Investing in a greener future: How this bank supports clients on their sustainability journey

An award-winning sustainability-linked loan for OUE C-REIT demonstrates Maybank Singapore's commitment to supporting its clients in achieving their ESG goals

THE striking silhouettes of OUE Bayfront and One Raffles Place form part of Singapore's iconic downtown skyline today - and represent a pledge to a more sustainable future.

Like the other properties owned by OUE Commercial Real Estate Investment Trust (OUE C-REIT) in Singapore, both are certified Green Mark Gold by the Building and Construction Authority, a testament to their adherence to strict environmental impact and performance standards.

Since its initial public offering (IPO) in 2014, OUE C-REIT has made remarkable strides in its sustainability journey. In just two years after green leases were introduced to its portfolio in 2021, they account for over one-fifth of its Singapore commercial segment net lettable area as of Dec 31, 2022. Unlike traditional leases, green leases are commitments made by both the landlord and tenant to actively manage and minimise a property's environmental footprint.

Beyond its core business, OUE C-REIT has also aligned its financing strategy with its green ambitions. For instance, sustainability-linked loans (SLLs) account for almost 70 per cent of its total debt as at June 30, 2023. Such loans (see box below) are tied to pre-agreed environmental performance targets, which are validated by an independent party.

Incentivising sustainable practices

"The targets tied to OUE C-REIT's SLLs align with our commitment to minimise the environmental impact of our portfolio by improving energy efficiency, as well as prudent water management to mitigate climate-related risks," says OUE C-REIT's chief executive officer Han Khim Siew. He further notes that OUE C-REIT has established targets for 2030 to reduce energy and water intensity by 25 per cent from 2017 levels.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Decoding green finance: Green loans vs sustainability-linked loans

Green loans and sustainability-linked loans (SLLs) are two key instruments in green finance. The latter is a relatively new and innovative instrument that aligns a company's financing costs with its sustainability performance.

Green loans are specifically used for projects with a positive environmental impact, such as renewable energy or pollution control. The use of funds is strictly monitored to ensure they are allocated to green projects only.

On the other hand, SLLs are more flexible. They can be used for any purpose, but the interest rate on the loan is linked to the borrower's achievement of predefined sustainability targets, such as reducing carbon emissions or improving energy efficiency.

The benefits of OUE C-REIT's SLLs extend beyond environmental impact. They also offer financial advantages, such as the potential for lower interest rates and a higher proportion of unsecured lending, which is not tied to any assets. This, in turn, allows for access to more competitive and diverse sources of funding.

With the support of Maybank Singapore, OUE C-REIT was able to leverage these benefits when it obtained an unsecured SLL totalling S$978 million in 2022, the largest ever among Singapore REITs.

A win-win for the bank and clients

As one of the loan's mandated lead arrangers and bookrunners, Maybank Global Banking at Maybank Singapore was actively involved in the deal throughout the syndication process, which garnered support from 19 banks and was oversubscribed 1.26 times. This robust backing, says the bank, reflects the appeal and viability of the SLL to a broad spectrum of stakeholders.

Han explains that OUE C-REIT partnered with Maybank because both shared the vision of incorporating sustainability into financing needs.

The confidence and trust in Maybank Singapore proved to be well-founded. OUE C-REIT's SLL deal was recognised as the Green Deal of the Year - Singapore at the Asian Banking & Finance Corporate & Investment Banking Awards 2023.

"Our participation in the sustainability-linked loan demonstrates our strong relationship and trust with OUE C-REIT. This award represents a significant milestone, underscoring Maybank's remarkable sustainability journey we embarked upon," says Gregory Seow, head of Global Banking at Maybank Singapore.

Seow emphasises that the bank has consistently showcased its capability in orchestrating and participating in groundbreaking SLLs and other green financing initiatives.

"By embracing environmental, social and governance (ESG) principles, Maybank stands poised to not only navigate risks linked to ESG factors but also catalyse a future of responsible and sustainable finance," he says.

