Beyond traditional assets: How AI, health tech and private equity are reshaping family portfolios

The UBS Singapore Family Wealth Forum 2024 offered insights to guide families through complex landscapes for long-term financial growth

Jolene Natasha Limuco

From succession and legacy planning to opportunities in private equity and other alternative investments, wealthy families from across the region gained key insights from leading investment and wealth management experts at a recent forum.

The UBS Singapore Family Wealth Forum 2024, held on June 20, was attended by 150 family offices from around the world, representing wealth of approximately US$150 billion (S$203 billion).

In his welcome address, Edmund Koh, President UBS Asia Pacific, said: “Over the years, the emergence of Asian family offices has paralleled the region’s economic ascent. The Family Wealth Forum reinforces our commitment to being the trusted partner in navigating the financial landscape and ensuring sustained growth and longevity of family wealth to create impact for the future generations.”

With ultra-high net worth (UHNW) families in Asia navigating a complex landscape of economic uncertainty, geopolitical tensions and technological disruption, an increasing number of wealth managers are being sought out to address these risks.

Koh added: “As the region’s leading wealth manager, we understand the unique challenges and opportunities family offices face in managing substantial family wealth across generations. We have been collaborating with Asia’s top business families on their investments, businesses and family legacy needs for over 60 years.”

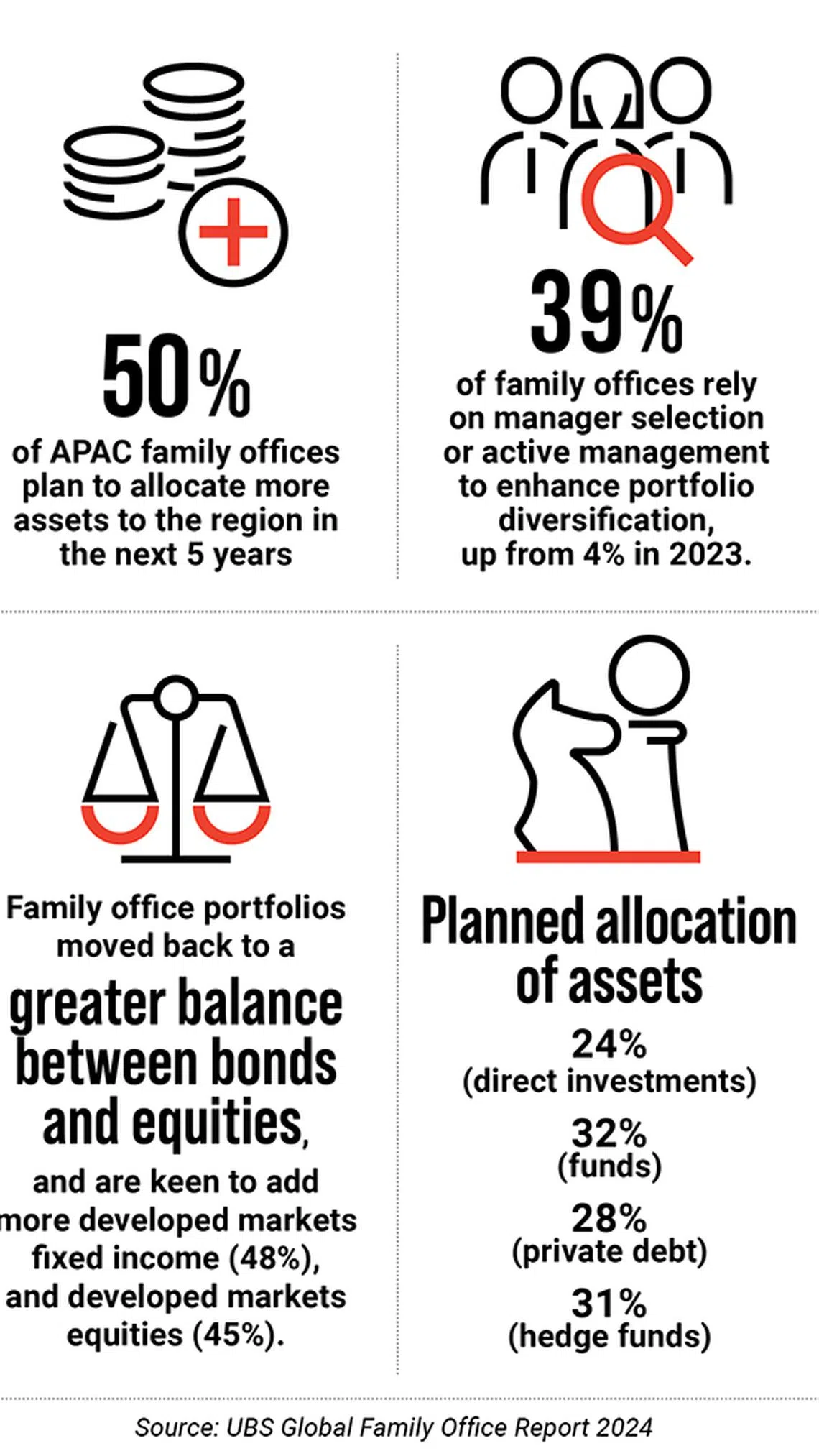

At the forum, several key trends were highlighted from the UBS Global Family Office Report 2024. It featured insights from 320 single family offices across seven regions of the world, representing families with an average net worth of US$2.6 billion.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Generative artificial intelligence (AI) is set to be the most popular investment theme among family offices over the next two to three years, with health tech and automation also emerging as significant areas of interest. At one of the forum’s panel sessions, speakers highlighted the importance of investing in AI infrastructure, such as cloud-based systems, that can handle the technology’s intensive computational requirements.

Applying endowment principles to family wealth

The UBS survey also found that family offices in Asia Pacific (APAC) planned to increase their allocation in alternative assets, such as private equity, private debt and hedge funds in the next five years to further diversify their portfolios.

