Looking to the future as AI, quantum computing and tokenisation transform financial services

Tokenisation needs further development such as interoperable compliance-enabled infrastructure that can support deployment at scale

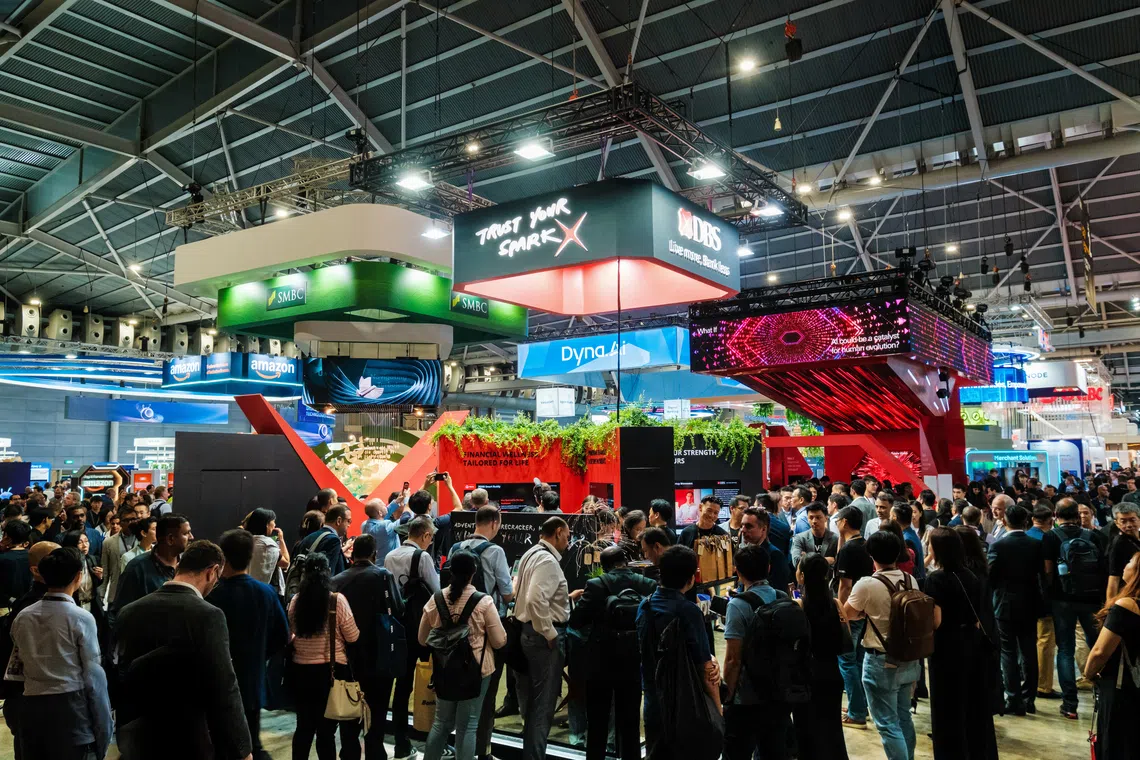

THE first Singapore Fintech Festival (SFF) was launched in 2016 to support the country’s goal of becoming a “Smart Financial Centre” and a world-class fintech hub. The inaugural event attracted over 13,000 participants from 60 countries.

Fast forward to 2024 and numbers had swelled to 65,000 attendees from 134 countries. Hackathons and innovation labs have become a regular part of the line-up.

This year, the SFF’s 10th anniversary, will see an even higher turnout while more than a thousand global leaders in finance, technology, and policy gather in Singapore to discuss the theme “Shaping the Next Decade of Growth”.

The extensive programme features insights from pioneers behind key technologies that have driven transformation of the financial sector as well as the changemakers working on technologies that will shape a new financial architecture in the next decade.

Monetary Authority of Singapore (MAS) managing director Chia Der Jiun told The Business Times: “At SFF 2025 and over the next few years, there will be a focus on deepening understanding of these three transformative technologies – AI, quantum computing and tokenisation – that have the potential to reshape financial services over the next decade.”

