).

These discoveries were derived from a series of newly launched data-driven indicators by State Street Corporation.

Known as the Institutional Investor Holdings Indicator and Institutional Investor Risk Appetite Indicator, these indicators use data from State Street’s over US$37 trillion of assets under custody and administration to provide insights on institutional investors’ portfolio allocation trends.

The risk appetite index, in particular, showed a broadening defensive behaviour by institutional investors across all asset classes.

It found that investors’ actions over April were much more cautious and that risky asset pricing was overly complacent.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

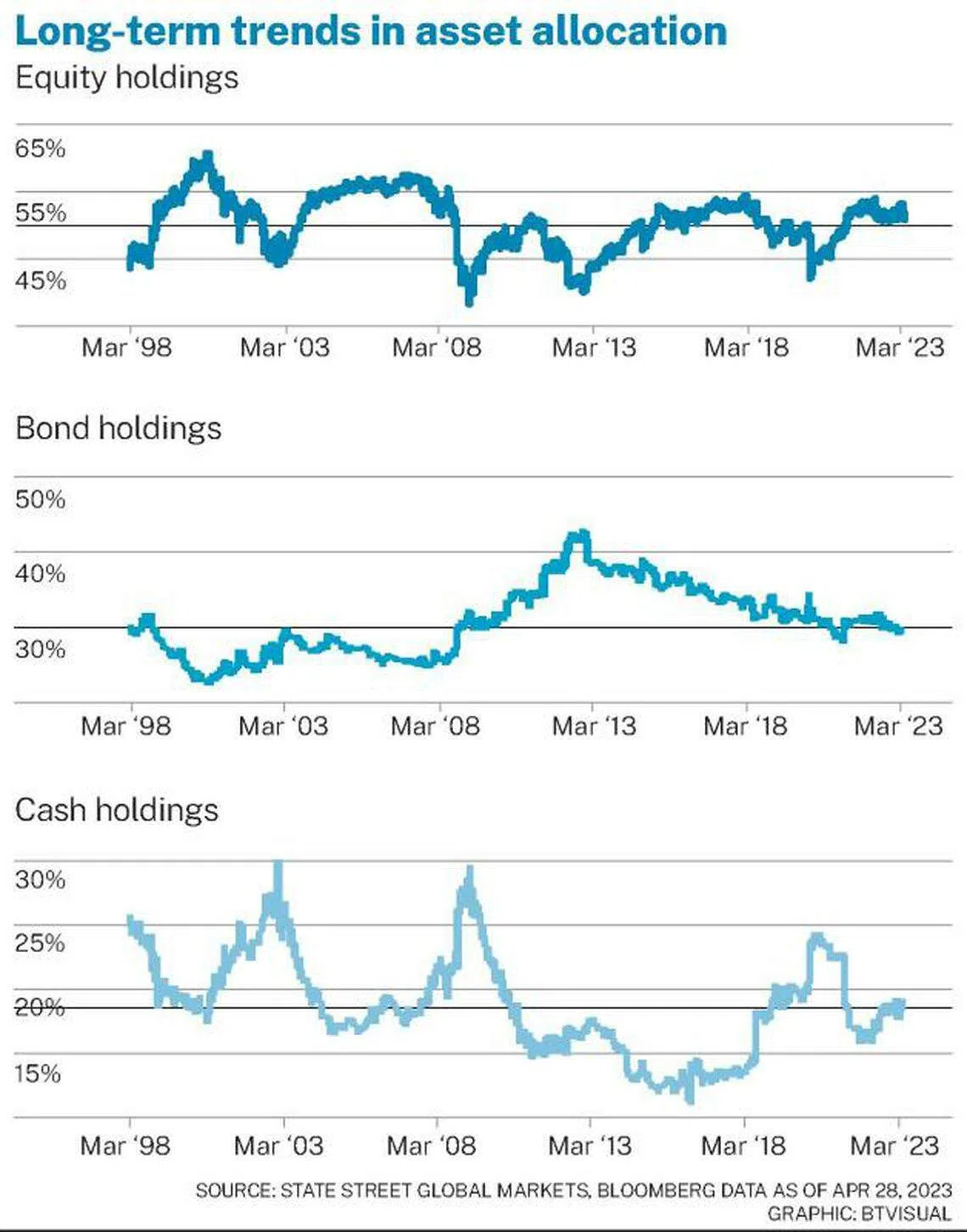

Further, State Street’s holdings indicator suggested that investors’ equity holdings were still above long-run averages, while cash holdings were below the same averages.

This indicates the potential for defensive behaviour to continue if debt ceiling concerns, interest rate volatility or stagflation fears flare up again, said the company’s analysts.

Separately, a new State Street S&P Global Institutional Investor Carbon Indicator, powered by S&P Global Sustainable1, was also launched on Wednesday. The indicator tracks the overall exposure of institutional investor portfolio holdings to carbon emissions.

It will show how institutional investors are managing their exposure to carbon risk and what is driving shifts in these exposures.

Both the holdings and risk appetite indicators are calculated daily and released monthly, while the carbon indicator will only be released annually.

The indicators will be made available on Insights, the research platform of State Street’s markets business, the company said.

Copyright SPH Media. All rights reserved.