Jin Yee Young, Co-Head UBS Global Wealth Management Asia Pacific and Country Head UBS Singapore, noted: “Looking ahead, we see a growing interest in endowment-style investing among APAC family offices as they reappraise their investment strategies. We have formulated Endowment Style Portfolios (ESPs) that adopt a higher asset allocation to alternatives (20-40 per cent), similar to endowments and this allows many of our UHNW clients to benefit from the same key investment principles that endowment funds have successfully put into practice.”

This shift to alternatives is aligned with the growing popularity of endowment-style investing among affluent families. This strategy, traditionally employed by non-profit organisations such as universities and hospitals, allows investors to more effectively diversify their investments, reduce volatility, and generate potentially higher risk-adjusted returns compared to traditional investments. Speakers at a discussion on endowment-style investing at the forum emphasised the need for investors to access all possible asset classes to maximise returns within their accepted risk levels. This means looking at alternative investments that are uncorrelated to traditional asset classes such as equities and bonds.

Navigating generational wealth transfer

Another panel discussion on legacy and succession highlighted the importance of embedding family values and fostering sustainable stewardship in decision-making processes. Two distinct approaches were discussed: deepening core business competencies and diversifying investments.

One approach focuses on expanding the core business and establishing early governance, ensuring strong family involvement and alignment with long-term goals. This method fosters a sense of purpose and continuity and is critical for sustaining family wealth.

The other approach involves diversifying investments across various asset classes and industries, allowing families to mitigate risks, adapt to changing market conditions, and explore new growth opportunities.

Lay Peng Tan, Head Family Advisory & Client Development Southeast Asia UBS Global Wealth Management, said: “We work closely with our clients on creating a family legacy for future generations. Our dedicated team has been delivering solutions that provide our clients with insights, comprehensive advice and execution services, according to their family’s legacy planning needs. In our recent Global Wealth Report, we are expecting a wealth transfer of almost US$83.5 trillion within the next 20 to 25 years. This reinforces the importance of proper wealth planning to help families with successful intergenerational wealth transfer.”

Copyright SPH Media. All rights reserved.