His aim is that SFF “should strive to sharpen its relevance and contribution as a major platform where ideas, perspectives and visions are exchanged and incubated, and help position (Singapore’s) financial ecosystem at the forefront of technological innovation and transformation.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

SFF is organised by the MAS, Global Finance & Technology Network and Constellar, in collaboration with The Association of Banks in Singapore.

In terms of AI, Chia said that last year had seen “strong interest from industry leaders in generative AI and its transformative potential for many aspects of the financial industry including compliance, wealth management, and customer engagement.”

He pointed out that industry leaders recognised that AI deployment must be anchored in robust governance frameworks that prioritise accountability, transparency, and trust.

On quantum computing, Chia noted that there is industry interest “to gain competency in the application of quantum technologies to financial infrastructure. While quantum computing is not yet mature as a technology, forward-thinking institutions are already investigating quantum-safe cryptography and quantum key distribution to strengthen their security infrastructure.”

A third important theme is that of asset tokenisation.

While Chia noted that industry applications have moved beyond pilots that prove the value of tokenisation with commercial use cases in multi-currency cash management and payments, collateral management, and security settlement, more can be done on this front.

He said: “There now needs to be further development in high quality settlement assets and interoperable compliance-enabled infrastructure that can support deployment at scale.”

Tokenisation and standardisation

Chia said that standardisation work needs to continue and requires coordination across the industry.

Under Project Guardian, MAS and the financial industry have been collaborating on establishing the foundation for a new era of financial infrastructure.

So far, there have been tokenisation projects involving various kinds of financial assets, yielding commercial benefits from faster, more efficient transactions and settlement.

Commercial services have also been launched, with banks, for example offering tokenised cash management services and money market funds have been tokenised.

Tokenisation frameworks have also been standardised across asset classes including asset & wealth management, fixed income, and foreign exchange.

A key risk however, according to Chia, is that as commercial players develop proprietary infrastructure, networks, and solutions, fragmentation can result and the ecosystem could end up with trapped liquidity and lack the scale needed for tokenised financial assets to obtain the full benefits of being transacted on-chain.

He elaborated: “We see different commercial players and groups of players experimenting with different networks and platforms. Some are building programmable, compliance-capable layers on existing public blockchains, while others are building proprietary solutions. As these networks compete to attract tokens and participants on their infrastructure, there is a risk of the ecosystem fragmenting into sub-scale walled gardens. Users on one platform cannot transact with users on another platform. Tokens on one chain cannot cross over to another. This creates market inefficiencies and locked liquidity in these networks.”

Such a prospect is being addressed by another ongoing initiative – Global Layer One – which aims to promote more interoperability between networks by developing common standards and templates that can be adopted.

This public-private collaboration focuses on fostering an ecosystem of compatible platforms. Chia said: “The aim is to enable a network of networks which are interoperable, compliance-enabled and which facilitate seamless transactions across borders and networks.”

Digital finance and unbacked digital assets

Digital assets is one area that is growing hand in hand with tokenisation development; with recent regulatory developments in the United States (US) likely to further spur the growth of digital assets.

In July 2025, the US signed the Genius Act into law, providing legislative clarity over stablecoins. The stablecoins are fully backed by liquid assets such as US dollars or short-term US Treasury bills.

In Singapore, MAS had finalised the Single Currency Stablecoin Framework in 2023. The framework focuses on distinguishing well-regulated stablecoins that maintain high value stability from the broader class of volatile crypto assets circulated in Singapore.

Chia said: “By imposing strict requirements on reserve backing, redemption, and transparency, MAS’ framework seeks to safeguard users and preserve financial stability while supporting responsible innovation.”

The regulator is working on legislative amendments to formalise the framework, and will issue a public consultation later this year.

With the likelihood that stablecoins will be issued in multiple jurisdictions to serve the needs of different regions, Chia’s view is that “Singapore is well-positioned as a trusted hub where global innovation meets robust regulation, and where financial institutions and fintechs can be based to provide new solutions that meet the needs in our regions”.

Apart from stablecoin and tokenisation in wholesale financial markets, developments in the US could result in more interest among retail investors in unbacked crypto assets, added Chia.

