Boustead posts 3% drop in H1 net profit as US tariffs moderate energy sector activities

The board nevertheless declares an unchanged interim cash dividend of S$0.015 per share

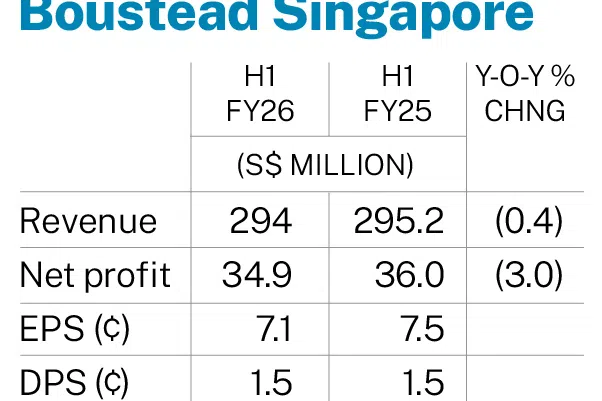

[SINGAPORE] Mainboard-listed Boustead Singapore ’s net profit for the half-year ended September fell 3 per cent year on year to S$34.9 million, from S$36 million.

Revenue stood at S$294 million, relatively flat from the year-ago period. This came on the back of slower real estate revenue recognition, and as US tariffs led to flat contributions from the energy engineering business.

The board of the engineering and infrastructure specialist has nevertheless declared an interim cash dividend of S$0.015 per share, unchanged from the previous year.

This is because Boustead “delivered reasonable profitability from core businesses and maintained a healthy net cash position”, the company said in its earnings statement on Monday (Nov 10).

Boustead saw a 10 per cent rise in revenue from its geospatial division to S$118.7 million, thanks to a higher percentage of multiyear subscription contracts in Australia and Singapore.

However, this was offset by lower revenue from the real estate solution divisions, which fell 9 per cent to S$95.6 million, due to most major projects being in early stages and resulting in slower revenue recognition than last year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Meanwhile, the energy engineering division’s revenue was relatively flat at S$74.3 million, as US tariffs led to a moderation of business activities in the global energy sector.

Healthcare revenue fell 24 per cent to S$5.2 million, as the completion of a one-off turnkey contract had contributed substantially to the previous year’s comparative period.

After adjusting for other gains and losses, impairments and exceptional adjustments, Boustead’s H1 net profit would have fallen more steeply – by 27 per cent to S$28.1 million.

“Very challenging”

The company faces a “very challenging operating environment”, said its chairman and group chief executive Wong Fong Fui.

“During the period under review, we have observed an overall tapered investment climate which has translated to sluggish business activities in some sectors,” said Wong.

Nevertheless, the geospatial division “continues to thrive in tandem with the need for Geographic Information System technology solutions”, he said, noting that they support government digitalisation initiatives.

The planned listing of UI Boustead Reit is another positive. This will consolidate Boustead’s real estate holdings in a single vehicle and represent its market value, while allowing capital to be recycled and redeployed to other business plans, Wong noted.

Boustead is now focused on optimising its balance sheet, tightening cost control, improving project execution and bidding for contracts selectively.

The company’s engineering order backlog stands at about S$396 million, comprising unrecognised project revenue remaining at the end of H1, as well as the total value of new orders secured since then.

Of the backlog, S$122 million is under the energy engineering division and S$274 million is under the real estate solutions division. Boustead has also secured a project with a contract value of over S$100 million in November.

The group expects to deliver “satisfactory results” in FY2026, barring unforeseen circumstances.

Boustead shares ended Monday at S$1.77, up by S$0.01 or 0.6 per cent, before the announcement.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.