At the forefront of global banking

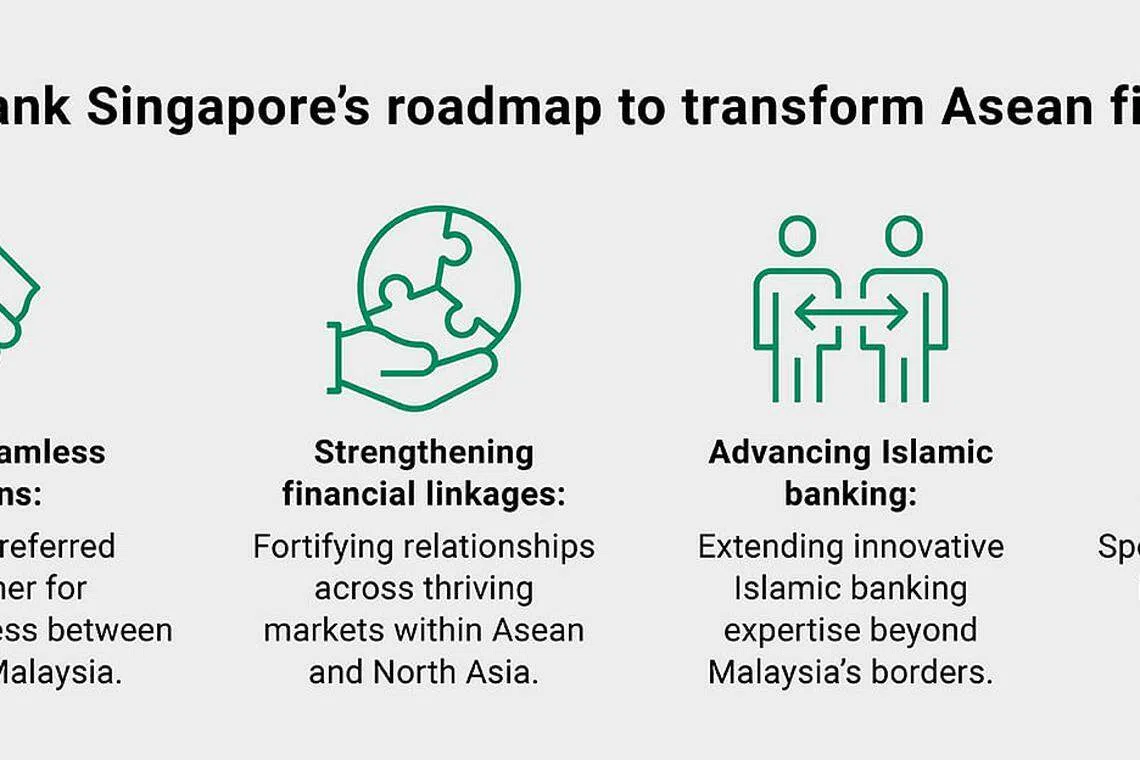

As the only bank with presence in all 10 Asean countries, Maybank offers its corporate and institutional clients a springboard into this dynamic region with a suite of wholesale financing solutions and services.

The bank's expertise in Islamic finance also sets it apart from the competition, enabling it to offer solutions that align with Shariah principles that promote sustainable growth through a culture of fairness and ethics. In fact, the bank structured the world's first S$250 million Islamic green financing deal for the hospitality sector in 2021. For its efforts, it won the Green Islamic Deal of the Year - Singapore award at the Asian Banking & Finance Corporate & Investment Banking Awards 2022.

Having also won the Corporate & Investment Bank of the Year - Singapore award at the Asian Banking & Finance Corporate & Investment Banking Awards 2023, Maybank Singapore is poised to build on this success.

The driving force behind Maybank Singapore's roadmap (see above) is Maybank's M25+ initiative, an agile business growth strategy launched in 2022 to enhance the bank's competitive standing in all markets it operates in. Underpinning Maybank's growth ambitions is its ethos "Humanising Financial Services", which reflects its promise of putting people first and embedding this approach at the heart of everything it does.

"As we set our sights on becoming the premier financial institution for sustainable business ventures, our distinguished capabilities and strategic advantages firmly establish us as a trailblazer in responsible growth, serving clients with unwavering excellence," says Seow.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.