He reiterated MAS’ view of unbacked crypto assets: “Unbacked crypto assets have no fundamental value, are volatile and are not suitable as investments for retail investors. We will step up consumer education and awareness initiatives to reinforce these messages.”

Quantum computing

Another key theme in the fintech space is that of quantum computing.

Under the Financial Sector Technology & Innovation Scheme, an additional S$100 million was earmarked in 2024 to support quantum capabilities.

Chia has been encouraged by the efforts of financial players to apply quantum technologies to financial services. For example, HSBC in Singapore has established a Quantum Centre of Excellence to develop quantum-safe solutions and explore real-world applications in areas such as risk management, security and optimisation.

MAS continues to support strategic initiatives by both local and global financial institutions to address meaningful problem statements. Some of these use cases include portfolio optimisation, risk simulation, and other forecasting tasks such as predicting customer behaviour and service usage patterns.

There are also pilots that enhance cyber security readiness to better prepare Singapore’s financial infrastructure and services for the quantum era. This includes Quantum Key Distribution (QKD) pilots by local financial institutions.

Chia urged the financial sector to build resilience against future cyber risks that could result from quantum computing.

Such measures include an inventory of cryptographic assets, building technical competencies for quantum security solutions as well as conducting proof-of-concept trials on such solutions to prepare for implementation.

MAS has conducted trials to study the viability of quantum-safe solutions for adoption in financial services.

One example involved the use of QKD for the secure transfer of financial data amongst MAS and the participating banks. This trial was conducted in collaboration with several banks (DBS, HSBC, OCBC, UOB) and technology partners (SPTel, SpeQtral).

Chia noted: “MAS will continue to engage financial institutions to prepare for a quantum-safe transition, as a full transition is complex and will take time.”

He said that “the supervisory teams have begun reviewing how financial institutions manage their cryptographic inventory and will be reviewing how financial institutions identify critical assets to be prioritised for quantum-safe migration.”

Artificial intelligence

Chia acknowledges that there are risks from the rise of digitalisation in financial services, including that of scams and service disruptions.

He said: “Fighting scams and strengthening the operational resilience of our financial digital infrastructure has been a key priority for MAS and the financial industry over the past two years.”

But he emphasised: “As financial institutions now adopt AI, MAS has made clear to them that they must in tandem enhance their governance and risk management practices for safe and responsible AI use.”

MAS is in the midst of developing a set of supervisory guidelines on AI risk management. “These guidelines will cover the governance and controls surrounding AI development and deployment in financial institutions, focusing on critical aspects such as evaluation, testing, and explainability. They are informed by our thematic review of AI model risk management in key banks,” said Chia.

An AI risk management handbook by the Project MindForge industry consortium is also in the works and will be released in the next few months.

According to Chia, it “will serve as a practical companion for financial institutions implementing our upcoming supervisory guidelines, detailing good practices on key issues such as how to manage AI life cycle risks and third-party AI risks.”

He summed up: “This approach – with supervisory guidance on the one hand, and a more detailed and dynamic good practices guide on the other – is designed to foster good industry practices, and provide flexible and adaptable guardrails for responsible and safe AI adoption by the industry.”

Looking ahead

With solid growth demonstrated by Singapore’s financial sector in 2024, Chia is confident it will remain resilient in 2025. He said: “We will build on the strong fundamentals and strengthen our position as a leading international financial centre.”

One of MAS’ priorities is for Singapore to build on its competitive strengths in key areas including asset and wealth management, insurance and foreign exchange, and grow sustainable finance

A second priority is to continue harnessing technology and innovation such as in the use of AI and tokenisation in financial services.

Singapore will work on strengthening global and regional connectivity in markets and payments.

Fourthly, continued efforts will be made to strengthen the talent pipeline. The workforce will gain further skills in sustainable finance and AI to prepare them for the next phase of growth even as Singapore remains open to high quality global talent.

Chia concluded: “Ultimately, our vision is for Singapore to be a leading international financial centre in Asia, that connects global markets, supports Asia’s development, and serves Singapore’s economy to create good jobs for locals.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.